TIDMAUTG

RNS Number : 4500Z

Autins Group PLC

25 January 2022

25 January 2022

Autins Group plc

(the "Company" or the "Group")

Full Year Results

Autins Group plc (AIM: AUTG), the UK and European manufacturer

of the patented Neptune melt-blown material and specialist in the

design, manufacture and supply of acoustic and thermal insulation

solutions, announces its results for the year ended 30 September

2021.

Financial Overview

-- Revenue increased by 8.9% to GBP23.4 million (FY20: GBP21.5 million)

-- Adjusted gross profit increased by 5.4% to GBP6.3 million (FY20: GBP6.0 million (1) )

-- Reported EBITDA maintained at GBP1.1 million (FY20: EBITDA (1) GBP1.1 million)

-- Cash flow from operations of GBP1.0 million (FY20: GBP1.5 million)

-- Operating loss reduced by 46.6% to GBP0.7 million (FY20: loss of GBP1.3 million)

-- Reported loss after tax reduced by 37.1% to GBP1.1 million (FY20: loss of GBP1.7 million)

-- Loss per share decreased by 37.1% to 2.74 pence (FY20: 4.35 pence)

-- Adjusted net debt (2) increased to GBP2.7 million (FY20: GBP1.9 million)

Operational Highlights

-- Revenue improvement reflected a marginal automotive recovery,

but mainly growth of GBP1.7 million in non-automotive revenue,

primarily in our flooring applications.

-- Neptune sales increased by 64% to GBP7.1 million (FY20:

GBP4.3 million) despite pandemic supply chain disruption.

-- Flooring sales grew 161% to GBP4.7 million (FY20: GBP1.8 million).

-- Gross margin reduced to 27.0% (FY20: 28.0% (1) ), 1.4%

reduction from cessation of transient sub-contract PPE sales.

-- Further operational efficiency improvements and Neptune

manufacturing yield gains bolstered automotive margins against

disrupted volume reductions and related cost increases.

-- Further strong performance seen in Germany; sales grew by 69%

to GBP7.5 million (FY20: GBP4.6 million) and EBITDA increased to

GBP0.9 million (FY20: GBP0.4 million).

-- Consistent EBITDA of GBP1.1 million achieved, despite

considerable pandemic and semi-conductor disruption challenges.

-- Operating cash inflow was GBP1.0 million (FY20: inflow of

GBP1.5 million) despite GBP0.5 million additional inventory,

primarily reflecting a strategic buffer investment for critical Far

East supplies.

-- GBP0.9 million of debt was repaid from the operating cash inflow.

-- Post period end, in December 2021, the Company raised GBP3.0

million (GBP2.8 million net) via the placing of 15 million new

ordinary shares at a price of 20 pence per share with new and

existing investors.

1 Adjusted gross profit for FY20 excludes a GBP0.2 million

exceptional inventory impairment, and a further GBP0.3 million of

exceptional restructuring costs are excluded from EBITDA. Gross

margin without adjustments in FY20 would be 27.3%. See note 2 for

reconciliation.

2 Cash less bank overdrafts, invoice discounting and hire

purchase finance, excluding IFRS16 lease liabilities.

Gareth Kaminski-Cook, Chief Executive, said:

" Despite the ongoing semi conductor challenges facing our UK

automotive market, the Group has grown 9% over the past year,

driven by ongoing success in Germany, in the flooring market and

sales of Neptune products . In the short term, our first priority

is to protect the business and ensure that we are in a strong

position to capture the automotive market recovery which will

surely come. Autins has a unique opportunity to establish a leading

position in the development of future Noise Vibration and Harshness

needs for EVs and other alternative fuels. "

For further information please contact:

Autins Group plc

Gareth Kaminski-Cook, Chief Executive Via SEC Newgate

Kamran Munir, CFO

Singer Capital Markets Tel: 020 7496 3000

(Nominated Adviser and Broker)

Mark Taylor / Asha Chotai

SEC Newgate Tel: 020 7653 9850

(Financial PR)

Bob Huxford

Max Richardson

About Autins

Autins is a UK and continental Europe based industrial materials

technology business that specialises in the design, manufacture,

and supply of acoustic and thermal products. Its key markets are

automotive, flooring, office furniture and commercial vehicles

where it supplies products and services to more than 160 customer

locations across Europe.

Autins is the UK and European manufacturer of the patented

Neptune melt-blown material and specialises in the design,

manufacture, and supply of acoustic and thermal insulation

solutions .

