Cream Finance Exploiter Moving Funds Over 16 Months After Hack, Here’s Why

30 Janeiro 2023 - 7:00PM

NEWSBTC

The Cream Finance exploiter is moving funds, more than 16 months

after hacking the DeFi protocol, stealing over $136 million of

various crypto assets. Related Reading: Bitcoin Mining Difficulty

Touches New ATH Following 4.68% Adjustment Cream Finance Exploiter

Transfers Funds According to CertiK, a blockchain analytic

platform, the exploiter moved 365.69 ETH, worth roughly $600,000 at

spot rates, to a new address. The amount is part of the over $136

million tokens stolen in late October 2021. #CertiKSkynetAlert 🚨

Cream Finance exploiter 0x70747df6ac244979a2ae9ca1e1a82899d02bbea4

sent ~$600K (365.69 ETH) to address

0x4648451b5f87ff8f0f7d622bd40574bb97e25980 Stay vigilant!

pic.twitter.com/IpFdzctstp — CertiK Alert (@CertiKAlert) January

30, 2023 Funds were moved to another address. It is not yet clear

what the hacker intends to do with the $600,000. Cream Finance is a

blockchain-agnostic DeFi protocol deployed on Ethereum, Fantom,

Polygon, and the BNB Smart Chain (BSC). It was forked from

Compound, a competing lending platform, and remains open source.

Cream Finance offers a wide range of services, including lending,

yield farming, and token exchange. CREAM, the governance token of

Cream Finance, is changing hands at $12.83 when writing on January

30. In crypto, addresses holding stolen funds are always marked and

therefore tainted. It makes it hard for hackers to launder stolen

funds on centralized exchanges or other platforms without being

identified. The decision by platforms to join hands to combat money

laundering from crypto and DeFi hackers is bearing fruits. These

platforms, mostly centralized exchanges like Binance, Coinbase, or

Huobi, allow users to purchase fiat currencies, including the USD,

JPY, or Euro, and are compliant with applicable know-your-customer

(KYC) and anti-money laundering (AML) rules. This means agents

trying to launder funds through these portals can be mapped out in

the real world and prosecuted. By picking out this transfer, CertiK

is updating the crypto and DeFi community that the perpetrator of

the hack is still active and trying to shuffle funds through

various addresses. However, considering the transparent nature of

underlying blockchains, including Ethereum, it is easy to track

transactions despite the sender’s private identity. Any mistake on

the hacker’s end can lead to their IP address being uncovered or

their identity decrypted, bringing them to the custody of law

enforcement agents. To counter this possibility and conceal their

tracks, hackers use crypto mixers like Tornado Cash. Despite the

United States Treasury Department banning citizens from using

mixers like Tornado Cash, users prefer the tool. Many users are

hackers wishing to cash out the funds anonymously. DeFi Under

Attack In late October 2021, Cream Finance was hacked for over $136

million. The hacker targeted the protocol’s v1 lending market,

siphoning several ERC-20 tokens and CREAM governance tokens.

Through a series of flash loans, the attacker manipulated the

protocol’s yield, allowing for borrowing more assets than

collateralized. The attack was the protocol’s third in 2021,

questioning the security of DeFi dApps against determined

attackers, some of whom might be sponsored by governments like

North Korea. In mid-January, Lazarus Group, a hacker cell

associated with North Korea, attempted to launder $63.5 million. We

detected Harmony One hacker fund movement. They previously tried to

launder through Binance and we froze his accounts. This time he

used Huobi. We assisted Huobi team to freeze his accounts.

Together, 124 BTC have been recovered. CeFi helping to keep DeFi

#SAFU! 🙏 — CZ 🔶 Binance (@cz_binance) January 16, 2023 Related

Reading: Dogecoin: Can Elon Musk’s McDonald’s Offer Give DOGE A

‘Happy’ Price? However, Binance and Huobi picked out their

transfers and froze assets. Funds were part of the amount stolen

from the Harmony Bridge hack.

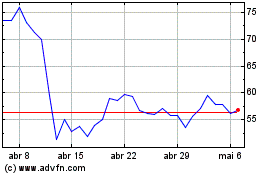

Compound (COIN:COMPUSD)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Compound (COIN:COMPUSD)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024