Commodity currencies such as the Australia, the New Zealand and

the Canadian dollars came under pressure in the Asian session on

Friday, as investors fretted about an upcoming recession.

Investors were also concerned about negotiations in Washington

to raise the U.S. government debt ceiling.

Crude oil prices continued to fall on demand worries, helping

ease concerns around inflation and further interest-rate hikes.

Soft U.S. data and a rise in U.S. gasoline inventories released

overnight pointed to a slowing economy and sliding global oil

demand.

Brent crude futures was down at $81.10 a barrel, dropping to

$2.02, or 2.4 percent. West Texas Intermediate crude (WTI) futures

was down at $77.29 a barrel, sliding to $1.87, or 2.4 percent.

U.S. weekly jobless claims surged last week; manufacturing

activity in the mid-Atlantic region plunged to its lowest level in

3 years in April; and existing home sales fell in March, adding to

recession worries.

In other economic news, data from Judo Bank showed that the

manufacturing sector in Australia continued to contract in April,

and at a faster rate, with a manufacturing PMI score of 48.1.

That's down from 49.1 in March and it moves further beneath the

boom-or-bust line of 50 that separates expansion from

contraction.

The survey also showed that the services PMI improved to 52.6 in

April from 48.6 in February. The composite PMI rose to 52.2 in

April from 48.5 in March.

In the Asian trading today, the Australian dollar fell to a

4-day low of 89.89 against the yen, from yesterday's closing value

of 90.45. The aussie is likely to find support around the 87.00

area.

The aussie dropped to 1.6326 against the euro, from yesterday's

closing value of 1.6268. On the downside, the aussie may find

support around the 1.65 mark.

Against the U.S. and the Canadian dollars, the aussie edged down

to 0.6715 and 0.9064 from yesterday's closing quotes of 0.6741 and

0.9082, respectively. If the aussie extends its downtrend, it is

likely to find support around 0.65 against the greenback and 0.89

against the loonie.

The NZ dollar fell to 1.7816 against the euro for the first time

since 22nd October 2020. At yesterday's close, the kiwi was trading

at 1.7752 against the euro. The next support level for the kiwi is

likely to be seen at 1.81 area.

Against the Australian dollar and the yen, the kiwi dropped to

nearly a 2-month low of 1.0925 and a 2-week low of 82.39 from

yesterday's closing quotes of 1.0915 and 82.92, respectively. If

the kiwi extends its downtrend, it may find support around 1.10

against the aussie, and 80.00 against the yen.

The kiwi edged down to 0.6155 against the U.S. dollar, from

yesterday's closing value of 0.6166. The NZD/USD pair may find its

support around the 0.58 level.

The Canadian dollar fell to nearly a 4-week low of 1.4805

against the euro and nearly a 2-week low of 1.3501 against the U.S.

dollar, from yesterday's closing quotes of 1.4775 and 1.3476,

respectively. If the loonie extends its downtrend, it is likely to

find support around 1.50 against the euro and 1.37 against the

greenback.

Against the yen, the loonie dropped to an 8-day low of 99.08

from yesterday's closing value of 99.59. The loonie may find

support around the 97.00 area.

Meanwhile, the safe-haven yen rose against its major rivals, as

Asian shares subdued on signals of recession in global economy.

In economic news, data from the Ministry of Internal Affairs and

Communications showed that the overall consumer prices in Japan

were up 3.2 percent on year in March. That was in line with

expectations and down from 3.2 percent in February. On a seasonally

adjusted monthly basis, inflation rose 0.4 percent, exceeding

expectations for a gain of 0.1 percent following the 0.6 percent

decline in the previous month.

Core CPI, which excludes volatile food costs, was up 3.1 percent

on year, matching forecasts and unchanged from the February

reading. On a monthly basis, core CPI gained 0.5 percent, also

matching forecasts and up from 0.4 percent a month earlier.

Data from Jibun Bank showed that the manufacturing sector in

Japan continued to contract in April, albeit at a slower rate, with

a manufacturing PMI score of 49.5. That's up from 49.2 in March

although it remain beneath the boom-or-bust line of 50 that

separates expansion from contraction.

The survey also showed that the services PMI slipped to 54.9 in

April from 55.0 in March.

The yen rose to a 1-week high of 146.63 against the euro and a

3-day high of 166.32 against the pound, from yesterday's closing

quotes of 147.19 and 166.98, respectively. If the yen extends its

uptrend, it is likely to find resistance around 141.00 against the

euro and 161.00 against the pound.

Against the U.S. dollar and the Swiss franc, the yen advanced to

a 4-day high of 133.75 and a 2-day high of 149.73 from yesterday's

closing quotes of 134.01 and 150.32, respectively. The yen may find

resistance around 131.00 against the greenback and 144.00 against

the franc.

Looking ahead, U.K. retail sales data for March is set to be

released at 2:00 am ET.

At 3:00 am ET, Vice President of the European Central Bank Luis

de Guindos will participate in an event organized by Colegio de

Economistas de Madrid on the occasion of the presentation of a

special issue of the Economistas magazine in Frankfurt.

Also, ECB Guindos is scheduled to speak at "Catedra de Economía

y Sociedad" organized by Fundación La Caixa in Madrid at 1:45 pm ET

in the New York session.

In the European session, PMI reports from European countries and

U.K., for April are due.

In the New York session, Canada retail sales data for February,

U.S. flash PMI reports for April and U.S. Baker Hughes oil rig

count data are due.

At 10:30 am ET, Member of the ECB's Executive Board Frank

Elderson will deliver an online speech at an event on "Accounting

for climate change within central bank and banking supervision

mandates" organized by Peterson Institute for International

Economics, in Frankfurt.

At 4:35 pm ET, Federal Reserve Board Governor Lisa Cook will

deliver a speech on "Important Questions for Economic Research"

before a Carroll Round Keynote Speech event, in Washington.

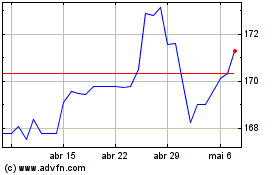

CHF vs Yen (FX:CHFJPY)

Gráfico Histórico de Câmbio

De Mar 2024 até Abr 2024

CHF vs Yen (FX:CHFJPY)

Gráfico Histórico de Câmbio

De Abr 2023 até Abr 2024