In 9M19, Braskem generated free cash flow of R$2.8 billion

14 Novembro 2019 - 11:45PM

PR Newswire (US)

SÃO PAULO, Nov. 14, 2019

/PRNewswire/ -- BRASKEM S.A. (B3: BRKM3, BRKM5 and BRKM6;

NYSE: BAK; LATIBEX: XBRK) announces today its results for 3Q19.

HIGHLIGHTS:

Braskem - Consolidated:

- Recurring EBITDA was US$389

million, in line with 2Q19, due to higher resin sales volume

from Brazil in both the domestic

and export markets and by PP sales in Europe, which partially offset lower

international spreads. In Brazilian real, recurring EBITDA came to

R$1,549 million, increasing 2% from

2Q19.

- Free cash generation was R$401

million in 3Q19, down 82% from 2Q19, due to the impact on

working capital from the lower feedstock consumption, which were

offset by the efficient management of inventories in the

quarter.

- Financial leverage measured by the ratio of net debt to EBITDA

in U.S. dollar stood at 2.78x.

- The recordable and lost-time injury frequency rate (CAF + SAF),

considering both Team Members and Partners per million hours

worked, stood at 1.17 in 3Q19, 34% lower than 2Q19 and 63% below

the industry average.

- In October, the Company filed 20-F Forms for fiscal years 2017

and 2018 with the U.S. Securities and Exchange Commission (SEC). As

a result, trading in Braskem's American Depositary Shares (ADSs)

was resumed on the New York Stock Exchange (NYSE).

- Braskem's shareholders approved, in the Extraordinary

Shareholders' Meeting of October 3,

2019, the distribution of minimum mandatory dividends for

the fiscal year 2018, in the amount of R$667.4 million, to be paid by December 31, 2019.

- In November, Braskem placed US$2.25

billion in bonds in the international market, with

US$1.5 billion due in 10 years and

US$750 million in 30 years, making it

the Company's largest bond issue ever. In the same period, the

Company issued R$550 million in

promissory notes due in up to five years. The proceeds are being

used primarily to repay other shorter-term, higher-cost

liabilities.

- In order to improve its communication with the market, Braskem

releases today its first report prepared based on the International

Integrated Report Framework developed by the International

Integrated Reporting Council (IIRC). In the integrated report, we

identify how the Company manages its 6 capitals (financial,

manufactured, social and relationship, natural, intellectual and

human).

Brazil:

- The PVC plants operated at a capacity utilization of 57%, 9

p.p. higher than in 2Q19, due to the stabilization of EDC

imports.

- EBITDA in Brazil was

US$231 million (R$919 million), up 38% from 2Q19, which is

explained by higher resin sales in the local and export markets and

by lower feedstock prices.

United States and

Europe:

- EBITDA in the United States

and Europe was US$91 million (R$361

million), down 15% on 2Q19, which is explained by the lower

sales in the United States due to

operational problems at the PP plants and by the lower PP spreads

also in the United States, though

still at high levels, with these factors partially offset by the

higher sales in Europe after the

resumption of propylene supply to one of the PP plants in

Germany.

Mexico:

- EBITDA in Mexico was

US$96 million (R$385 million), up 9% in 2Q19, which is mainly

explained by the commercial strategy to direct shipments to more

profitable regions.

- Braskem Idesa obtained from its creditors waivers of the

non-pecuniary obligations in the project finance agreements,

including postponement of the Guaranteed Physical Completion

Date, from November 30, 2016 to

November 30, 2020, and of the

Guaranteed Financial Completion Date, from December 31, 2016 to December 31, 2020. As a result, the principal

debt may be reclassified from current to non-current liabilities in

the annual financial statements for 2019.

The full earnings release is available on the Company's IR

website: http://www.braskem-ri.com.br/home-en

Braskem will host conference calls to discuss its Results

MONDAY, November 18, at 11:00 a.m. US ET.

Additional information may be obtained from the Investor

Relations Department at +55 11 3576-9531 or

braskem-ri@braskem.com.br

View original

content:http://www.prnewswire.com/news-releases/in-9m19--braskem-generated-free-cash-flow-of-r2-8-billion-300958973.html

View original

content:http://www.prnewswire.com/news-releases/in-9m19--braskem-generated-free-cash-flow-of-r2-8-billion-300958973.html

SOURCE Braskem S.A.

Copyright 2019 PR Newswire

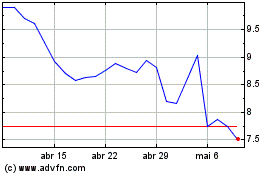

Braskem (NYSE:BAK)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

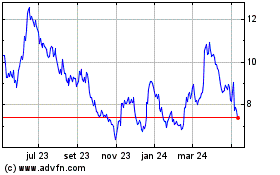

Braskem (NYSE:BAK)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024