Bitcoin HODLing Rewards: Long-Term Holders Selling At 326% Profit

10 Dezembro 2024 - 2:30AM

NEWSBTC

On-chain data shows that long-term Bitcoin holders have been

selling recently as their profits have ballooned to notable levels

after the price surge. Bitcoin Long-Term Holders Have Been In Huge

Profits Recently As CryptoQuant community analyst Maartunn

explained in a new post on X, the long-term holders have sold big

in the past month. The “long-term holders” (LTHs) refer to the

Bitcoin investors who have been holding onto their coins for more

than 155 days. This cohort includes the most relentless hands of

the market, who rarely sell regardless of whether a rally or crash

is going on. These investors are in sharp contrast to the

“short-term holders” (STHs), who generally react to any happening

in the sector. Related Reading: Analyst Sets $4.40 XRP Target As

3rd-Straight Bull Pennant Forms As such, the times that the LTHs

decide to sell can be to watch out for since it means the market is

at a stage where even these diamond hands have become tempted to

part with their long-held coins. Bitcoin is currently experiencing

one such instance, as the bull run to unseen highs has forced some

LTHs into harvesting their hard-earned profits. Below is the chart

shared by the analyst that shows the trend in the 30-day change for

the LTH supply. As displayed in the graph, the Bitcoin LTH supply

has registered a large negative change during the past month, which

suggests these HODLers have broken their silence. In total, the

diamond hands have transferred 827,783 BTC in this window.

Naturally, not all transactions correspond to selling, but

generally, there is a high chance of selling being the intent

whenever the LTHs move their coins. The reason behind the LTH

selloff becomes apparent when considering the group’s profit-loss

margin. As CryptoQuant author Axel Adler Jr pointed out in an

X post, the group is sitting on average profits of 326%. From

the chart, it’s visible that while the profits of the Bitcoin LTHs

are high on their own, they are still considerably less than the

margin during the 2021 bull run. Related Reading: Bitcoin Flash

Crash Causes $710 Million In Crypto Long Liquidations This, of

course, doesn’t mean that the current rally also has as much room

left to go, as it’s very possible that this cycle would simply net

these diamond hands fewer gains than last time. While the LTHs have

been spending significant amounts recently, Bitcoin hasn’t budged

too much, which implies considerable new demand is still flowing

into the sector that is absorbing this selling pressure. However,

It remains to be seen how long this balance will be maintained. BTC

Price Bitcoin had shown a brief break out of its consolidation

phase earlier in the month, but it would appear the asset has found

its way back into the range as its price is now trading around

$98,200. Featured image from Dall-E, CryptoQuant.com, chart from

TradingView.com

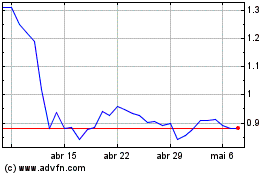

Flow (COIN:FLOWUSD)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Flow (COIN:FLOWUSD)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024