Dollar Tumbled Last Week After An Eight-week Rally

02 Dezembro 2024 - 5:43AM

RTTF2

After a gaining streak that extended for eight weeks, the U.S.

Dollar slipped against major currencies during the week ended

November 29. The U.S. Dollar plummeted against the euro, the

British pound, the Australian dollar, the Japanese yen, the Swiss

franc as well as the Swedish krona.

It however gained against the Canadian dollar amidst recent

threats of higher trade tariffs by U.S. on Canada. The Dollar Index

also recorded heavy losses amidst renewed Fed rate cut

expectations, easing geopolitical tensions in the Middle East and a

reassessment of the trade and fiscal policy under the new

regime.

The Dollar Index, a measure of the Dollar's strength against a

basket of 6 currencies, dropped 1.7 percent during the week ended

November 29. From the level of 107.55 recorded at close on November

22, the index declined to close at 105.74 a week later. The Index

recorded the week's high of 107.50 on Tuesday and the week's low of

105.61 on Friday.

At the onset of the new week, the dollar retreated from two-year

highs after U.S. President-elect Donald Trump nominated hedge fund

manager Scott Bessent for the post of Treasury Secretary. The news

appeared to suggest milder shifts from existing policy, reassuring

bond markets, dragging down bond yields and weakening the

greenback.

Minutes of the FOMC released on Tuesday showed participants

being concerned about easing policy too quickly or too slowly. They

noted that monetary policy would need to balance the risks of

easing policy too quickly, thereby possibly hindering further

progress on inflation with the risks of easing policy too slowly,

thereby unduly weakening economic activity and employment. The

participants also deemed it appropriate to reduce policy restraint

gradually given the uncertainties concerning the level of the

neutral rate of interest.

However, renewed tariff threats helped the Dollar rebound to the

week's high on Tuesday. U.S. President-elect Donald Trump warned on

Tuesday about imposing additional trade tariffs on China, Mexico,

and Canada.

Data released by the U.S. Bureau of Economic Analysis on

Wednesday morning showed the Annual PCE Price index increasing as

expected to 2.3 percent from 2.1 percent in the previous month. The

core component thereof also rose as expected to 2.8 percent from

2.7 percent in the previous month. The month-on-month PCE price

index was steady at 0.2 percent and its core constituent was steady

at 0.3 percent, both matching expectations.

With no negative surprises in the PCE-based inflation readings

released on Wednesday, rate cut expectations got a boost, dragging

down the dollar. According to the CME FedWatch tool that tracks the

expectations of interest rate traders, the likelihood of a

quarter-point rate cut in December increased to 66 percent by

Friday from 52 percent on Monday.

The dollar's weakness and hawkish comments from ECB officials

lifted the EUR/USD pair to a high of 1.0597 on Friday from the

week's low of 1.0424 recorded on Tuesday. Despite a weak economic

outlook for the region, the pair added 1.52 percent during the

week, closing at 1.0575 on Friday, versus 1.0417 a week earlier.

Data released during the week had shown the region's inflation

rising in November in line with expectations but further above the

ECB's target.

The GBP/USD pair jumped 1.64 percent during the week ended

November 29, lifting the sterling to $1.2737, from $1.2531 a week

earlier. The pair climbed from the low of 1.2503 touched on Tuesday

to the high of 1.2749 recorded on Friday amidst renewed inflation

fears and not-so-dovish hints from Bank of England officials.

The Australian Dollar added 0.14 percent against the U.S. Dollar

during the week ended November 29. The pair which touched the

week's high of 0.6549 on Monday dropped to the week's low of 0.6432

on Tuesday. The pair eventually closed at 0.6510 versus 0.6501 a

week earlier. The Aussie's moves came amidst the monthly CPI

indicator remaining steady at 2.1 percent in October.

The USD/JPY pair slipped 3.2 percent during the past week amidst

an uptick in Tokyo CPI and comments from BoJ officials that renewed

bets of the next rate hike by the Bank of Japan in December. The

pair dropped to 149.75, from 154.74 a week earlier. The weekly

trading range was a bit wider, between a high of 154.72 recorded on

Monday and 149.46 recorded on Friday. Trade tensions between U.S.

and other nations too supported the safe haven yen's climb to a

six-week high.

Despite the massive tumble during the past week, the Dollar has

rebounded on Monday, lifting the six-currency Dollar Index 0.59

percent higher to 106.36. On the U.S. economic data horizon are the

ISM Manufacturing PMI on Monday, JOLTs jobs data on Tuesday, ISM

Services PMI and Fed Chair Jerome Powell's speech on Wednesday, and

the monthly non-farm payrolls data on Friday.

The EUR/USD pair has decreased to 1.0504 amidst concerns about

the political situation in France. The GBP/USD pair dropped to

1.2676. The AUD/USD pair slipped to 0.6472. The USD/JPY pair has

however increased to 150.31.

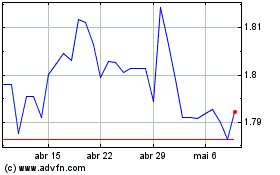

Euro vs NZD (FX:EURNZD)

Gráfico Histórico de Câmbio

De Nov 2024 até Dez 2024

Euro vs NZD (FX:EURNZD)

Gráfico Histórico de Câmbio

De Dez 2023 até Dez 2024