TIDMUKCM

UK Commercial Property REIT Ltd

21 February 2023

UK Commercial Property REIT Limited

UKCM secures significant new lettings at M25 based Ventura Park

industrial estate

21 February 2023: UK Commercial Property REIT Limited ("UKCM" or

the "Company") (FTSE 250, LSE: UKCM) announces that it has secured

new leases on 116,200 sq ft of space comprising two units, B and 7,

at its Ventura Park industrial estate in Radlett,

Hertfordshire.

The units have been taken by two new occupiers following the

departure of the previous tenant on 17 January 2023, with one

moving in the following day, demonstrating the continued strong

demand for good value, well-located industrial space. The leases

secure GBP2 million of rent per annum in aggregate which, in

addition to the premium over the previous passing rent, is ahead of

ERV.

As a result of the agreements, UKCM has increased the weighted

average lease term of Ventura Park from 5.75 years to 7.4 years and

has taken occupancy to 94.4%. The new leases maintain UKCM's

occupancy level at 98%.

Location Collective, the UK's third largest film studio

operator, has agreed to take the 86,000 sq ft Unit B on a 15 year

lease and is due to take occupation in April 2023. The company

intends to refurbish the site into a high specification film studio

facility as part of plans to roll-out further facilities in the

coming years. As part of the agreement, UKCM will install LED

Lighting throughout the unit and an electric Variable Refrigerant

Flow temperature control system in the office to improve the EPC

rating from an E to a B.

Aerospace Reliance Ltd, a global supplier of aircraft

maintenance materials, took occupation of the 32,000 sq ft Unit 7

on the 18 January, the day after it became vacant, having agreed a

10 year lease. Unit B already has an EPC rating of B.

Ventura Park is a 35 acre multi-let industrial estate comprising

590,000 sq ft of storage and logistics space across 13 industrial

units and is let to a range of tenants. Situated in Radlett, it is

located close to the M25 between the M1 and A1(M) junctions, which

provide a quick connection to London and the wider UK.

The 29,000 sq ft Unit G&H is available to let.

Will Fulton, Fund Manager of UKCM at abrdn, said : "These latest

lettings at Ventura Park have been agreed very shortly after the

units became vacant at market rent significantly ahead of the

previous rent paid, reflecting the strength of the market, lack of

supply and strength of this location for London businesses. They

clearly demonstrate the continued demand for well-located

industrial business space, situated in close proximity to large

urban areas and key transport arteries and are testament to our

asset management team's ability to capture rental reversion, in

line with our strategy to drive income on behalf of

shareholders."

UKCM was advised by Paul Londra of TLRE and Sam Vyas of Avison

Young.

ENDS

(1) Based on occupancy as of 31st December 2022.

For further information please contact:

Richard Sunderland / Emily Smart / Andrew Davis, FTI

Consulting

Tel: 020 3727 1000

Email: UKCM@fticonsulting.com

Notes to Editors - UK Commercial Property REIT

UK Commercial Property REIT is a FTSE 250 Real Estate Investment

Trust listed on the London Stock Exchange. It aims to provide

shareholders with an attractive level of income together with the

potential for capital and income growth from investing in and

managing a GBP1.31 billion (as at 31 December 2022) diversified

portfolio. The portfolio has a strong bias towards prime,

institutional quality properties and is diversified by location and

sector across the UK.

*The Company is managed and advised by abrdn (the Company's

appointed AIFM).

Further information on the Company's investment policies, the

types of assets in which the Company may invest, the markets in

which it invests, borrowing limits as well as details of its

management, administration and depositary arrangements can be found

in the Company's Annual Report and Investor Disclosure Document.

The above documents are available on the Company's website

www.UKCPREIT.com. Paper copies of these documents are available on

request, free of charge, via the contact details outlined on the

website.

Property is a relatively illiquid asset class, the valuation of

which is a matter of opinion. There is no recognised market for

property and there can be delays in realising the value of property

assets. Investors should be aware that past performance is not a

guide to future results. The value of investments, and the income

from them, can go down as well as up, and an investor may get back

less than the amount invested.

For further information on UK Commercial Property REIT, please

visit www.UKCPREIT.com .

This information is provided by Reach, the non-regulatory press

release distribution service of RNS, part of the London Stock

Exchange. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

Reach is a non-regulatory news service. By using this service an

issuer is confirming that the information contained within this

announcement is of a non-regulatory nature. Reach announcements are

identified with an orange label and the word "Reach" in the source

column of the News Explorer pages of London Stock Exchange's

website so that they are distinguished from the RNS UK regulatory

service. Other vendors subscribing for Reach press releases may use

a different method to distinguish Reach announcements from UK

regulatory news.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NRATBMLTMTJTMPJ

(END) Dow Jones Newswires

February 21, 2023 04:45 ET (09:45 GMT)

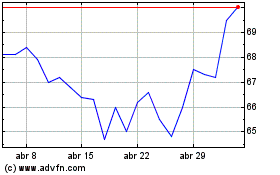

Uk Commercial Property R... (LSE:UKCM)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Uk Commercial Property R... (LSE:UKCM)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024