Bitcoin Funding Rates Turn Positive, Why The Rally May Not Be Over

04 Agosto 2022 - 8:00PM

NEWSBTC

Bitcoin funding rates had fallen below neutral two weeks ago after

finally recovering from a month-long downtrend. This had sparked

fears of another bearish trend starting in the market. However,

this has quickly changed as the numbers for last week have come in.

This time around, the bitcoin funding rates are painting a better

picture for the digital asset. Funding Rates Return To Neutral The

bitcoin funding rates for the last week have been more optimistic

compared to previous weeks. This is because it had continued to

maintain its positive at neutral for the whole seven days; there

was not a single point in the week that funding rates had actually

fallen below neutral. This is the first time since March that the

funding rates have consistently remained above the negative level

for a while week. Related Reading: Bitcoin Miner Revenues Continue

To Grow, Will This Put A Stop To The Sell-Offs? A recovery in

funding rates is always a welcome change for the market, this is

why last week’s day remains important. With a market such as this,

where bitcoin continues to struggle to comfortably break above

$23,000, there needs to be a significant change in not only

sentiment but in the amount of money being injected into the space.

BTC funding rates return to neutral | Source: Arcane Research With

funding rates recovering to neutral, it once more puts it on a path

towards becoming neutral, something that has eluded bitcoin for

most of the year so far. The trend, which had started in June, has

now reached an acceptable point, but the end game remains for

finding rates to turn positive if bitcoin is to continue on a bull

rally. BTC trading below $23,000 | Source: BTCUSD on

TradingView.com Will Bitcoin Recover? Bitcoin is still trending at

$22,800, which has surprisingly become a support level for the

digital asset. This level continues to hold tentatively but needs a

big push to rise out of this level. With funding rates recovering,

perp traders may likely provide that needed push. Related Reading:

Why Bitcoin Investors Should Pay Attention To The Macro Environment

As for the leverage in the bitcoin market, it remains elevated.

This means that more traders are opening positions in the digital

asset. But it also puts them in a precarious position in a

situation where liquidations could pile up quickly, especially with

a move below $22,000. Nonetheless, the bull indicators remain

strong, albeit a bit weaker compared to last week. The resistance

at $23,000 is not as strong as bears would like, which puts the

next major resistance well above $23,500. If bitcoin can beat the

50-day moving average once more, then it is likely to surge above

$24,000 once more. Featured image from The Economic Times, charts

from Arcane Reseach and TradingView.com Follow Best Owie on Twitter

for market insights, updates, and the occasional funny tweet…

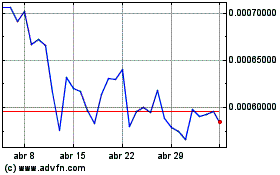

OMI Token (COIN:OMIUSD)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

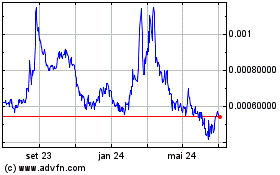

OMI Token (COIN:OMIUSD)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024

Notícias em tempo-real sobre OMI Token da Criptomoeda bolsa de valores: 0 artigos recentes

Mais Notícias de ECOMI