Australian Dollar Extends Fall On Disappointing Chinese Economic Data

15 Maio 2023 - 11:40PM

RTTF2

The Australian dollar extended its recent weakness against other

major currencies in the Asian session on Tuesday, after the release

of data from the Chinese economy showing that growth in retail

demand and production at a slower pace.

Data from the National Bureau of Statistics showed that retail

sales jumped an annual 18.4 percent, missing forecasts for 21.0 but

still up from 10.6 percent in the previous month. Industrial output

in China was up 5.6 percent on year in April. That was also well

shy of expectations for a gain of 10.9 percent but up from the 3.9

percent increase in March.

Fixed asset investment was up 4.7 percent on year, lower than

the expectations for 5.5 percent and down from 5.1 percent a month

earlier. The unemployment rate came in at 5.2 percent, beneath

forecasts for 5.3 percent, which would have been unchanged from the

March reading.

The Australian dollar fell slightly half-an-hour earlier, after

the release of RBA minutes indicating that a rate hike was

announced due to inflation risks.

The Reserve Bank of Australia Governor Philip Lowe raised

interest rates unexpectedly by 25 basis points to 3.85 percent in

the May's monetary policy meeting and signaled more hikes to bring

inflation back to the target in a reasonable timeframe.

Members of the Reserve Bank of Australia's Monetary Policy Board

acknowledged that there are still significant uncertainties

surrounding the country's economic outlook, minutes of the board's

May 2 meeting revealed.

In the Asian trading today, the Australian dollar fell to a

4-day low of 1.0702 against the NZ dollar from yesterday's closing

value of 1.0733. The aussie may test support near the 1.04

region.

Moving away from a recent 4-day high of 0.6709 against the U.S.

dollar, the aussie slid to 0.6680. On the downside, 0.65 is seen as

the next support level for the aussie.

Against the euro and the yen, aussie edged down to 1.6271 and

90.82 from yesterday's closing quotes of 1.6223 and 91.18,

respectively. If the aussie extends its downtrend, it is likely to

find support around 1.66 against the euro and 88.00 against the

yen.

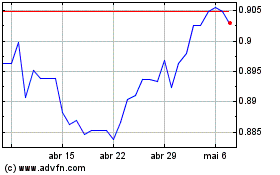

The aussie dropped to 0.9004 against the Canadian dollar, from

yesterday's closing value of 0.9021. The next possible support

level for the aussie is seen around the 0.89 area.

Looking ahead, U.K. unemployment data for March is due to be

released at 2:00 am ET.

In the European trading, Eurozone first quarter GDP data and

German ZEW economic sentiment index for May are slated for

release.

In the New York session, Canada CPI for April, U.S. retail sales

data for April, industrial production for April and U.S. NAHB

housing market index for May are scheduled for release.

At 8:15 am ET, Federal Reserve Bank of Cleveland President

Loretta Mester will deliver a speech in person before the Global

Interdependence Center "Central Banking Series: Dublin" event, in

DUBLIN, Ireland.

AUD vs CAD (FX:AUDCAD)

Gráfico Histórico de Câmbio

De Mar 2024 até Abr 2024

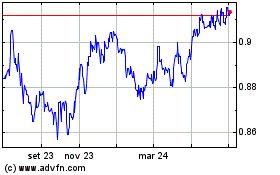

AUD vs CAD (FX:AUDCAD)

Gráfico Histórico de Câmbio

De Abr 2023 até Abr 2024