Chairman's Statement

Continued strategic progress despite automotive market

uncertainty

Despite making progress in key strategic areas and achieving

sales growth in FY21, the performance for the Group has been

constrained due to the global shortage of semi-conductors that

limited the ability of our key OEM customers to manufacture

vehicles to meet market demand.

Financial performance

Group sales for the year were up 8.9% to GBP23.4 million (FY20:

GBP21.5 million).

Sales in our core automotive business declined in the second

half of the year (compared to H1) due to a reduction in vehicle

production by OEMs caused by the global shortage of

semi-conductors. However, automotive sales in the second half were

still an improvement on the equivalent period of the prior year,

which was severely impacted by Covid disruptions.

Our German business continued its strong performance, growing

sales by 69% to GBP7.5 million (FY20: GBP4.65 million). This

reflected strong flooring sales and some additional automotive

revenues compared to FY20.

Adjusted gross margin reduced to 27.0% (FY20: 28.0%) primarily

due to cessation of PPE sales and raw material cost price increases

which were only partially offset by continued operational

improvements. EBITDA (after IFRS 16 adjustments) was stable at

GBP1.1m (FY20: GBP1.1m). The operating loss for the Group narrowed

to GBP0.7 million for the year (FY20: loss GBP1.3 million).

Net debt (excluding IFRS 16 debt) increased to GBP2.7 million

(FY20: GBP1.9 million) and cash equivalents reduced to GBP1.2

million (FY20: GBP2.8 million). With the reduced cash headroom and

the short-term uncertainty on the timing of recovery in the

automotive market, the Board decided to raise GBP3.0 million

(gross) via a placing of new shares to ensure the Company is in a

position to capitalise on market recovery. In addition, the Company

renegotiated certain of its banking obligations. These actions were

completed after the year end and are described further below.

Strategy

The business made good progress in key strategic areas in

FY21.

We continued to use our noise, vibration and harshness ("NVH")

expertise to diversify into new markets with European sales

increasing by 51% to GBP9.2 million. We also made progress

diversifying away from our core automotive market with

non-automotive revenue growing by 53% to GBP4.8 million. Flooring

sales were a particular highlight and we are also seeing success in

the emerging office pod market.

Neptune, our proprietary melt blown material, continues to be

attractive to both existing and new customers due to its specific

acoustic and thermal performance and its lighter weight. It was

pleasing to see Neptune product sales increase by 64% to GBP7.1

million in the year. We are undertaking investment projects to

increase the manufacturing capacity and operational efficiency of

our Neptune plant in anticipation of continued sales growth.

We remain committed to becoming a leading NVH specialist to

automotive manufacturers in Europe and continue to focus on

positioning Autins as an electric vehicle NVH solutions provider.

We are already supplying key brands in this space and are

concentrating our R&D efforts on increasing our electric

vehicle product solutions while enhancing the environmental

credentials of our Neptune material by increasing recycled

content.

In the short term, we have taken steps to protect the Group from

the reduced vehicle production caused by the global shortage of

semiconductors. We are well placed to benefit from the automotive

market recovery once these supply side issues are resolved.

Post year end placing and banking facilities

In December 2021, the Group completed a placing of 15 million

new ordinary shares raising GBP3.0 million (gross). The Board

intends to use these funds to provide the Group with a working

capital buffer while the automotive market recovers from the

semi-conductor supply issues and to fund increased working capital

for growth in Germany and for UK safety stocks. Part of the

proceeds will be allocated to invest in the Neptune manufacturing

facilities (to further increase capacity and profitability) and to

accelerate electric vehicle product development and other

commercial activities.

In addition, the Group has negotiated waivers of its banking

covenants to March 2023 and a six month deferral of capital

repayments.

The combination of these actions has significantly improved the

Group's liquidity position.

People

In all areas of our operations, the staff of Autins have shown

energy, initiative and loyalty throughout the year. We have had to

respond to the lower than expected demand from our core automotive

market by adjusting our staffing costs appropriately. As furlough

payments were phased out, we have looked at more flexible ways of

working and I would like to thank all of our staff for the support

and adaptability that they have shown.

Our people are our greatest asset and we remain committed to

providing a safe and rewarding environment for all of our

staff.

Ian Griffiths stepped down from the Board in March 2021 having

joined at its IPO in 2016. I would like to thank Ian for his

valuable contributions to our Board discussions and wish him well

for the future.

