Moody’s Expect U.S. Banks To Deteriorate, Boon For Bitcoin?

14 Março 2023 - 7:00PM

NEWSBTC

Moody’s Investor Service, better known as Moody’s,

has revised its view on the entire U.S. banking system

from “stable” to “negative.” They cite rapid deterioration in the

operating environment following the bank runs and failure of

Silicon Valley Bank (SVB) and Signature Bank. Moody’s

Downgrades The Entire U.S. Banking Sector Moody’s also warned that

it would further downgrade or place on review seven financial

institutions, which could impact the sector’s credit ratings and

borrowing costs. The rating firm, among three of the world’s

best, gave its outlook on the entire U.S. banking system following

the bank runs and subsequent failure of SVB and Signature Bank,

which caused a contagion across the financial markets. In a

report, Moody’s said: We have changed to negative from stable our

outlook on the U.S. banking system to reflect the rapid

deterioration in the operating environment following deposit runs

at Silicon Valley Bank (SVB), Silvergate Bank, and Signature Bank

(SNY) and the failures of SVB and SNY. By moving in to change their

preview on the state of the U.S. banking system, their change could

impact credit ratings, which, in turn, would impact borrowing.

Related Reading: Bitcoin Trader Sentiment Returns To Greed As BTC

Jumps Past $25,000 The Federal Reserve (Fed) has reportedly

established a facility to ensure that institutions with liquidity

problems would have access to cash, effectively opening swap lines

in the U.S. Banking sector’s deposit base totaling $17.6

trillion. So the FED just opened swap lines on the entire US

Banking deposit base of $17.6T. The FED balance sheet is $8.4T. One

year swaps. Then what? Did the FED just become the FDIC? Who eats

the losses? Isn't this QE infinity? Can the banks make any loan now

consequence free… https://t.co/cvmnlS3Utq — Lawrence Lepard, "fix

the money, fix the world" (@LawrenceLepard) March 14, 2023 Through

the Treasury Department, the U.S. government also said depositors

with more than $250,000 at SVB and Signature would have full access

to their funds. Countering Fed’s assurances, Moody’s said

that concerns remain. Specifically, their report said banks holding

substantial unrealized securities and non-retail, uninsured U.S.

depositors are still potentially at risk of loss. The rating

firm also expects the U.S. economy to fall into recession later

this year, further pressuring the industry. Bitcoin Rallying As

Inflation Drops Amid the banking crisis, Bitcoin maintains an

uptrend. The cryptocurrency has been rallying since the United

States government, on Sunday, said it would intervene and bail out

depositors affected by the closure of Silicon Valley Bank (SVB).

The coin quickly reversed last week’s losses early this week,

bouncing from $19,700 to soar above February high to over $25,000.

Notably, this development comes amid dropping inflation in the

United States. Recent Consumer Price Index (CPI) data from the

U.S. Bureau of Labor Statistics showed that inflation slowed to 6%

for its February print. Related Reading: Bitcoin Sees Largest

Inflow In 6 Months, Sign Of Profit Taking? Although inflation was a

central metric being tracked closely by traders and investors, the

risk of a system-wide financial collapse in the United States seems

to supersede all other economic data. Current market expectations

for the path of the Fed Funds Rate…-Mar 22, 2023: 25 bps hike to

4.75%-5.00%-Pause-Rate cuts start in July 2023 w/ a Fund Funds Rate

of 4% at the end of 2023 and 3% at the end of 2024.

pic.twitter.com/ICPJbBSD7d — Charlie Bilello (@charliebilello)

March 13, 2023 With the government intervening and inflation

dropping, analysts expect the Fed to reverse its previous monetary

policy stance and slow down on rate hikes in the coming

months. Feature Image From Reuters, Chart From TradingView

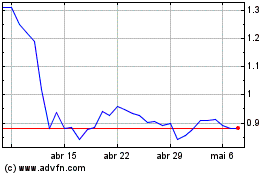

Flow (COIN:FLOWUSD)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Flow (COIN:FLOWUSD)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024