Australian Dollar Drops Amid Risk Aversion

11 Julho 2022 - 3:51AM

RTTF2

The Australian dollar fell against its most major counterparts

in the European session on Monday, as a rise in COVID-19 cases in

China and the energy crisis in Europe dampened risk sentiment.

China's commercial hub of Shanghai is bracing for another mass

testing campaign after the discovery of a new subvariant Omicron

BA.5.2.1. This has intensified the lockdown worries in the

city.

Russia stopped gas exports through the Nord Stream gas pipeline,

heightening a gas crisis in Europe.

Investors fear that Russia may extend the scheduled maintenance

period in an attempt to destabilize Europe.

Commodity prices fell amid concerns over a global recession and

the implementation of fresh COVID-19 curbs in multiple Chinese

cities.

The aussie dropped to 4-day lows of 0.6782 against the greenback

and 1.1032 against the kiwi, reversing from its early highs of

0.6855 and 1.1076, respectively. The aussie is likely to find

support around 0.64 against the greenback and 1.07 against the

kiwi.

The aussie was down against the loonie, at a 6-day low of

0.8823. On the downside, 0.86 is possibly seen as its next support

level.

The aussie retreated to 92.92 against the yen, from a 6-day high

of 93.69 seen in the previous session. The next likely support for

the currency is seen around the 90.00 level.

Against the euro, the aussie remained lower, with the pair

trading at 1.4888. The aussie is seen locating support around the

1.53 mark.

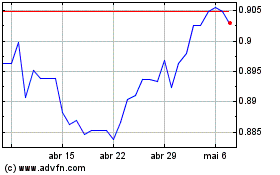

AUD vs CAD (FX:AUDCAD)

Gráfico Histórico de Câmbio

De Mar 2024 até Abr 2024

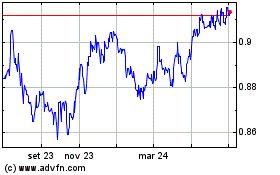

AUD vs CAD (FX:AUDCAD)

Gráfico Histórico de Câmbio

De Abr 2023 até Abr 2024