Environmental, Social and Governance

During the year we strengthened our ESG policy to include

commitment targets to be carbon neutral by 2050 in the UK and to

have achieved a 68% improvement by 2030. We continuously undertake

initiatives to improve the efficiency of our manufacturing

equipment so that we use less energy and water, whilst reducing

waste and increasing the proportion of renewable energy used. We

converted all lighting to LED in the UK and Sweden during the year.

Key areas for improvement in the short-term are continuing

reduction of our carbon footprint at our Tamworth Neptune facility

and a reduction in staff churn.

We are committed to playing our part in reducing emissions and

increasing the environmental benefits of our products and working

practices. Our future is about sustainable growth and Autins has

made ESG a central commitment of the business to support

decarbonisation and a better environment, promote our social

responsibilities and ensure fairness and promote diversity.

The Board remains committed to robust corporate governance and

risk management to ensure the delivery of our strategic ambitions

and the financial health of the Group. We apply the Quoted

Companies Alliance Corporate Governance Code (the "QCA Code"). The

Board is currently operating with two independent non-executive

directors. We consider this appropriate in the short term and in

keeping with the cost mitigation measures that have been applied to

all staffing costs in the year. We are committed to increasing the

number of independent non-executive directors on the Board as soon

as appropriate in the recovery cycle.

Dividend

No final dividend is proposed.

The Board will continue to monitor net earnings, debt levels and

expected capital requirements with a view to reinstating a

progressive dividend policy at the appropriate time.

Outlook

In the short term, automotive revenue performance will continue

to be constrained by the global shortage of semiconductors. The

Board anticipates improvement in the supply of semiconductors

during the second half of 2022 but, due to our financial year end

date, this is likely to have a limited impact on FY22 automotive

sales.

The outlook for our non-automotive sales remains strong in the

short-term and we will continue to focus on diversification of

customers and markets.

The medium term outlook remains positive. Retail demand for cars

remains good and this should result in a strong recovery in

automotive sales from current levels once the supply of

semiconductors has normalised. In addition, innovation in flooring

and demand for our Neptune technology is underpinning growth in new

markets and driving momentum for expansion in Europe.

The Board expects these factors to improve the sales growth of

the Group in the medium term.

Adam Attwood

Chairman

Chief Executive Officer's Review

Delivering operational improvements and accelerating

diversification

Our materials and solutions contribute to a quieter, safer,

cleaner and more energy-efficient world.

Autins is an industry-leading designer, manufacturer, and

supplier of acoustic and thermal management solutions. We apply our

expertise in material technologies to solve complex and challenging

problems to create better and more comfortable environments in a

wide range of industry applications including automotive, flooring,

workspace solutions and commercial vehicles. We manufacture a range

of technical materials, including our own patented material,

Neptune, in our facilities in the UK, Germany and Sweden, making us

a truly European business.

Growth in a challenging year

Modest market recovery at the beginning of the financial year

delivered some improvement in volumes, which, when combined with

improved overhead and operating cost control, led us to finish the

half year with a strong EBITDA, operating cash flow and net debt

position. UK automotive sales declined from April onwards as the

semi-conductor crisis deepened and this depressed financial

performance in the second half of the financial year resulting in a

consistent EBITDA for the full year.

Despite these headwinds, it is pleasing to report that we

finished the year with Group sales up 9% year on year at

GBP23.4million. German sales flourished, growing 69% to GBP7.6

million and we capitalised on significant project wins from the

previous year to deliver flooring sales growth of 161% to GBP4.7

million and Neptune based product growth of 64% to GBP7.1

million.

Delivering the growth strategy

The diversification strategy is progressing well, where

dedicated commercial resource has delivered non-automotive sales

growth of 60% which now represents 20% of our sales mix, up from 8%

last year (PPE sales excluded). European sales are now 39% of Group

sales, up from 25% last year.

We won 32 projects with 22 different customers during the year,

most of which are blue chip brands. 14 projects were won with

Neptune products. The project enquiry pipeline value for FY22 and

beyond remains healthy. Continuing our progress in diversification,

we began supply of Neptune to DAF trucks in September 2021 and post

year end have received our largest purchase order for the supply of

Neptune into the walls and ceilings of office pods to be delivered

to the US market.

