Commodity Currencies Depreciate Amid Risk Aversion

25 Abril 2023 - 10:47PM

RTTF2

Commodity currencies such as the Australia, the New Zealand and

the Canadian dollars came under pressure in the Asian session on

Wednesday, as Asian shares traded lower amid renewed concerns about

turmoil in the banking sector after First Republic reported a loss

of more than $100 billion in deposits in the first quarter.

Disappointing results from several other U.S. companies also hurt

sentiment.

Traders also cautiously awaited a slew of upcoming central bank

meetings, most notably the U.S. Federal Reserve, the European

Central Bank, due over the next two weeks.

The three central banks are widely expected to raise interest

rates in order to fight inflation, and it is feared that policy

tightening by the banks could significantly slow down economic

growth.

The Australian dollar is also pressured by a sharp decline in

copper and iron ore prices.

Crude oil prices fell sharply on Tuesday amid concerns over the

outlook for energy demand due to fears of a global economic

slowdown, while the dollar's rise weighed as well. West Texas

Intermediate Crude oil futures for June ended lower by $1.69 or 2.2

percent to $77.07 per barrel.

In economic news, data from the Australian Bureau of Statistics

(ABS) showed that the nation's consumer price index rose to 7

percent annually, slightly more than expected for a rise of 6.9

percent in the first quarter of the year. In the previous quarter,

the consumer prices gained to 7.8 percent.

The consumer prices rose to 1.4 percent in the first quarter,

above the economists expectation for a gain of 1.3 percent. In the

previous quarter, the consumer inflation showed a gain of 1.9

percent.

Data from Statistics New Zealand showed that New Zealand posted

a merchandise trade deficit of NZ$1.273 billion in March. That

missed expectations for a shortfall of NZ$920 million following the

downwardly revised NZ$796 million deficit in February.

Exports were up 0.6% on year to NZ$6.51 billion, beating

forecasts for a gains of NZ$6.10 billion and up from the downwardly

revised NZ$5.06 billion in the previous month. Also, imports jumped

an annual 10 percent to NZ$7.78 billion versus expectations for

NZ$6.80 billion following the downwardly revised NZ$5.86 billion a

month earlier.

In the Asian trading today, the Australian dollar fell to 1.6613

against the euro for the first time since November 2020. The

EUR/AUD pair closed yesterday's trade at 1.6550. The aussie may

test support around the 1.68 area.

The aussie slid to more than 2-week low of 88.15 against the

yen, from yesterday's closing value of 88.61. The AUD/JPY pair may

find its support level around the 86.00 mark.

Against the U.S., the Canada and the New Zealand dollars, the

aussie dropped to a 6-week low of 0.6606, a 1-week low of 0.9008

and nearly a 2-week low of 1.0766 from yesterday's closing quotes

of 0.6625, 0.9028 and 1.0791, respectively. If the aussie extends

its downtrend, it is likely to find support around 0.64 against the

greenback, 0.89 against the loonie and 1.06 against the kiwi.

The NZ dollar fell to nearly a 4-week low of 81.83 against the

yen, from yesterday's closing value of 82.07. The kiwi is likely to

find its support level around the 80.00 area.

The kiwi dropped to a 2-day low of 0.6129 against the U.S.

dollar, from an early high of 0.6149. On the downside, 0.60 is seen

as the next support level for the kiwi.

Moving away from an early 5-day high of 1.7849 against the euro,

the kiwi edged down to 1.7905. If the kiwi extends its downtrend,

it is likely to find support around the 1.80 level.

The Canadian dollar fell to 1.4972 against the euro, from

yesterday's closing value of 1.4947. The loonie may find its

support around the 1.51 area.

Against the U.S. dollar and the yen, the loonie edged down to

1.3642 and 97.86 from yesterday's closing quotes of 1.3626 and

98.14, respectively. If the loonie extends its downtrend, it is

likely to find support around 1.38 against the greenback and 93.00

against the yen.

Looking ahead, German Gfk consumer confidence for May is due to

be released at 2:00 am ET.

Two hours later, Switzerland economic sentiment index for April

is slated for release.

In the New York session, Canada preliminary manufacturing sales

data for March, U.S. durable goods order for March and U.S. EIA

weekly crude oil report are set to be released.

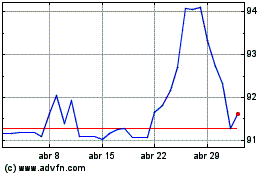

NZD vs Yen (FX:NZDJPY)

Gráfico Histórico de Câmbio

De Mar 2024 até Abr 2024

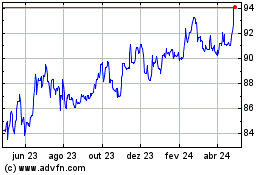

NZD vs Yen (FX:NZDJPY)

Gráfico Histórico de Câmbio

De Abr 2023 até Abr 2024