Altyn Plc Directorate change

01 Fevereiro 2017 - 5:00AM

UK Regulatory

TIDMALTN

ALTYN PLC

Appointment of Executive Director and Corporate Broker

Altyn plc ("Altyn" or the "Company"), is pleased to announce the

appointment of Neil Herbert as Executive Deputy Chairman effective

immediately.

Aidar Assaubayev, Chief Executive Officer, said "Neil has been

working closely with Altyn since his appointment as a non-executive

director in February 2016. With our mine expansion on plan and on

budget we are delighted that he is now joining us in an executive

capacity, where his wealth of experience in both mining and finance

strengthens our management team."

Neil Herbert, Deputy Chairman, said "We are working to transform

the Sekisovskoye gold mine, which produced 20,890oz in 2015, into a

100,000oz producer in 2019. We are also working on the adjacent

Karasuyskoe ore fields, which will provide Altyn with open pit

expansion potential beyond 2019. These projects will transform

Altyn into a significant gold producer."

Neil Herbert has worked in the resource sector since joining

Antofagasta in the 1990s, during which time the Company was

transformed into a major copper producer. He was subsequently

appointed as a senior executive at Brancote Holdings plc, Patagonia

Gold plc, Galahad Gold plc, International Molybdenum plc, UraMin

Inc and also Polo Resources Ltd where he was both Chairman and

Managing Director.

Mr Herbert is currently Chairman of Helium One Ltd and Siderian

Capital Resources Ltd and is also a non-executive Director of

Concepta plc, IronRidge Resources plc, Kemin Resources plc, Waratah

Resources Limited and, since February 2016, Altyn plc. Prior to

joining the resource sector he worked for PwC and he is a fellow of

the Association of Chartered Certified Accountants.

He has been issued share options over 46,686,843 Altyn plc

ordinary shares at an exercise price of 2.125 pence per share.

The Company is also pleased to announce the appointment of VSA

Capital as Corporate Broker to the Company. VSA Capital Limited is

a London based investment banking group providing corporate finance

and corporate broking services to companies operating in the

natural resources sector.

Neil Herbert - Past Public Directorships in last 5 years :

Polo Resources Ltd, Anglo African Agriculture Plc, Premier

African Minerals Ltd, GCM Resources plc, Sunrise resources plc.

For further information please contact:

Altyn plc

Rajinder Basra, CFO +44 (0) 207 932 2456

VSA Capital (Corporate Broker)

Andrew Monk / Andrew Raca +44 (0) 203 005 5000

Information on the Company

Altyn is a gold mining, exploration and development group based

in Kazakhstan. Whilst the Company was initially established to

exclusively develop and operate the Sekisovskoye gold and silver

mine in the East Kazakhstan Region, it is now actively targeting

additional gold mining opportunities in Kazakhstan. This includes

the adjacent prospective Karasuyskoye Ore Fields, on which Altyn

was recently awarded the tender to perform further confirmatory

testing in order to gain the sub-soil user licence.

The Company holds a 100 per cent shareholding in DTOO

Gornorudnoe Predpriatie Sekisovskoye ("DGPS") which holds a subsoil

use contract in relation to the Sekisovskoye deposit, covering a

total area of 0.855km². The subsoil use contract for Sekisovskoye

is valid until 2020 and the Company currently intends to seek to

extend the contract in accordance with its terms. The Company also

holds a 100 per cent shareholding in Altyn MM LLP (formerly Altai

Ken-Bayitu LLP), which owns and operates the processing plant at

the Sekisovskoye deposit. The Sekisovskoye deposit is located at

the village of Sekisovskoye, approximately 40km north of the town

of Ust-Kamenogorsk, the capital city of the East Kazakhstan Region.

The current operation is focused on mining the near-vertical

deposits which extend to the surface below the open pits which have

been previously mined.

The Company intends that the Sekisovskoye deposit shall become a

selective-mining underground operation. As at 31 May 2014, the

Company's proven and probable reserves consisted of 2.3Moz of gold

and 3.0Moz of silver and the Company's measured, indicated and

inferred resources consisted of 5.1Moz of gold and 3.5Moz of

silver, in each case as classified in accordance with JORC.

In the year ended 31 December 2015, the Company's consolidated

revenue was US$24.05 million and its net assets US$38.4

million.

View source version on businesswire.com:

http://www.businesswire.com/news/home/20170131005911/en/

This information is provided by Business Wire

(END) Dow Jones Newswires

February 01, 2017 02:00 ET (07:00 GMT)

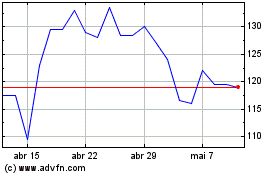

Altyngold (LSE:ALTN)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Altyngold (LSE:ALTN)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024