Crypto Fear & Greed Index Drops To One-Month Low, Here’s What It Means

06 Março 2023 - 3:30PM

NEWSBTC

Crypto investor sentiment is already on the downside following the

market crash, erasing the progress that has been made over the last

month. The Fear & Greed Index is now on a reversal, falling

back to its lowest point in over one month. Crypto Fear & Greed

Index Trending Toward Fear Coming out of the weekend, the Crypto

Fear & Greed Index has seen a decline which has sent it back

toward the fear territory. It is currently sitting at a score of 48

at the time of writing which puts it closer to fear than it is to

greed. It also shows that investors are warier when it comes to

getting into the market, which would explain the muted momentum in

the market over the last couple of days. Related Reading: Bitcoin’s

Decline To $22,000 Triggers Second-Largest Liquidation Trend In

2023 It is also the first time that the Fear & Greed Index has

been this low since January. Usually, higher numbers follow market

uptrends and vice versa. It also shows how investors are viewing

the market, so a less favorable view could lead to less money

flowing into the market. Fear & Greed Index inches toward

fear territory | Source: alternative.me However, the level

at which the Fear & Greed Index is currently sitting is

considered neutral as it falls within the 47-53 range. This means

that even if the index is still closer to fear, investors are still

considered to be indecisive when it comes to investing in crypto.

But a mere 2-point fall from here can easily plunge it back into

fear as the fight against the bear market continues. Market Leaves

Quick Gains Behind A good amount of the selling pressure being felt

in the crypto market right now is a result of the anticipated

Ethereum Shanghai upgrade. With billions of dollars locked in the

contract, it is expected that a good chunk of ETH will be dumped on

the market as coins are gradually unlocked. Market cap loses $12

billion during the weekend | Source: Crypto Total Market Cap on

TradingView.com This expectation also explains why the Crypto Fear

& Greed Index remains in neutral territory for such an extended

period of time. Investors are waiting to see the outcome of the

upgrade before throwing their hats in the ring, although the

upgrade has now been pushed back from March to April. Related

Reading: Decline In Bitcoin Whale Activity Could Signal Further

Downside For BTC Price With the crash, the market has now settled

into a more sustainable pace which could be good for the market.

There is also less volatility right now in the market with only a

slight uptick in the trading volume of Bitcoin, presumably a result

of the USD transfer suspensions across multiple exchanges. At the

time of writing, the total market cap is sitting at $985 billion,

with a $12 billion loss from its weekend peak of $997 billion.

Follow Best Owie on Twitter for market insights, updates, and the

occasional funny tweet… Featured image from Zipmex, chart from

TradingView.com

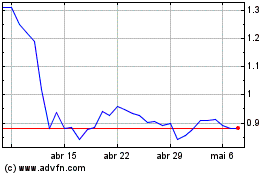

Flow (COIN:FLOWUSD)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Flow (COIN:FLOWUSD)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024