Bitcoin Bearish Signal: Exchanges Receiving Large Deposits

29 Outubro 2022 - 4:00PM

NEWSBTC

On-chain data shows the Bitcoin exchange inflows have spiked up

over the last day, something that could prove to be bearish for the

price of the crypto. Bitcoin Exchange Inflow Mean Has Observed Two

Spikes In The Past 24 Hours As pointed out by an analyst in a

CryptoQuant post, the two exchange inflow mean spikes amounted to

around 21 BTC and 17 BTC respectively. The “exchange inflow mean”

is an indicator that measures the mean amount of Bitcoin being

transferred to the wallets of centralized exchanges per

transaction. It’s different from the normal inflow metric in that

instead of simply measuring the total number of coins flowing into

exchanges, it tells us how large the average transaction to

exchanges has been recently. When the value of this indicator is

high, it means investors are depositing a lot of BTC to exchanges

right now. Such a trend can be a sign of dumping in the market.

Related Reading: Dogecoin Records Over 41% Gains Following Market

Recovery On the other hand, low values of the metric suggest there

isn’t much selling pressure in the Bitcoin market at the moment.

Now, here is a chart that shows the trend in BTC exchange inflow

mean over the last few days: Looks like the value of the metric

seems to have been quite high recently | Source: CryptoQuant As you

can see in the above graph, the Bitcoin exchange inflow mean has

seen a couple of spikes in the last 24 hours. The first of these

measured to around 21 BTC, which means that at the time it occurred

the average transaction going into exchanges involved 21 coins.

Similarly, the second spike had the mean inflow value touch more

than 17 BTC. Related Reading: Why Bitcoin (BTC) Could Not Surpass

Litecoin (LTC) In This Key Area Since these spikes have come as the

price of the crypto has surged up, they could be coming from whales

trying to profit from the pump. In the past, the occurrence of

multiple Bitcoin exchange inflow mean spikes larger than 15 BTC in

value has generally been followed by a dip in the crypto’s price.

Below is another chart that the same quant posted earlier in the

month, which displays a recent instance of this kind of trend in

the inflow mean. The exchange inflow mean spikes lead to the price

going down | Source: CryptoQuant BTC Price At the time of writing,

Bitcoin’s price floats around $20.6k, up 8% in the last week. Over

the past month, the crypto has gained 6% in value. The below chart

shows the trend in the price of the coin over the last five days.

The value of the crypto seems to have surged up recently | Source:

BTCUSD on TradingView Featured image from Hans-Jurgen Mager on

Unsplash.com, charts from TradingView.com, CryptoQuant.com

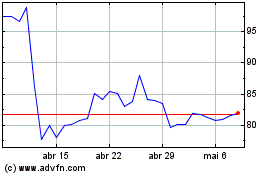

Litecoin (COIN:LTCUSD)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Litecoin (COIN:LTCUSD)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024