Market Reacts To Trump’s Crypto Support: Almost $10 Billion Invested In US Bitcoin ETFs

10 Dezembro 2024 - 5:00AM

NEWSBTC

Since Donald Trump became president-elect a little more than a

month ago, roughly $10 billion has flooded into US spot Bitcoin

ETFs, showing growing optimism that his administration will support

the cryptocurrency industry. According to Bloomberg, a dozen funds

from big issuers including BlackRock and Fidelity Investments have

received around $9.9 billion in net inflows into their various

Bitcoin ETFs since November 5, bringing their total assets to

around $113 billion. Trump’s Appointments Signal Shift To

Pro-Crypto Regulation Trump’s recent selections, such as a digital

asset champion to lead the US Securities and Exchange Commission

(SEC) and the creation of a White House czar for artificial

intelligence and crypto, indicate a shift toward a more friendly

regulatory climate. Notably, Trump has praised the concept of

establishing a national Bitcoin reserve, which is gaining

bipartisan support in Congress, with pro-crypto Senator Cynthia

Lummis at the lead. Related Reading: XRP Skeptic Turned

Believer? Critic Hails XRP As Crypto’s Chart King Bitcoin recently

surpassed the $100,000 mark for the first time on December 5,

trading at around $96,898 as of Monday. The cryptocurrency’s

six-week winning streak is the longest since the market frenzy of

2021, but analysts remain concerned about volatility. David Lawant,

head of research at crypto premier broker FalconX, noted that a

sustained push above the $100,000 milestone will most likely

necessitate other positive catalysts, as BTC has struggled to

recapture this level while stabilizing after the advance over the

last four days. Bitcoin Rally Boosts MicroStrategy And Peers

Bloomberg also notes that the positive atmosphere surrounding

cryptocurrencies has resulted in a substantial rebound among

companies that have followed MicroStrategy’s strategy of selling

convertible bonds to fund Bitcoin purchases. MicroStrategy alone

sold $6.2 billion in convertibles this year and intends to raise an

additional $21 billion through fixed-income offerings. Other

companies, including MARA Holdings and Core Scientific, have

successfully obtained significant funds to support their Bitcoin

acquisitions. MicroStrategy’s stock, MSTR, has risen 73% since

Donald Trump’s election, while MARA, Riot Platforms, and Core

Scientific’s shares have increased by 63%, 33%, and 30%,

respectively. This trend closely resembles Bitcoin’s nearly

40% growth within the same period. With a market capitalization

approaching $2 trillion, Bitcoin’s recent ascent has dramatically

increased MicroStrategy’s assets, which are now worth more than $41

billion. Related Reading: Dogecoin Price Prediction: Here’s What

The 91-Day Pattern Says Could Happen Next The terms of recent

crypto-related convertible deals stand out, particularly because

many are structured with zero coupons, allowing investors to engage

in convertible arbitrage. Despite the high demand for these

instruments, there appears to be little anxiety about prospective

Bitcoin price decreases. Raj Imteaz, head of convertible and equity

derivatives advisory at ICR Capital LLC, noted that larger players

in the market feel compelled to issue convertibles to remain

competitive. “If your competitor has a large war chest funded

at very low coupons and you haven’t tapped the market, you’re at a

competitive disadvantage,” he said. “You almost have to issue

converts to stay competitive within crypto.” Featured image from

DALL-E, chart from TradingView.com

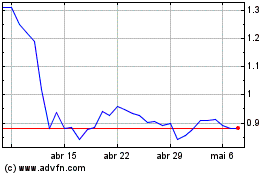

Flow (COIN:FLOWUSD)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Flow (COIN:FLOWUSD)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024