Bitcoin Bubble About To Burst? Analyst Warns Prices Could Dip To $7,000

22 Maio 2023 - 7:00PM

NEWSBTC

Mike McGlone, a senior commodity strategist at Bloomberg, has

highlighted Bitcoin’s (BTC) historical patterns of boom and bust,

which are closely tied to liquidity. According to McGlone,

Bitcoin’s current price level of around $27,000 may be at risk of

reversion, considering that it was only $7,000 at the end of 2019

before the massive liquidity pump in 2020. Related Reading: Solana

(SOL) Records Surge In New Active Addresses, But Onchain Activity

Takes A Dive Bitcoin Faces Unprecedented Risk? McGlone’s analysis

also indicates that Bitcoin’s downward trajectory, as demonstrated

by its 52-week moving average, contrasts with the upward trend it

experienced at the onset of the pandemic. This suggests that the

cryptocurrency is susceptible to booms when liquidity is abundant

but vulnerable to busts when liquidity is removed. As such, McGlone

recommends respecting the down-sloping 52-week mean in assessing

Bitcoin’s direction bias. Despite the recent bank run, the Federal

Reserve (Fed) has tightened twice, which may indicate the central

bank’s tenacity, McGlone points out that slumping copper and

cryptocurrencies, including Bitcoin, are paying heed to the

warning, which contrasts notably with the resilient stock market.

Furthermore, in a recent interview, McGlone warned that Bitcoin

could potentially experience a significant decline and return to

its 2019 rally starting point of around $7,000. McGlone cites the

drying up of liquidity and rising interest rates as key factors

that could lead to a mean reversion for Bitcoin. While

acknowledging the potential for Bitcoin to rebound, McGlone notes

that the cryptocurrency has yet to exhibit strong divergence from

other assets and suggests that investors should wait for a

significant drop in the S&P 500 and copper before considering a

long position in Bitcoin. Looking at the facts of Bitcoin, McGlone

notes that before the massive liquidity pump in 2020, the

cryptocurrency’s average price in 2019 was around $7,000. It

subsequently surged to $60,000 before settling at its current level

of $27,000. While Bitcoin is still trading at four times its 2019

average price, McGlone cautions that the risk of mean reversion

remains and suggests that investors should exercise caution in the

current market environment. BTC’s ABC Pattern Could Signal

Consolidation And Potential For Upside Crypto analyst Michael Van

de Poppe has assessed Bitcoin’s recent price action and suggests

that the ABC pattern could technically be complete for BTC. The C

wave went lower than the initial A wave, and they are approximately

the same length from a price drop perspective. The lowest wick was

only $500 off the base case, and the price seems to have entered

consolidation just as expected, albeit higher. Van de Poppe notes

that C waves having approximately the same length as the A wave is

uncommon, and sometimes the C wave can go much deeper than the A

wave. However, at this point, it is worth considering that the

bottom of the C wave may be in. If another drop is lower, it should

happen in the first half of this week. If the price breaks

above $27,700 or even flips the descending trendline, that could be

early signs that consolidation is ending, and Bitcoin’s price is

ready for continuation upwards. The ultimate level to flip for

higher conviction is $29,000, and RSI is above 50. Related Reading:

How Does Current Bitcoin Rally Compare With Historical Ones? On the

other hand, if there is a daily candle close below $16,700, another

leg down becomes more likely, and Van de Poppe’s target for that

would still be $24,000 – $25,3000. Van de Poppe emphasizes that

both scenarios are bullish over the medium timeframe (months) as

long as Bitcoin’s price does not drop and stays under $22,000 in a

sustained manner. Featured image from iStock, chart from

TradingView.com

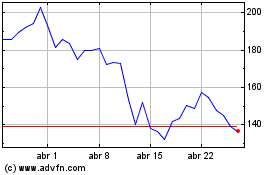

Solana (COIN:SOLUSD)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Solana (COIN:SOLUSD)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024