Avalanche Partners With Amazon, What’s Next For The Price?

11 Janeiro 2023 - 5:15PM

NEWSBTC

Avalanche and its dApp ecosystem shall now be supported by Amazon

Web Services (AWS), which also comprises one-click node deployment

through the AWS marketplace. With this partnership with AWS, Ava

Labs can help customers deploy custom offerings linked to over

100,000 partners spread across 150 countries. Related Reading:

Bitcoin Currently More Stable Than Gold, DXY, Nasdaq, Here’s What

Could Happen Next Technically, the Avalanche node operators can

operate in AWS GovCloud for the FedRAMP compliance use case, which

is an essential pre-requisite for many enterprises and governments.

This partnership will help scale blockchain adoption among many

enterprises, government organizations, and other institutions.

Howard Wright, the VP and Global Head of startups at AWS, stated:

Looking forward, web3 and blockchain are inevitable. No one can

call the time or date or quarter that it’s going to happen and

it’ll be mainstream, but we’ve seen the cycles of growth before.

The velocity of this one seems like it’s accelerating and we’re

just excited to be a part of this. Through the partnership,

individuals will find it much easier to launch and manage nodes on

Avalanche; additionally, it will strengthen and make the network

more flexible for developers to work on. This new development has

positively affected the altcoin’s price, but it is yet to be seen

if the coin can sustain this price sentiment. Avalanche Technical

Analysis The news of AWS being incorporated into the Avalanche

ecosystem has instantly spiked investor interest. The daily chart

of AVAX displays a 6.6% gain, which can be termed a rally. This has

made the coin break past the $13.60 resistance level, and now AVAX

is valued at $14.40. It is yet to be seen if the coin manages to

breach the $15 mark, acting as a resistance mark for the coin. A

fall from the current price will bring the altcoin down to $13.70.

The Relative Strength Index was overbought, which means the asset

was overvalued. The overvalued condition can be attributed to the

newest development. Usually, once the asset is overbought, the

price corrects itself. Due to bullish sentiment, AVAX shot past the

20-Simple Moving Average line (SMA), indicating that buyers have

been driving the price momentum in the market. Not just the 20-SMA,

the altcoin was parked above the 50-SMA due to excessive demand.

The Moving Average Convergence Divergence suggests price momentum

and a trend reversal. The indicator formed a few green histograms,

which are buy signals for the coin. The most recent histogram

increased in size, anticipating the rise in the price of the asset.

Investors could quickly take this as a signal for entry as the

price would increase over the next few trading sessions before it

started to retrace. Related Reading: Polkadot Records New

Achievements In Dev’t Activity, Pushes DOT Price Up The Directional

Movement Index reads the price direction, and it was bullish. The

+DI line (blue) was above the -DI line (orange). The Average

Directional Index (red) was near 20 with a slight uptick,

confirming that although the price witnessed a northbound movement,

the price direction lacks substantial strength. Featured Image From

Unsplash, Charts From TradingView.com

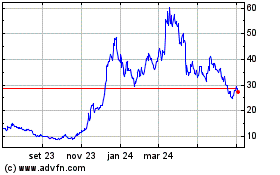

Avalanche (COIN:AVAXUSD)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

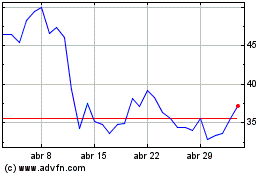

Avalanche (COIN:AVAXUSD)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024