Pound Mixed After BoE Decision

23 Março 2023 - 7:10AM

RTTF2

The pound showed mixed performance against its major rivals in

the European session on Thursday, after the Bank of England raised

its benchmark rate by 25 basis points and signalled further

tightening if there are signs of persistent price pressures.

The nine-member Monetary Policy Committee decided to lift the

bank rate to 4.25 percent from 4 percent. This was the highest rate

since 2008.

Seven members of the panel voted for a quarter point hike, while

Swati Dhingra and Silvana Tenreyro again sought to maintain the

status quo.

Most of the members observed that headline inflation had

surprised significantly on the upside and the near-term path of GDP

was likely to be somewhat stronger than expected previously.

"Renewed and sustained demand for labor could still reinforce

the persistence of higher costs in consumer prices, even if

second-round effects related to energy price inflation were to

diminish," the minutes said.

The MPC vowed to continue to monitor closely indications of

persistent inflationary pressures, including the tightness of labor

market conditions and the behavior of wage growth and services

inflation.

"If there were to be evidence of more persistent pressures, then

further tightening in monetary policy would be required," the panel

said.

The pound pulled back to 1.2264 against the greenback, from a

1-1/2-month high of 1.2343 hit at 3:25 am ET. The currency may find

support around the 1.19 level.

The pound touched 0.8865 against the euro, its lowest level

since March 10. The pound had ended yesterday's trading session at

0.8845 against the euro. On the downside, 0.90 is possibly seen as

its next support level.

The pound eased off to 1.1245 against the franc, heading to

pierce a 6-day low of 1.1228 seen at 4:30 am ET. At Wednesday's

close, the pair was worth 1.1239. The pound is seen finding support

around the 1.11 level.

The pound rose to 161.84 against the yen, from a 3-day low of

160.68 it touched in the previous session. The pair was valued at

161.10 when it ended trading on Wednesday. The pound is likely to

find resistance around the 164.00 level.

Looking ahead, Eurozone flash consumer sentiment index for March

will be out at 11 am ET.

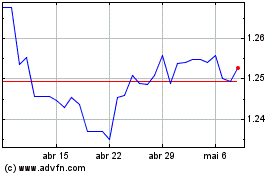

Sterling vs US Dollar (FX:GBPUSD)

Gráfico Histórico de Câmbio

De Mar 2024 até Abr 2024

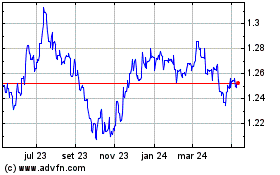

Sterling vs US Dollar (FX:GBPUSD)

Gráfico Histórico de Câmbio

De Abr 2023 até Abr 2024