9 Crypto Predictions For 2025: Nansen CEO Predicts Biggest Bull Run Ever

27 Novembro 2024 - 7:00PM

NEWSBTC

In a thread on X, Alex Svanevik, CEO of leading on-chain analytics

platform Nansen, unveiled nine bold predictions for the crypto

industry in 2025. Svanevik forecasts that the upcoming year will

herald “the mother of all bull markets,” propelled by technological

advancements, regulatory shifts, and widespread adoption across

various sectors. #1 Crypto Memecoins Will Set New On-Chain Records

Svanevik predicts that memecoins—cryptocurrencies inspired by

internet memes—will continue to attract retail investors to the

crypto space. He anticipates these tokens will significantly boost

on-chain metrics, leading to unprecedented records in decentralized

exchange (DEX) volumes across multiple blockchain networks. Related

Reading: From Bitcoin to Altcoins: Crypto Inflows Hit Record $3.1

Billion, Led by Spot ETFs “Memecoins continue to onboard retail to

crypto—and smash onchain metrics. We’ll see new records in DEX

volume for lots of chains,” Svanevik stated. “Better

infrastructure, easier user experience, lower transaction fees—all

these make the journey on-chain better for newcomers.” #2 A DeFi

Renaissance Svanevik foresees a resurgence in decentralized finance

(DeFi), driven by clearer regulations and the activation of revenue

models within DeFi protocols. With the upcoming departure of the US

Securities and Exchange Commission (SEC) Chairman Gary Gensler on

January 20, Svanevik predicts that regulatory hurdles will be

reduced and institutional capital will flow more freely into DeFi

platforms. “DeFi renaissance. Gary’s gone. Revenue switch = on,” he

notes. “We actually have useful DeFi protocols now that tons of

capital can flow into. Perhaps valueless governance tokens will

accrue value.” #3 Spot Solana ETF Launch Svanevik anticipates the

introduction of a spot Solana (SOL) exchange-traded fund (ETF),

asserting that it will outperform the launch metrics of the

Ethereum ETF. “SOL ETF. And it does better than the ETH ETF did at

launch.” As NewsBTC reported, discussions between SEC staff and

issuers for a spot Solana ETF are “progressing,” with S-1

registration statements currently under review. Exchanges may soon

file Form 19b-4 applications, initiating the official regulatory

approval process. Asset management firms such as VanEck, 21Shares,

Canary, and Bitwise are actively competing to launch the first SOL

ETF in the United States, aiming for a debut in 2025. #4 Resurgence

Of Permissioned Blockchains Svanevik predicts a comeback for

permissioned blockchains, expecting them to gain significant

traction this time. “Permissioned chains make a comeback, and this

time gain much more traction. Watch Haven1 here. Tokenization will

be a big theme for permissioned chains.” #5 Flourishing Bitcoin

Ecosystem Svanevik expects the Bitcoin ecosystem to thrive both in

traditional finance (TradFi) and through on-chain developments.

“Bitcoin ecosystem continues to flourish—both in TradFi and

on-chain (via projects like Bitlayer).” Related Reading: Inside

Trump’s Crypto Holdings: $6.9M Portfolio, With One Altcoin Ready

For A Major Rally #6 DeSci Will Become A New Strong Narrative

Decentralized Science (DeSci) initiatives are predicted to fund

groundbreaking scientific endeavors, particularly in longevity

research and other frontier fields. “DeSci funds (crazy) science.

Lots of crypto leaders are interested in longevity specifically and

science more generally. This means more access to capital for

frontier science—and probably more headlines,” Svanevik writes. #7

Crypto Accelerates AI Development Svanevik envisions

cryptocurrencies playing a dual role in accelerating artificial

intelligence (AI) projects and offering solutions to mitigate

associated risks. “Crypto accelerates AI, but also protects us from

AI. Wacky experiments with agents continue. Cryptodollars pour into

AI projects.” He also highlights the emergence of cryptographic

proof-of-human projects to combat bots and fake content: “More

cryptographic proof-of-human projects come to market to combat bots

and fake content.” #8 Enactment Of FIT21 Law Svanevik anticipates

significant legislative developments with the enactment of the

FIT21 law, potentially catalyzing a new era of innovation and

growth in the United States. “FIT21 becomes law. The era of the

American Renaissance begins.” #9 Exponential Growth For RWAs

Svanevik predicts substantial growth in the market capitalization

of tokenized real-world assets, estimating at least a threefold

increase. “We’ll see a 3X in market cap of RWAs—on the low end.

Probably a lot more. People will finally realize the full potential

of crypto: Every asset will be tokenized.” At press time, Bitcoin

traded at $94,239. Featured image created with DALL.E, chart from

TradingView.com

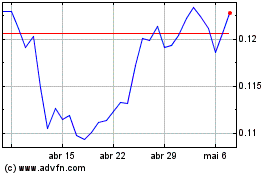

TRON (COIN:TRXUSD)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

TRON (COIN:TRXUSD)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024