NZ Dollar Falls Amid Risk Aversion, Downbeat NZ Data

12 Maio 2023 - 1:34AM

RTTF2

The New Zealand dollar weakened against other major currencies

in the Asian session on Friday, as Asian stocks traded lower with

weakness in materials and energy stocks amid tumbling commodity

prices. Also, data showed that the manufacturing sector in New

Zealand continued to contract in April.

"Banking stress won't be going away anytime soon as we await to

see which banks put too much in long-dated Treasuries," says Edward

Moya, Senior Market Analyst at OANDA.

Traders are also cautious amid worries about economic slowdown

and renewed concerns about the turmoil in the US banking

sector.

Crude oil prices fell sharply on Thursday amid uncertainty about

the outlook for energy demand. West Texas Intermediate Crude oil

futures for June ended lower by $1.69 or 2.3 percent at $70.87 a

barrel.

In economic news, data from Business NZ showed that the

manufacturing sector in New Zealand continued to contract in April,

albeit at a slower pace, with a manufacturing PMI score of 49.1.

That's up from 48.1 in March.

In the Asian trading today, the NZ dollar fell to a 4-day low of

1.7467 against the euro and a 3-day low of 1.0705 against the

Australian dollar, from yesterday's closing quotes of 1.7329 and

1.0639, respectively. If the kiwi extends its downtrend, it is

likely to find support around 1.80 against the euro and 1.08

against the aussie.

Against the U.S. dollar and the yen, the kiwi dropped to 8-day

lows of 0.6254 and 84.19 from yesterday's closing quotes of 0.6298

and 84.76, respectively. The kiwi may test resistance around 0.61

against the greenback and 81.00 against the yen.

Meanwhile, the safe-haven Swiss franc strengthened against its

major rivals, as Asian stock market traded lower.

The Swiss franc rose to a 1-week high of 1.1159 against the

pound, from yesterday's closing value of 1.1184. The franc may test

resistance around the 1.10 area.

Against the euro and the yen, the franc advanced to 2-day highs

of 0.9743 and 151.08 from yesterday's closing quotes of 0.9753 and

150.37, respectively. If the Swiss franc extends its uptrend, it is

likely to find resistance around 0.96 against the euro and 154.00

against the yen.

The franc edged up to 0.8918 against the U.S. dollar, from

yesterday's closing value of 0.8942. On the upside, 0.88 is seen as

the next resistance level for the franc.

Looking ahead, U.S. export and import prices for April, U.S.

University of Michigan's preliminary consumer sentiment for May and

U.S. Baker Hughes rig count data are due in the New York

session.

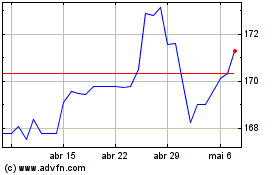

CHF vs Yen (FX:CHFJPY)

Gráfico Histórico de Câmbio

De Mar 2024 até Abr 2024

CHF vs Yen (FX:CHFJPY)

Gráfico Histórico de Câmbio

De Abr 2023 até Abr 2024