Lido (LDO) Plummets Over 20% In Past Week, Here’s Why

09 Março 2023 - 9:20AM

NEWSBTC

Putting the global crypto market’s ubiquitous downward trend aside,

Lido Finance (LDO) token has been moving in a bearish direction

over the past week. While the universal bearish trend could have

contributed to LDO’s downward trend in the past week, research

proves it’s more than that. Over the past week, LDO has

recorded a sharp decline in price, falling by 22.4% from a high

above $3 as of March 3 to as low as $2.35 at the time of writing.

According to Coinmarketcap, more than $500 million has been removed

from its market cap over the same period. Two Instances On

Lido (LDO) Decline In The Past 7 Days Lido’s recent fall in value

can be attributed to the recent announcement of Mixbytes, a

development team to Lido Finance, disclosing the ending of its

support for liquid staking on Polkadot and Kusama. This

announcement has seen most liquid stakers of Polkadot and Kusama

withdrawn from the Lido Finance protocol, therefore, affecting both

its total value locked (TVL) and native token’s price negatively.

In the past 7 days, Lido’s TVL has plummeted alongside LDO price,

falling by 5.7%, according to DeFilama. Mixbytes stated it will no

longer “develop and technically support” Lido on Polkadot and

Kusama from August 1. In addition, as a result of the update, users

will not be able to deposit funds for stake into Lido for the

Polkadot and Kusama protocols as of March 15. Related

Reading: Lido Finance (LDO) Is Down 18% In 7 Days, Time To Buy The

Dip? Furthermore, Mixbytes further stated in the announcement that

it is working on an alternative host for the UI which will be

launched by the community on August 1. Veering back to the reason

behind the LDO decline in the past week, another instance is the

ongoing rumor shared by Bankless David Hoffman. According to

Hoffman, the United States Securities and Exchange Commission might

have issued a Wells Notice to Lido and some other crypto projects

in the industry. A Wells Notice is a formal letter sent by the SEC

informing a recipient or firm that it is planning to bring

enforcement actions against them. Though Hoffman eventually

renounced the rumor, as the news has not yet had any official

confirmation, it can be attributed to one of the reasons behind

LDO’s falls over the past week. LDO Continues Downtrend The

past few weeks have not been favorable for LDO as the token has

only continued to suffer a downward trend following several

negative news circulating in the industry as well as events stated

above. Lido Finance (LDO) price is moving sideways on the 4-hour

chart. Source: LDO/USDT on TradingView.comLDO’s past 24 hours trend

hasn’t also been any different as the token is currently down 8.5%

in the past day with a trading price just above $2. The token’s

trading volume has also gone weak indicating a possible continuous

downtrend. Related Reading: Lido DAO (LDO) Holds 10% Gains On

Weekly Chart While Majority Of Coins Shrink LDO’s trading volume

has fallen from a high of $239 million on March 3 to a low of $89

million over the past 24 hours. Notably, despite the prolonged

downtrend, LDO still ranks firmly as number 30 on the list of

cryptocurrencies with the largest market caps, according to

Coinmarketcap. Featured image from iStock, chart from TradingView

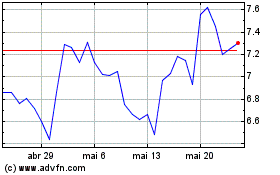

Polkadot (COIN:DOTUSD)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Polkadot (COIN:DOTUSD)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024