TIDMJAN

Jangada Mines PLC

03 May 2022

Jangada Mines plc / EPIC: JAN.L / Market: AIM / Sector:

Mining

3 May 2022

Jangada Mines plc ('Jangada' or 'the Company')

Shareholder Q&A Following Publication of Technical Report

for Pitombeiras Vanadiferous Titanomagnetite ('VTM') Project

Jangada Mines plc, a Brazilian focussed natural resource

development company, has received a number of questions following

the release of its Technical Report on 21 April 2022 for the

Pitombeiras VTM Project. In line with its commitment to increasing

shareholder engagement, the Company is pleased to provide answers

to relevant questions and clarity on the Project's potential value

and status.

Brian McMaster, Executive Chairman of Jangada stated, "We have

had a number of questions, which we have answered below. I would

like to stress the results were both exciting and robust with a

headline 100.3% post-tax Internal Rate of Return ('IRR'), and a

US$96.5 million post-tax Net Present Value ('NPV') (8% discount

rate), with a 13-month payback. There are few projects with such a

strong IRR, which show no geological, economic, or legal impediment

to proceeding to production."

1. Question: What metals are included in the study valuation?

Answer: The evaluation included the FeV2O5 concentrate and TiO2

production. Presently, the evaluation of the Fe 62% and V2O5 has

been completed aiming to be a Feasibility Study ('FS') standard,

while the inclusion of the TiO2 remains at a Preliminary Economic

Assessment ('PEA') level.

2. Question: What pricing was used in the Technical Report ?

Answer: The pricing for the economic evaluation used was as

follows. The Fe/V2O5 concentrate was US$165.64/t, U$120/t for the

Fe component and US$45.64 for the V2O5. A price of US$220/t was

used for the TiO2.

3. Question: What confidence do you have in the production rates for the project?

Answer: The study for Fe/V2O5 production is essentially up to FS

level. The annual production of 186,000t of Fe 62% / V2O5 and

66,000t of TiO2 at a production/processing rate of 600,000tpa

therefore carries a relative high level of confidence for Fe/V2O5

while it is a lower level for TiO2.

4. Question: What is included in the financial figures?

Answer: The financial figures include the production of Fe/V2O5

concentrate and TiO2 and are summarised below:

-- US$96.5 million NPV @ 8% discount rate

-- 100.3% post-tax IRR

-- US$415.2 million total gross revenue

-- US$145.9 million post-tax, undiscounted operating cash flow

-- Post-tax payback period of 13 months

-- US$18.45 million CAPEX (US$2.25 million for TiO2)

-- US$1.26 per tonne mined average operating cost

-- US$19.39 per tonne of Fe V2O5 concentrate processed average operating cost

-- US$ 12.48 per tonne of TiO2 processed average operating cost

5. Question: Which resource categories have been used in the Technical Report?

Answer: The Technical Report was based on the parameters of a FS

and thus only included the 5.10Mt in the Measured and Indicated

resource categories, while excluding the Inferred. With drilling,

there is the possibility to upgrade the Inferred resource of

3.16Mt, which would have an immediate impact on the Life Of Mine

and subsequent potential financial metrics.

6. Question: Is their scope to increase the resource?

Answer: Yes. The Total Project Mineral Resource Estimation

('MRE') below (effective/published date of July 20th, 2021), is

from only 3 of 8 known magnetic targets, being Pitombeiras North,

South, and Goela.

Resource Classification Mass (Mt) Average Grade %

V(2) O(5) TiO(2) Fe(2) O(3)

---------- ------- -----------

Measured 1.75 0.48 9.47 47.79

---------- ---------- ------- -----------

Indicated 3.35 0.45 8.82 45.16

---------- ---------- ------- -----------

Measured + Indicated 5.10 0.46 9.04 46.06

---------- ---------- ------- -----------

Inferred 3.16 0.44 9.00 45.86

---------- ---------- ------- -----------

7. Question: Can you explain the pricing used in the Mineral

Resources Statement compared to the Technical Report?

Answer: In the Technical Report in the section titled Mineral

Resource, it stated the following:

'A reasonable prospect for an eventual economic extraction of

the Mineral Resources has been established through the calculation

of a conceptual open pit shell, following the input parameters: 1)

Selling price for iron concentrate (62%/65% Fe, + V2O5 credit) of

US$105.75/t; 2) mining cost of US$2.78/t mined; 3) processing cost

of US$6.00/t processed; 4) general and administrative (G&A)

costs of US$1.14/t; 5) global mass recovery of 80%; 6) mining

dilution of 5%, and; 7) mining recovery of 95%.'

These figures were conceptual and were used for the Resource

calculation by the geological consultant as of July 2021, being the

date of its publication. They do not represent the pricing

parameters for cash flow used in the Technical Report, which were

updated by GE21, the Company's consultant and had an effective date

of 31st January 2022 (see Question 2). According to technical

information disclosure rules and GE21, these had to published when

publishing the report and have unfortunately proven confusing. GE21

is a leading Brazilian based mining consultant with a highly

experienced team and an extensive national and international

affiliate network including the British Geological Survey.

8. Question: From the Dec 21st RNS, it was stated that all

aspects of the FS had been completed apart from the TIO2

components. What progress has been made in the last four

months?

