Arbitrum (ARB) Airdrop Is Around The Corner, How To Trade It

23 Março 2023 - 8:05AM

NEWSBTC

Today, March 23 at 1:00 pm EST, Arbitrum (ARB) will start trading

on Binance. The launch of the airdrop is likely the biggest DeFi

event since the Uniswap airdrop three years ago. Around 635,000

wallets qualified for the airdrop and could initially cause massive

volatility in the ARB price. Until the listings, it is not known at

what price the Arbitrium token will actually launch. What is clear,

however, is that ARB’s total supply is ten billion, according to

the Arbitrum Foundation, of which 1.275 billion ARB will be

unlocked on launch day. The rest will remain locked for at least

one year. Based on this, forecasts assume that ARB could launch at

a price of $15 per token, as Guillermo Daniel Salazar, co-founder

at StablePay.io, recently estimated via Twitter – although some

estimates are significantly lower. In comparison, Optimism (OP)

launched last year with a total supply of about 4.3 billion OP,

with only 315 million being released into circulation. Within the

first hour of trading, the Arbitrum token reached a max price of

$2.31. How To Trade The Arbitrum (ARB) Airdrop Based on previous

airdrops, some analysts are trying to predict how to trade today’s

ARB airdrop. One of them is Miles Deutscher, who has looked at the

last three major airdrops: BLUR, Aptos (APT) and Optimism (OP), to

derive patterns from them. Related Reading: How Arbitrum and

Optimism Made Millions in 2022 According to him, there is a clear

underlying pattern to observe. At the beginning, the price of the

airdrop token shoots up. After that, there is a gradual sell-off as

the recipients of the airdrop sell their tokens. Once this selling

pressure subsides and the sell side is exhausted, an explosive

recovery occurs. Deutscher shared the charts below that confirm

this pattern, but cautioned that the Arbitrum token may not

necessarily follow the same trend from previous airdrops. “It’s

just interesting to observe the similarities between previous

patterns. If you’re trading, it’s a risky game (especially with

leverage),” Deutscher concluded. The popular Twitter analyst “Mac”

has also analyzed the patterns of recent airdrops. His analysis is

a bit different. He thinks ARB will see a dump candle for a few

hours after launch at most, when market makers and airdrop claimers

sell their tokens. Related Reading: Bitcoin Back Above $27,600 As

US Banking Crisis Is Far From Over Once the airdrop claim reaches

60-80%, the analyst expects a bounce – this is the time to buy.

However, he believes this will be a short-lived pump of a few days

maximum, similar to UNI and BLUR. For Mac, who shared the UNI chart

below, this is the time to sell. Following that, the analyst says

there will be a distribution phase, followed by a re-accumulation,

where he sees another entry point. “The real pump starts. This is

where the real money will be made,” the analyst stated. Featured

image from iStock

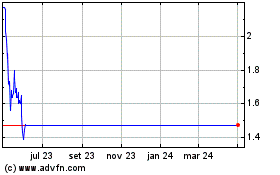

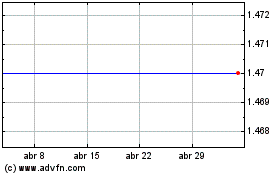

(COIN:OPPUSD)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

(COIN:OPPUSD)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024