Quant Points Out Curious Relationship Between USDT Inflows & Bitcoin Price

22 Março 2023 - 5:38PM

NEWSBTC

A quant has explained using on-chain data that an interesting

relationship may exist between the USDT exchange inflows and

Bitcoin price. USDT Derivative Exchange Inflows May Be Influencing

Bitcoin Price As pointed out by an analyst in a CryptoQuant post,

many stablecoins entering into derivative exchanges have recently

preceded a rise in the BTC price. The relevant indicator here is

the “Tether derivative exchange inflow means,” which measures the

mean amount of USDT currently being transferred into the wallets of

all derivative exchanges. This metric is different from the normal

exchange inflow, since that one measures the total amount of the

stablecoin flowing into exchanges rather than the average amount

flowing into these platforms per transaction. The benefit of this

indicator over the normal exchange inflow is that a few whales can

skew the latter metric as they generally transfer large amounts. At

the same time, the former provides a better picture of the average

investor’s behavior in the market. When the inflow mean value is

high, a large amount of USDT is flowing into exchanges with each

transaction right now. On the other hand, low values imply the

average holder isn’t depositing too many coins to these platforms.

Related Reading: Bitcoin Whale Activity Reaches Highest Weekly

Levels Of 2023 Now, here is a chart that shows the trend in the

7-day moving average (MA) Tether exchange inflow means, as well as

that in the Bitcoin price, over the last couple of weeks: The

possible relationship between the price of Bitcoin and USDT

derivative exchange inflow mean | Source: CryptoQuant As you can

see in the above graph, the quant has marked the various points of

interest in the USDT derivative exchange inflow mean and also how

the Bitcoin price reacted to these instances. It seems like

whenever this metric has spiked to relatively high levels recently,

the cryptocurrency’s price has first observed a small downtrend and

followed up with some rise. Related Reading: $28.7K Could Be Next

Level To Break For Bitcoin, Here’s Why Generally, investors deposit

stablecoins like Tether to exchanges when they want to swap them

out for a volatile cryptocurrency like Bitcoin, thus providing

buying pressure on the price of the coin they are shifting into.

However, as the inflow mean indicator used here is strictly for

derivative exchanges, the likely purpose behind these deposits

wasn’t to purchase other assets with them (as spot exchanges are

usually used for this reason). The quant thinks that these recent

Tether exchange inflows were possibly being made to open long

positions for Bitcoin, hence the bullish effect on the asset.

“Since this is not a rule, it cannot be accepted as 100% accurate,

and we may not always see the price movement I mentioned,” the

analyst cautions. “I have presented you with a statistic to be

careful about when opening your trades.” BTC Price At the time of

writing, Bitcoin is trading around $28,000, up 14% in the last

week. Looks like the value of the asset has declined in the last

few hours | Source: BTCUSD on TradingView Featured image from Maxim

Hopman on Unsplash.com, charts from TradingView.com,

CryptoQuant.com

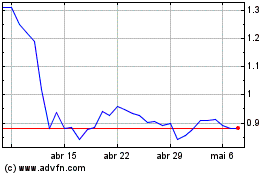

Flow (COIN:FLOWUSD)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Flow (COIN:FLOWUSD)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024