Answer: For the last four months, our independent consultant

GE21 has been evaluating the potential of the titanium component of

the Project, the relevant processing routes, and its impact to the

economics of Pitombeiras. This process takes time and has now been

included to a PEA level and included in the headline figures. The

next stage is to bring the titanium evaluation up to an FS standard

to match the Fe/V2O5 portion of the Project.

9. Question: What is your level of confidence in Pitombeiras?

Answer: The numbers speak for themselves. The Project

potentially presents an excellent value and, with both V2O5 and

TiO2, we have exposure to commodities related to the new energy

economy, which have a positive pricing environment. With our

technical advisors seeing no geological, economic, or legal

impediment to proceeding to production, we believe we have a

project that is highly attractive. All chapters of the Technical

Report including pit design and operation, processing route,

production matrix and sales route are defined to FS level

(exception being chapter relating to TiO2, which is at PEA level).

Importantly, we are in a progressive and stable mining jurisdiction

which, in the current global environment and increasing supply

pressures, underpins the wider story.

10. Question: What are the reasons for choosing wet separation

processing, as opposed to the original PEA's dry separation, which

has reduced the IRR from the initial PEA?

Answer: The Davis tube tests indicated that the mass recovery

and product content would be high, meaning a dry ore processing

rout via magnetic separation was chosen. A FS goes into more detail

to ensure a de-risked development path can be defined. Following

additional tests, the route that proved to be viable for

beneficiation was the wet processing for iron liberation and

concentration through flotation. The wet process reduced the mass

recovery rates and increased the equipment, energy, and

transportation costs, which increased the OPEX and CAPEX. Despite

this, and a reduction in the headline figures, the project remains

robust with an IRR of 103%.

11. Question: Why does the DSO operation refer to 62% Fe

content, as opposed to previous references of 65% Fe?

Answer: The previous DSO was based on the Davis tube methodology

and dry iron ore concentration. With more detailed studies, as

explained in the answer to the question number 10 above, it was

verified that the ore beneficiation would have to be wet processing

for iron liberation and concentration through flotation and the

guaranteed content of iron would be 62%.

12. Question: What is the current off-taker situation?

Answer: The Board has a wide range of contacts within the

mineral industry. The channels have been open to many of these as

the Project has been de-risked through the previous evaluation

studies. Now that most of the Project is to FS, off-take discussion

can be commenced to a level that potential parties can understand

the processing routes and costs, making the Project open for

terms.

13. Question: Are you acquiring new projects?

Answer: The Company has highly experienced Brazilian centric

legal, financial, and operational management team able to source

and execute on projects. They have a proven track record of being

able to find high value low-cost opportunities, such as the

acquisition of the Pedra Branca Platinum Group Metals Project,

which was vended to TSX listed, ValOre Metals, for an initial

consideration of c. 25,000,000 shares and C$3,000,000. We identify

and evaluate multiple projects to see if they fit our investment

criteria and have the potential to add shareholder value.

14. Is the Company considering a fund raising?

Answer: No. The Company has a strong treasury with the last

reported cash position of $5 million as at 30 June 2021. There are

few companies on AIM with a comparative economic project with and

NPV8 of US$96.5m, cash and a market capitalisation of under GBP17m.

The Board also controls 42.7% of the equity and would not want to

dilute its position.

15. Question: Were you disappointed by the market's reaction to

the Technical Report findings?

Answer: In a nutshell, yes. The report de-risked the Project

significantly and published highly compelling numbers. With a

market cap of under GBP17m, a strong treasury, a defined mining

asset with an NPV of US$96.5m and IRR of 100.3%, a scalable

resource, a proven team operating in a stable jurisdiction and the

potential for additional value accretive acquisitions, I am

disappointed.

**ENDS**

For further information please visit www.jangadamines.com or

contact:

Jangada Mines plc Brian McMaster (Chairman) Tel: +44 (0) 20 7317

6629

Strand Hanson Limited Ritchie Balmer Tel: +44 (0)20 7409 3494

(Nominated & Financial James Spinney

Adviser)

Tavira Securities Limited Jonathan Evans Tel: +44 (0)20 7100 5100

(Broker)

St Brides Partners Ana Ribeiro jangada@stbridespartners.co.uk

Ltd Oonagh Reidy

(Financial PR)

This information is provided by Reach, the non-regulatory press

release distribution service of RNS, part of the London Stock

Exchange. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

Reach is a non-regulatory news service. By using this service an

issuer is confirming that the information contained within this

announcement is of a non-regulatory nature. Reach announcements are

identified with an orange label and the word "Reach" in the source

column of the News Explorer pages of London Stock Exchange's

website so that they are distinguished from the RNS UK regulatory

service. Other vendors subscribing for Reach press releases may use

a different method to distinguish Reach announcements from UK

regulatory news.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NRABKBBNKBKBOPK

(END) Dow Jones Newswires

May 03, 2022 02:02 ET (06:02 GMT)

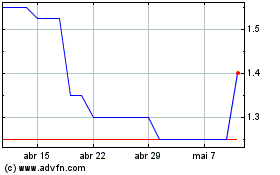

Jangada Mines (LSE:JAN)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Jangada Mines (LSE:JAN)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024