Looking forward

In the short term, our first priority is to protect the business

during the ongoing semi-conductor crisis and ensure that we are in

a strong position to capture the automotive market recovery which

will surely come in due course. I would like to thank our

shareholders for supporting the recent GBP3.0 million equity raise,

which enables us to protect the interests of all our stakeholders

and enables the leadership team to focus on driving sales growth in

our core and new markets, whilst improving the profitability of the

operations.

Our Group strategy remains unchanged. We will continue to

leverage the superior properties of Neptune and our acoustic and

thermal expertise to win market share in automotive NVH and

accelerate growth in flooring, workspace solutions and commercial

vehicles. We will also continue to evaluate new, profitable markets

and maintain a laser focus on operating costs and margins.

Our core market is undergoing its biggest transformation ever

and Autins has a unique opportunity to establish a leadership

position in the development of future NVH needs for EVs and other

alternative fuels. We have extensive experience in EVs having

provided NVH solutions for JLR, AMG, LEVC and Polestar, but future

fully electric platforms will create a set of new NVH challenges

and we intend to be at the forefront of developing the

solutions.

Gareth Kaminski-Cook

Chief Executive Officer

Financial Review

Maintaining business fitness and improving resilience against

challenging market fundamentals

In H1, the Group saw partial recovery in automotive volumes and

strong growth in European flooring applications. Combined with

prior and continuing operations and cost structure improvements

this yielded an EBITDA of GBP1.1 million, a narrowly positive

profit after taxation, and an operating cash inflow of GBP1.0

million. With the Invoice Financing (IF) bank facility also

increasing with sales, cash headroom improved to GBP6.1 million.

This performance was encouraging (with the estimated UK volume

recovery being no better than 75%) and validated the Group's

ability to make significant returns once volumes recover nearer to

normal levels.

In H2, the semi-conductor supply disruption then caused

significant and unexpected continued monthly revenue reductions; as

measured against detailed communicated OEM twelve to sixteen week

operational rolling demand schedules. The mid-month and mid-week

reductions could be as high as 50%, with the lowest revenue points

being July and August (which also usually include holiday plant

shutdowns). This was seasonally unusual given that the H2 demand

profile is typically stronger than H1 driven by demand from new car

registrations. There has been steady revenue recovery since the

August lows and ongoing improvement is expected. Overall automotive

revenues in H2 were down almost 30% against H1. This drove EBITDA

to become negative in H2, with lower operating cash flow. Stock

buffering against supply chain disruption and repayment of the

GBP0.75 million CBILS bullet loan also impacted cash headroom.

To strengthen the balance sheet, increase working capital and

provide a market recovery buffer, in December 2021 the Group

completed a GBP3.0 million equity placing, largely from existing

shareholders, and also obtained further bank support in the form of

agreed capital payment deferments and covenant waivers which are

described more fully below.

Revenue

Automotive revenues remained disrupted throughout FY21. UK and

Sweden were the most impacted, with the disruption causing volume

reductions in excess of 50% at certain points in H2. UK Tooling

revenues reduced by 76% to GBP0.3 million (FY20 GBP1.3 million) as

OEMs also slowed new launch and development activities. Counter to

this, Germany experienced significant automotive growth overall

from additional contract volume wins, with the supply chain

disruption being less acute for the German market until very late

in FY21.

Revenues on PPE items in the UK declined from GBP1.2 million in

FY20 to GBP0.1 million in FY21.The PPE revenues should be

considered transient for the FY20 (prior year) peak pandemic

period. This was partially offset in the UK with revenues from

initial development and launch volumes demand of non-automotive

office pods and working space solutions. Both of these markets

remain target growth areas for the Group, with sales continuing to

increase in the period since the year end, associated with

favourable customer product performance feedback.

The most significant revenue growth for the Group in FY21 was in

flooring applications from Germany, which grew 161% year on year to

GBP4.6 million. Neptune sales grew 64% to GBP7.1 million in FY21

(FY20: GBP4.3 million), primarily within automotive end

applications.

Gross margin

Automotive margins were largely stable over the year. This was

the net result of a combination of adverse cost push and volume

reduction factors, being offset by improvements from operational

efficiency actions, improvements in Neptune processes and

manufacturing methods and the growth of Germany's non-automotive

flooring applications. This is explained further below.

UK Automotive margins had a slightly weaker mix than the prior

year, with some traditionally strong products having come to end of

life cycle with the OEMs. However, Neptune sales grew as noted

above by 64%, and this significantly improved the overall

absorption of manufacturing fixed costs in our Tamworth facility.

