Polkadot Extends Decline, Can Bulls Defend $5.15 Support?

25 Maio 2023 - 5:59PM

NEWSBTC

The Polkadot price analysis continues to indicate a bearish outlook

as the market undergoes a notable decline. Within the past 24

hours, the asset’s price experienced a slight decline,

demonstrating sideways movement under the influence of bearish

sentiment. On a weekly timeframe, there has been limited movement

in the price of DOT. In terms of technical indicators, DOT has

exhibited bearish strength, with low buying pressure. Both demand

and accumulation levels have decreased based on the daily chart.

Related Reading: Bitcoin Bearish Signal: NUPL Finds Rejection At

Long-Term Resistance Given the indecisiveness in Bitcoin’s chart,

many altcoins, including DOT, have either remained constrained

under immediate resistance levels or have entered consolidation

phases. It is crucial for DOT to maintain a price level above its

immediate support to avoid the possibility of another substantial

decline in upcoming trading sessions. If selling pressure

intensifies, there is a risk of the altcoin breaking below its

crucial support level. The declining market capitalization of

Polkadot indicates that sellers are still exerting control over the

asset. Polkadot Price Analysis: One-Day Chart As of the current

writing, DOT is being traded at $5.29, with Polkadot hovering near

its critical support level of $5.15. Should the price fall below

this level, it may further decline to $5. On the upside, a

significant resistance level is observed at $5.40. If DOT bulls

manage to surpass this resistance, it could potentially trigger a

rally towards $5.71, indicating a 6% appreciation. Further progress

could then lead the price into the $6 range. Notably, the trading

volume of DOT in the last session was relatively low. This

suggested that buying strength was weaker compared to selling

pressure. Technical Analysis During the months of April and May,

the demand for DOT remained relatively weak. Analysis shows that

the Relative Strength Index (RSI) remained below the 40-mark,

indicating that selling pressure outweighed buying pressure in the

market. Additionally, DOT remained below the 20-Simple Moving

Average (SMA), further affirming the dominance of sellers in

driving the price momentum. However, if DOT manages to surpass the

$5.30 mark, it has the potential to climb above the 20-SMA line.

This could potentially attract buyers back into the market and

shift the overall sentiment in a more positive direction. As demand

for DOT declined, the altcoin exhibited decreasing buy signals on

its one-day chart. The Moving Average Convergence Divergence

(MACD), which represents price momentum and trend reversal,

displayed declining green histograms, indicating a weak buy signal

for DOT. Furthermore, the Bollinger Bands, which illustrate price

volatility and fluctuations, exhibited constriction, indicating a

range-bound movement. Related Reading: Bitcoin Hangs At $26,200:

Why This Is A Crucial Support Level The upcoming trading sessions

hold importance for DOT as they will determine whether the price

breaks out above or below the crucial support line. Featured Image

From UnSplash, Charts From TradingView.com

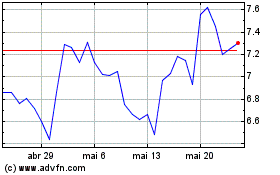

Polkadot (COIN:DOTUSD)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Polkadot (COIN:DOTUSD)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024