Pound Falls As U.K. Jobless Rate Ticks Up

16 Maio 2023 - 2:07AM

RTTF2

The pound dropped against its major counterparts in the European

session on Tuesday, as the nation's jobless rate came in higher

than expected in the three months to March, reducing concerns over

more interest rate hikes from the Bank of England.

Data from the Office for National Statistics showed that the

unemployment rate rose to 3.9 percent in the three months to March

from 3.8 percent in the preceding period. The rate was forecast to

remain unchanged at 3.8 percent.

Average earnings, excluding bonuses, increased 6.7 percent

annually, lower than economists' forecast of 6.8 percent.

Average earnings, including bonuses, came in at 5.8 percent and

in line with estimates.

Claimant count rose to 46,700 in April from a revised 26,500 in

March.

The pound weakened to 0.8718 against the euro and 1.2465 against

the greenback, from its early highs of 0.8675 and 1.2532,

respectively. The pound is seen challenging support around 0.90

against the euro and 1.21 against the greenback.

The pound fell to 169.39 against the yen and 1.1164 against the

franc, reversing from an early high of 170.49 and a 5-day high of

1.1223, respectively. The pound is poised to find support around

164.00 against the yen and 1.10 against the franc.

Looking ahead, Eurozone first quarter GDP data and German ZEW

economic sentiment index for May are slated for release

shortly.

In the New York session, Canada CPI for April, U.S. retail sales

data for April, industrial production for April and U.S. NAHB

housing market index for May are scheduled for release.

At 8:15 am ET, Federal Reserve Bank of Cleveland President

Loretta Mester will deliver a speech in person before the Global

Interdependence Center "Central Banking Series: Dublin" event, in

DUBLIN, Ireland.

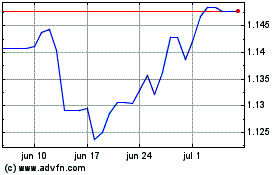

Sterling vs CHF (FX:GBPCHF)

Gráfico Histórico de Câmbio

De Mar 2024 até Abr 2024

Sterling vs CHF (FX:GBPCHF)

Gráfico Histórico de Câmbio

De Abr 2023 até Abr 2024