Despite cost push factors mainly relating to Far East container

shipments costs and scrim materials, other procurement improvements

were made to hold internal Neptune contribution margins steady. The

net result is an improved end to end margin on Neptune products,

which should continue to improve further with expected Neptune

volume increases over the longer term, with some new contract

volumes having already been won.

The gross margins on German flooring applications are consistent

with our mainstream automotive margins. However, given that the

follow-on costs are primarily sales commissions with very few

additional operational costs to serve, the net EBITDA margins from

flooring are significantly additive, which is illustrated further

below.

Revenue reduction on PPE items as noted above reduced overall

gross margin. Much of the FY20 work for face visors was on a

subcontract manufacturing basis having no materials costs, and face

mask revenues were a mix of sales to both resellers and end users

derived from our patented Neptune materials. This profile naturally

yielded above average margins. The PPE impact alone is the

equivalent of 1.4% gross margin reduction for the Group. With total

Group gross margins at 27.0% for FY21, compared with 28.0%

(adjusted gross margin) for FY20 , the intrinsic aggregate gross

margin across all non PPE products is an improvement of 0.4%. As

automotive volumes recover towards normalised levels, this should

yield further improved absorption of facility fixed costs and the

gross margin percentage would be expected to recover further.

EBITDA and operating profit

FY21 EBITDA was consistent at GBP1.1 million (FY20: GBP1.1

million) after adjusting for exceptional and non-recurring costs as

noted below. The reported statutory operating loss was GBP0.7

million (FY20: operating loss of GBP1.3 million), representing an

improvement of GBP0.6m.

Germany sales were GBP7.6 million (FY20: GBP4.6 million) and the

associated EBITDA was GBP0.9 million (FY20: GBP0.4 million) being

12% of Group sales. This helped to offset the EBITDA reductions in

UK and Sweden. Sweden revenues were consistent with the prior year

at GBP1.6 million (FY20: GBP1.6 million) and yielded an EBITDA of

GBP0.2 million (FY20: GBP0.3 million). UK Revenues reduced to

GBP14.3 million (FY20: GBP15.4 million) given the automotive supply

disruption, and EBITDA reduced to GBP0.0 million (FY20: GBP0.4

million). These stated measures exclude the impact of management

recharges into Europe, and apply Group plc costs entirely against

the UK entities. UK EBITDA and operating profit also benefitted

from GBP0.1 million of release from provisions for bad and doubtful

debts, following an extended focus on debtor collection improvement

over the prior 18 months.

The Directors also note that GBP0.65 million (FY20: GBP1.0

million) of employment costs were met by income from the government

job retention scheme, in the relevant publicised support periods in

the UK, and their overseas equivalents in Sweden and Germany. There

were no other financial support grants during the year (FY20:

GBP0.1 million). In total, government financial support received

was approximately GBP0.45 million lower in FY21 than the prior

year.

The FY20 EBITDA is stated after excluding items that management

considered to be a result of significant one-off events, including

the restructuring costs associated with the detailed review of

operations, which followed the new CFO appointment in January 2020.

These included employee severance costs and the planned scrapping

of inventory to enable improved floor space utilisation with the

aim of reducing premises costs. Exceptional costs relating to

restructuring in FY20 were GBP0.3 million, and exceptional

inventory impairments were GBP0.2 million. Management information

used in running the Group is measured with a focus on the

underlying operational performance and, as such, these items were

excluded. There are no such adjustments or exceptional costs

recorded in FY21.

The Board acknowledge that these are alternative measures of

performance and are not GAAP (nor are they intended to be) but are

used to help illustrate underlying business performance and are

informative to users of the accounts.

Exceptional and adjusting items

There were no exceptional costs charged in FY21. As noted above,

in FY20 the Group incurred an exceptional cost of sales of GBP0.16

million relating to inventory rationalisation and exceptional

administrative costs of GBP0.29 million as a result of a change of

Chief Financial Officer.

To be consistent with analysts measure of the Group's

performance, amortisation of GBP0.2 million (FY20: GBP0.2 million)

in relation to acquired intangible assets recognised as a result of

the Group's conversion to IFRS at IPO (having previously been held

as non amortising goodwill) should be excluded to provide an

adjusted operating profit. Accordingly, the adjusted operating

loss, allowing for exceptional costs and amortisation, would be

GBP0.5 million (FY20: GBP0.6 million).

