Dollar Weakens On Fed Rate Cut Hopes Amid Coronavirus Concerns

25 Fevereiro 2020 - 4:41AM

RTTF2

The U.S. dollar lost ground against its most major counterparts

in the European session on Tuesday, as hopes for a Fed rate cut

increased on fears that the coronavirus outbreak would dampen

economic growth.

The dollar, viewed as a safe-haven asset, initially rose on a

jump in new coronavirus infections in China and worldwide.

Former Minneapolis Fed President Naryana Kocherlakota called for

a rate cut as early as May, according to a Bloomberg Opinion

piece.

"I don't think that the FOMC should wait that long to deal with

this clear and pressing danger," Kocherlakota wrote. "I would urge

an immediate cut of at least 25 basis points and arguably 50 basis

points."

Market participants are pricing in a 25 basis-point cut at the

Fed's policy-setting meeting in June.

The greenback dropped to 0.9768 against the franc, from a high

of 0.9805 seen at 8:00 pm ET. The greenback is seen finding support

around the 0.96 region.

The greenback was marginally down against the yen at 110.55. The

pair had finished Monday's deals at 110.69. Further drop in the

greenback may see support around the 108.00 level.

Final data from the Cabinet Office showed that Japan's leading

index rose in December as initially estimated.

The leading index, which measures the future economic activity,

rose to 91.6 in December from 90.8 in November. This was in line

with initial estimate.

The greenback depreciated to a 6-day low of 1.2995 against the

pound from yesterday's closing value of 1.2926. If the greenback

extends decline, 1.31 is possibly seen as its next support

level.

The latest quarterly Distributive Trends Survey from the

Confederation of British Industry showed that British retailers

plan to raise their investment in the year ahead for the first time

in two years.

The balance for investment intentions rose to +26 percent from

-38 percent in November, which was the biggest swing since the

survey began in 1983.

In contrast, the greenback climbed against the commodity-linked

currencies, as improving risk sentiment buoyed the latter.

The U.S. currency gained to 1.3306 against the loonie, 0.6593

against the aussie and 0.6319 against the kiwi, from its early low

of 1.3278, 4-day low of 0.6623 and a 5-day low of 0.6358,

respectively. The next possible resistance for the greenback is

seen around 1.34 against the loonie, 0.63 against the aussie and

0.62 against the kiwi.

The greenback also appreciated against the euro with the pair

trading at 1.0833. At Monday's close, the pair was worth 1.0853. On

the upside, 1.06 is possibly seen as the next resistance for the

greenback.

Data from Destatis showed that the German economy stagnated in

the fourth quarter, in line with the initial estimate, as the

positive contribution to growth from investment was nullified by

foreign trade.

Gross domestic product remained flat sequentially after

expanding 0.2 percent in the previous quarter. The statistical

office confirmed the flash estimate released on February 14.

Looking ahead, U.S. consumer confidence index for February,

S&P/Case-Shiller home price index and FHFA house price index

for December are due out in the New York session.

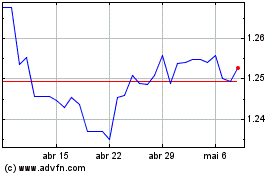

Sterling vs US Dollar (FX:GBPUSD)

Gráfico Histórico de Câmbio

De Mar 2024 até Abr 2024

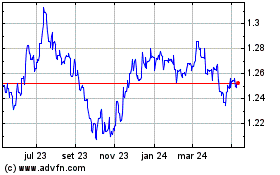

Sterling vs US Dollar (FX:GBPUSD)

Gráfico Histórico de Câmbio

De Abr 2023 até Abr 2024