Eurozone Private Sector Logs Record Fall In March

03 Abril 2020 - 1:41AM

RTTF2

The euro area private sector logged its biggest monthly fall on

record in March as the coronavirus disease, or covid-19, pandemic

impacted heavily on economic activity, final data from IHS Markit

showed Friday.

The final composite output index fell sharply to 29.7 in March

from 51.6 in February. This was also weaker than the flash estimate

of 31.4.

Both services and manufacturing sectors recorded notable

declines in output in March. Manufacturers posted the sharpest fall

in production since April 2009. At the same time, services activity

declined at a record pace.

The final services Purchasing Managers' Index plunged to a

record low of 26.4 from 52.6 a month ago. The reading was also

below the preliminary estimate of 28.4.

The covid-19 pandemic and associated measures taken to contain

the outbreak through Europe weighed heavily on business

performance.

Chris Williamson, chief business economist at IHS Markit said,

the data indicate that the eurozone economy is already contracting

at an annualized rate approaching 10 percent, with worse inevitably

to come in the near future.

Incoming new work deteriorated to the greatest extent in the

22-year survey history. Further, confidence about the future was

the lowest recorded by the survey since data were first available

in July 2012.

Due to high uncertainty, companies reduced their employment

levels. Job losses were registered for the first time in over five

years and posted the fastest fall since June 2009.

Backlogs of work, a measure of capacity constraints at firms,

deteriorated to the greatest degree in 11 years.

On the price front, the survey showed that reduced energy prices

and lower employment costs pushed overall operating expenses down

moderately for the first time in four years. Average output charges

were reduced to the greatest degree in over a decade.

Among big-four economies, Italy and Spain registered the

sharpest reductions in March.

Germany's private sector posted a record contraction in March

with the steep drop in services and accelerated reduction in

manufacturing output.

The final composite PMI declined to 35.0 from 50.7 in February.

This was below the flash score of 37.2. Likewise, the services PMI

came in at 31.7, down sharply from 52.5 in February and below the

flash 34.5.

France also posted record contraction in business activity in

March. The composite PMI fell to 28.9 from 52.0 in February. The

flash reading was 30.2.

Similarly, the services PMI declined sharply to 27.4 from 52.5

in February and below the preliminary score of 29.0.

Italy's composite output index declined to 20.2 in March from

50.7 in February. The sector fell at the sharpest rate since the

series began in January 1998. The services PMI came in at 17.4

versus 52.1 in February.

Spain's private sector ended a period of nearly six-and-a-half

years of uninterrupted growth. The composite output index fell to

26.7 from 51.8 in February. The services PMI fell nearly 30 points

to 23.0 in March.

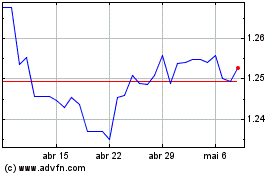

Sterling vs US Dollar (FX:GBPUSD)

Gráfico Histórico de Câmbio

De Mar 2024 até Abr 2024

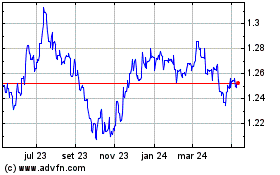

Sterling vs US Dollar (FX:GBPUSD)

Gráfico Histórico de Câmbio

De Abr 2023 até Abr 2024