Long Queues Seen At Silicon Valley Bank-Owned Boston Private – A Bank Run?

11 Março 2023 - 10:16AM

NEWSBTC

Long queues have been observed at Boston Private, a banking service

provider, that was recently acquired by Silicon Valley Bank

(SVB). Bank Run At Boston Private Bank? According to Lawrence

Lepard, an investment manager, Boston Private might be currently

experiencing a bank run. As of March 11, there were long

queues as depositors looked to withdraw their hard-earned

cash. Shades of 1930’s. This is my bank in Wellesley this

morning. Boston Private Bank, recently acquired by Silicon Valley

Bank. Ruh, roh. pic.twitter.com/MAD46ozShx — Lawrence Lepard, "fix

the money, fix the world" (@LawrenceLepard) March 10, 2023 In 2021,

Boston Private was acquired by SVB for $1 billion. The

collapse of SVB has also put USDC, the stablecoin issued by Circle,

a consortium of among other companies, under immense

pressure. At the time of writing on March 11, USDC had

de-pegged, trading at $0.96 to the USD. SVB is one of six banking

partners Circle uses for managing around a quarter of its reserves

held in cash. While Circle and USDC continue to operate normally,

the position of USDC in crypto and the uncertainty surrounding SVB

has caused a ripple effect across the market. Related Reading: USDC

Is In Trouble, But It Won’t Go To Zero Like UST Did – Here’s Why

The Federal Deposit Insurance Corporation (FDIC) has stepped in and

is now the receiver at SVB. This move would likely prevent a much

larger crisis in what is considered one of the largest bank

failures since 2008. All assets held in SVB have now been

frozen and can only be accessed by insured depositors. However,

uninsured depositors will only be gifted a coupon to access part of

their money within the next week. With FDIC as the receiver, many

of the bank’s employees would not receive their paychecks if they

run their payroll through SVB. The main office and all branches of

SVB will reopen on Monday, March 13. The FDIC will pay uninsured

depositors an advance dividend within the next week. As the FDIC

sells all the bank’s assets, future dividend payments may be made

to uninsured depositors. Silicon Valley Bank Had Billions In Assets

And Deposits As of December 31, 2022, Silicon Valley

Bank had approximately $209 billion in total assets and

about $175 billion in total deposits. The amount of deposits in

excess of the insurance limits is yet to be determined. The number

of uninsured deposits will be determined once the FDIC obtains

additional information from the bank and its customers. Related

Reading: Bitcoin Rally Fueled By USD Coin (USDC) Rotating Into BTC:

Santiment The collapse of SVB is a reminder that the traditional

finance system is also very fragile, showing the importance of

diversification between fiat and digital assets. It’s worth knowing

that while the FDIC has stepped in, less than 3% of users are

insured, meaning that most customers, around 97%, may be left

holding the bag. Feature Image from Jim Wilson/The New York Times,

Chart From TradingView

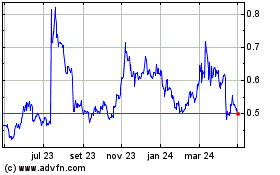

Ripple (COIN:XRPUSD)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Ripple (COIN:XRPUSD)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024