Solana Dips To 5-Month Low As Memecoin Traders Retreat Post-LIBRA Scandal

26 Fevereiro 2025 - 9:00PM

NEWSBTC

The cryptocurrency market is experiencing significant turbulence

this week, with Solana (SOL) facing particularly steep challenges.

As the excitement surrounding memecoins wanes, prices have dropped

to their lowest levels in several months. Following the

historic hack of the ByBit exchange and President Trump’s

controversial tariff proposals, the overall crypto market has seen

a downturn, with Bitcoin falling 12% in the past week. In contrast,

Solana has plummeted 22%, reaching a new five-month low. Solana

Struggles As New Data Shows Dramatic Drop As reported by Fortune,

the decline in Solana’s value can be attributed to its association

with recent celebrity-backed memecoin scandals, particularly the

LIBRA incident. This cryptocurrency surged to a nearly $5

billion market cap before crashing, following promotion from

Argentine President Javier Milei, whose involvement has sparked

outrage and prompted an investigation. Related Reading:

Avalanche (AVAX) Overextended—Is A Market Shakeup Imminent? Zach

Pandl, head of research at the crypto asset manager Grayscale,

noted that this incident has highlighted the volatility and risks

associated with memecoins, stating, “The current phase of memecoin

trading on Solana is over.” Solana’s rise as the preferred

blockchain for memecoin development was largely due to its low

transaction costs, high transaction speeds, and user-friendly

infrastructure. Platforms like Pump.fun facilitated the rapid

creation of cryptocurrencies on Solana, leading to a peak of over

71,000 memecoins launched in a single day. However, this number has

since dwindled to just 26,000, according to data from analytics

firm Dune. Analysts Warn Of Potential Drop Below $100 While many

memecoins lack intrinsic value and are often linked to scams, Pandl

suggested that the recent memecoin frenzy had some positive impacts

on the Solana ecosystem. “It onboarded users, generated

revenue, and helped stress test the Solana blockchain in various

ways,” he explained. “In that sense, memecoin trading is one of the

many building blocks to developing the next generation of financial

infrastructure.” Adding to Solana’s woes, the open interest for

Solana futures has declined by 44% over the past month, dropping

from an all-time high of $6.39 billion to just $3.57 billion today.

This decline indicates a reduction in investor confidence and

interest in leveraging Solana positions. Related Reading: Panic

Sell? Bitcoin’s $86K Fall Wipes Out $1 Billion In Trades CoinGecko

data also shows a similar pattern from investors, as trading volume

has dropped 54% in the last 48 hours, representing only $5 billion

of Solana’s total market cap of $66 billion. Currently trading at

$134, analysts have identified this price point as a crucial

support zone in the ongoing downtrend. According to Crypto General,

if this support fails to hold, the next support level could fall

below $100, representing a drop of more than 65% from Solana’s

all-time highs. Featured image from DALL-E, chart from

TradingView.com

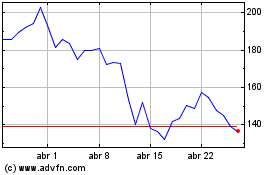

Solana (COIN:SOLUSD)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Solana (COIN:SOLUSD)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025