What’s Next For Solana As The Coin Witnesses Bearish Momentum?

21 Fevereiro 2023 - 7:00PM

NEWSBTC

The Solana price had managed to surge over 20% in just over a week,

but at the moment, the price remains consolidated. With Bitcoin

staying below the $25,000 belt, altcoins have been experiencing

congested price action below their immediate price ceilings. The

coin has dropped nearly 3% in the last 24 hours and is now trading

below $26. However, the technical outlook for SOL remained

optimistic as demand and accumulation were still positive. Related

Reading: MATIC Price Retraces But Buyers Can Re-Enter At This Level

As the altcoin managed to break above many resistance levels in the

last week, the daily chart is yet to reflect the bearishness. If

demand wobbles, SOL might fall through its local support level.

Solana’s price has been trading between $23 and $26, respectively.

If the altcoin manages to breach the upper belt of the range, then

there could be another rally and a shift to bullish price action.

The market capitalization of Solana fell at the time of writing,

which reflected that sellers had become more active. Solana Price

Analysis: One-Day Chart SOL was trading at $25.29 at the time of

writing. It was trading relatively close to $26, the present

overhead ceiling. Demand for SOL needs another push for the price

to break past the $26 level. If SOL manages to move above that

level, then the altcoin might attempt to trade near $29 before it

starts correcting. Conversely, if buyers don’t exert pressure,

Solana might fall to $23 and then to $21. The amount of Solana

traded in the last session was high, meaning the coin experienced

selling strength. Technical Analysis The altcoin recovered on the

chart, and so did its buying strength, but as SOL lost momentum in

the last 24 hours, buying strength dipped slightly. The Relative

Strength Index noted a downtick, despite the indicator being above

the 60 mark. This reading indicated that even though buying

pressure fell, buyers overpowered sellers. The Solana price was

also above the 20-Simple Moving Average line (SMA), meaning buyers

were driving the price momentum in the market. Despite a fall in

value, SOL continued to depict buy signals on the one-day chart.

The Moving Average Convergence Divergence indicates price momentum

and a change in trend. The indicator formed green histograms tied

to buy signals. Buy signals usually indicate an increase in price

over the next trading session. The Awesome Oscillator also reads

the price trend. Related Reading: “Buy The Dip” Mentality Returning

To Bitcoin? This Metric May Suggest So The indicator formed green

signal bars above the half-line, which signified bullish movement.

Although SOL continues to look cheerful, the inability to cross the

overhead resistance will cause a setback to the altcoin’s price

movement. Featured Image From UnSplash, Charts From

TradingView.com.

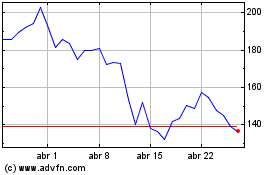

Solana (COIN:SOLUSD)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Solana (COIN:SOLUSD)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024