U.S. Dollar Firms Ahead Of Inflation Data

10 Dezembro 2024 - 10:16AM

RTTF2

The U.S. dollar climbed against its major counterparts in the

New York session on Tuesday ahead of the release of key inflation

data that could influence the Federal Reserve's future policy.

Reports on U.S. consumer and producer price inflation are due to

be released on Wednesday and Thursday, respectively.

The CPI is expected to increase to 2.7 percent year-over-year,

up from 2.6 percent in October.

The report is significant before the Fed meeting due next

week.

While the Fed is widely expected to lower rates by another 25

basis points next week, the data could impact the outlook for

future rate cuts by the central bank.

Data from the Labor Department showed that the jump by U.S.

labor productivity in the third quarter was unrevised from the

previous estimate.

The report said labor productivity shot up by 2.2 percent in the

third quarter, unrevised from the initial estimate and in line with

economist estimates.

The greenback moved up to a 6-day high of 1.0498 against the

euro, 5-day high of 0.8828 against the franc and near a 2-week high

of 152.17 against the yen, off its early lows of 1.0567, 0.8771 and

150.89, respectively. The next possible resistance for the currency

is seen around 1.03 against the euro, 0.91 against the franc and

154.00 against the yen.

The greenback rose to more than a 4-month high of 0.6365 against

the aussie, 1-year high of 0.5791 against the kiwi and a 4-1/2-year

high of 1.4195 against the loonie, from its early lows of 0.6442,

0.5867 and 1.4157, respectively. The currency is poised to

challenge resistance around 0.62 against the aussie, 0.56 against

the kiwi and 1.43 against the loonie.

The greenback edged up to 1.2723 against the pound. If the

greenback rises further, it is likely to test resistance around the

1.24 region.

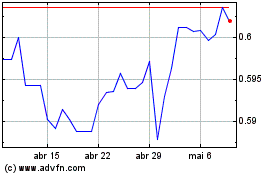

NZD vs US Dollar (FX:NZDUSD)

Gráfico Histórico de Câmbio

De Nov 2024 até Dez 2024

NZD vs US Dollar (FX:NZDUSD)

Gráfico Histórico de Câmbio

De Dez 2023 até Dez 2024