Canadian Dollar Firms As BoC Lifts Rate Unexpectedly

07 Junho 2023 - 8:52AM

RTTF2

The Canadian dollar rose against its major counterparts during

the New York session on Wednesday, as the Bank of Canada hiked its

key interest rate by a quarter-percentage point amid stubbornly

high inflation and stronger than expected economic growth.

In a surprise move, the BoC raised its key rate by 25 basis

points to 4.75 percent from 4.50 percent.

The central bank said the rate hike reflects its view that

monetary policy was not sufficiently restrictive to bring supply

and demand back into balance and return inflation sustainably to

the 2 percent target.

The Bank of Canada also said it is continuing its policy of

quantitative tightening, which it said is complementing the

restrictive stance of monetary policy and normalizing the bank's

balance sheet.

The bank's Governing Council said it will continue to assess the

dynamics of core inflation and the outlook for consumer price

inflation.

The Bank of Canada reiterated that it remains resolute in its

commitment to restoring price stability for Canadians.

The loonie touched 104.63 against the yen, its highest level

since November 23. The currency is likely to challenge resistance

around the 106.00 level.

The loonie climbed to more than a 4-week high of 1.3320 against

the greenback and near a 4-month high of 1.4290 against the euro,

off its early lows of 1.3426 and 1.4382, respectively. The loonie

is seen finding resistance around 1.29 against the greenback and

1.40 against the euro.

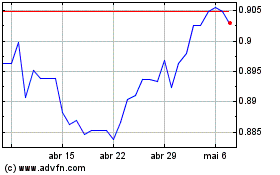

The loonie edged up to 0.8900 against the aussie, from an early

fresh 2-week low of 0.8988. The currency may find resistance around

the 0.865 level.

AUD vs CAD (FX:AUDCAD)

Gráfico Histórico de Câmbio

De Mar 2024 até Abr 2024

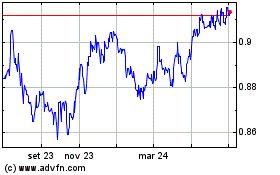

AUD vs CAD (FX:AUDCAD)

Gráfico Histórico de Câmbio

De Abr 2023 até Abr 2024