XRP Outperforms The Market As It Roses By 5%, Breakout Imminent?

08 Março 2023 - 5:00PM

NEWSBTC

XRP has outperformed all major cryptocurrencies on the market after

a tumultuous week. The token has risen more than 5% since Monday,

breaking its downtrend since late February from above $0.4137. XRP

is trading at $0.3963, making it the only crypto in the top ten

digital assets with gains last week. According to Glassnode

data, XRP has seen only $3.5 million in liquidations in the last 24

hours, $2.5 million of which were short liquidations, highlighting

the strength of the token’s uptrend since early March. XRP faces a

major resistance wall at the $0.40 level; if the token manages to

break its nearest obstacle, it will represent a short-term victory

for XRP bulls and break the downtrend channel pattern. Related

Reading: Polygon (MATIC) At Risk Of Dropping To $1 Despite Mercedes

Benz Deepening Partnership Is A Bull Rally On The Way For

XRP? Despite the recent statements by Federal Reserve (Fed)

Chairman Jerome Powell in his mission to control inflation, which

can affect stocks and crypto assets in the medium term as the

institution raises interest rates, XRP is unaffected by the

worrying news from a macroeconomic perspective. On the other hand,

the token, which serves as a component for the XRPL settlement

layer and facilitates payment transactions on its network, has

broken the correlation with Bitcoin. This cryptocurrency is in a

downtrend after seeing massive selling pressure in recent weeks,

which has resulted in a path for digital assets to crash toward

lower levels. According to the trader and chart analyst, who goes

by the pseudonym EgragCrypto, XRP has reached a milestone; after a

long period of consolidation and uncertainty from investors, the

token managed to turn the Fibonacci channel 0.86 from a major

resistance to support. As seen in the above chart, the current

price of the token represents solid support. If the bulls hold and

consolidate the price, they can push the token above its major

resistance in the medium term at $0.4235. This support can act as a

threshold for the bulls as there is a major resistance ahead; if it

is not broken, the 0.86 Fibonacci channel will be a crucial level

to watch. If the price falls below the current channel, traders may

see a downtrend to $0.3. Ripple CEO Claims The SEC Lacks Of

Infrastructure For “Registered Tokens” The Securities and Exchange

Commission (SEC) and Ripple, the company that created the XRP

Ledge, have an open court case in the U.S. Southern District of New

York. According to several experts, this action could decide the

future of crypto assets and whether or not XRP is a security under

SEC rules. In a Twitter post, Ripple CEO Brad Garlinghouse

stated that the SEC does not have the legal framework to classify a

token as a security. The regulator lacks clarity on the crypto

industry, according to the executive. Garlinghouse added that

the SEC has declared “war” on the industry and that the regulator

should create a framework and set guidelines for the crypto

ecosystem. Ripple’s CEO also concluded: If you want to regulate,

then regulate. Put in the hard work to build a framework and set

guidance, as so many other G20 countries are already doing. The 27

EU member countries can agree on a set of rules with MiCA…what’s

stopping the US?! Related Reading: Cardano Investors Suffer As Vast

Majority Of ADA Holders Nurse Losses Currently trading just below

the $0.4 mark, XRP has gained 5% in the last 24 hours. The token

has seen gains in a broader time frame thanks to its uptrend. Over

the past seven and fourteen days, XRP has posted gains of 5.1% and

1.7%, respectively, with a market cap of $20 billion. Feature

image from Unsplash, chart from TradingView.com

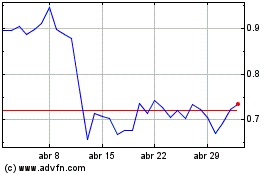

Polygon (COIN:MATICUSD)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Polygon (COIN:MATICUSD)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024