Yen Falls On U.S. Debt Deal Approval

02 Junho 2023 - 3:37AM

RTTF2

The yen weakened against its major counterparts in the European

session on Friday amid risk appetite, as the U.S. Senate approved a

bipartisan deal to address the debt ceiling and implement budget

cuts, avoiding a potential U.S. default.

The Senate voted 63-36 to pass the bill on raising the debt

ceiling, a day after its approval in the House of

Representatives.

Hopes of a pause in the U.S. central bank's policy also boosted

sentiment as Philadelphia Federal Reserve President Patrick Harker

said the Fed should probably skip raising interest rate at its next

policy meeting.

Focus now shifts to the monthly U.S. jobs report due later in

the day, which could impact the outlook for interest rates.

Economists expect employment to increase by 190,000 jobs in May

after an increase of 253,000 jobs in April. The unemployment rate

is expected to inch up to 3.5 percent from 3.4 percent.

The yen fell to 153.76 against the franc and 139.10 against the

greenback, off its early highs of 152.88 and 138.60, respectively.

The yen is seen finding support around 156.00 against the franc and

145.00 against the greenback.

The yen weakened to a 2-day low of 149.70 against the euro and a

3-day low of 174.23 against the pound, from its early highs of

149.24 and 173.71, respectively. The yen is likely to find support

around 153.00 against the euro and 177.00 against the pound.

The yen dropped to a 10-day low of 92.11 against the aussie,

3-day low of 84.83 against the kiwi and more than a 6-month low of

103.64 against the loonie, down from its early highs of 91.11,

84.09 and 103.11, respectively. The next likely support for the

currency is seen around 96.00 against the aussie, 86.00 against the

kiwi and 107.00 against the loonie.

Looking ahead, U.S. jobs data for May will be released in the

New York session.

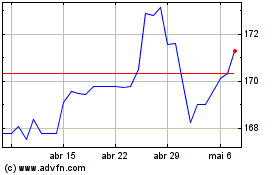

CHF vs Yen (FX:CHFJPY)

Gráfico Histórico de Câmbio

De Mar 2024 até Abr 2024

CHF vs Yen (FX:CHFJPY)

Gráfico Histórico de Câmbio

De Abr 2023 até Abr 2024