Joint venture

The Group's joint venture, Indica Automotive, is an acoustic

foam conversion business based in Northampton that supplies

components into the Group's UK operations (who remain the largest

customer) as well as its own automotive customer base. The joint

venture continues to leverage the access to low cost material and

finished component sources provided by its other parent, Indica

Industries PV, based in India.

Indica Automotive's turnover increased by 14% to GBP2.4 million

(FY20: GBP2.1 million). H1 21 revenues were GBP1.5 million (H1 20:

GBP1.5 million), and revenue declined by 40% in H2 as call offs for

existing parts were reduced, given an equivalent impact from the

semi-conductor supply constraints. Further margin and overhead cost

control actions were taken by management, and GBP0.05 million of UK

furlough income was received, helping to generate a profit after

tax of GBP0.1 million (FY20: GBP0.1 million). Sales overheads were

increased, as the sales organisation was expanded for future

growth.

Currency

The Group's overseas operations and certain key raw material

suppliers require the Group to trade in currencies other than

Sterling, its base currency. During the year, operational

transactions were conducted in US Dollar, Swedish Krona and Euro

and the retranslation of the results of the German and Swedish

operations were affected by currency fluctuations. The key raw

materials for Neptune production are currently imported from South

Korea with transactions conducted in US Dollars. The Group has

taken steps to mitigate this risk by establishing alternative

sources for non-patented product which could then also be

transacted in alternative currencies. The Group also has Euro based

purchases for materials and production, including equipment. As

Euro sales are expected to increase from our German business, this

would allow us to manage relative balances in British Pounds, Euros

and US Dollars.

The Group continues to benefit from natural hedging, arising

from its structure and trading balances, which means that the

Group's result in both FY20 and FY21 has only been impacted in a

limited way as a result of currency translations.

The Group held no forward currency contracting arrangements at

either year-end. Transactions of a speculative nature are, and will

continue to be, prohibited. As Neptune grows management will

continue to monitor the Group's US Dollar exposure and its impact

on the Group's results. Where the frequency and quantum of

purchases can support active currency management, we may implement

a formal hedging strategy.

Net finance expense

The finance expense remained consistent at GBP0.5 million (FY20:

GBP0.5 million) and under IFRS 16 includes GBP0.3 million of

financing charges derived primarily from property rental expenses.

Bank interest at GBP0.2 million (FY20: GBP0.2 million) is derived

almost entirely from the CBILS and MEIF term loans. The Group's

MEIF term loan is at a coupon rate of 7.5% and remained fully drawn

during FY21, with no capital repayments having been made under

agreed extension terms. The CBILS short term bullet loan of GBP0.75

million received in July 2020, at a net zero cash interest cost for

the first 12-month period, was repaid to agreed terms in August

2021. The CBILS 6 year term loan of GBP2.0 million remained

outstanding at 30 September 2021 (FY20: GBP2.0 million), and

attracts an interest rate of 3.99% above base rate.

The primary UK invoice financing facility remained undrawn

throughout FY21, in line with our strategy to optimise working

capital, with an extended focus on debtor collections yet

maintaining a timely payment cycle to trade creditors. Inventory

continued to be rationalised where possible, however an investment

of up to GBP0.5 million was made in strategic buffer stocks for

flooring business growth and protection against Far East supply

disruption. Modest short-term overdrafts only prevailed within our

Sweden operations and were reduced over the year to end FY21 at

GBP0.02 million (FY20: GBP0.15 million). Our key Far East suppliers

continued to extend the Group's direct open credit throughout FY21,

and so the bank trade finance facility was not utilised. Car and

equipment finance leases further reduced in FY21 as some agreements

completed during the year, with no renewals, which reduced interest

costs to GBP0.02 million (FY20: GBP0.03 million).

An analysis of the net finance expense is presented in the note

below.

Taxation

The effective tax rate in the year was below that expected based

on current UK corporation tax levels. Given the quantum of losses

compared to expected profitability in the next two years, the Group

has not recognised the majority of current year losses as a

deferred tax asset. The balance sheet asset has been reviewed and

is considered to be supportable based on the Group's expected

trading.

The Group's technical R&D and applications teams have, as in

prior years, continued to enhance materials applications, improve

processes and develop new products. The pandemic and semi-conductor

supply chain disruption to revenues has meant that significant net

losses continue to remain available. Accordingly, the Group

strategy remains to utilise the losses to obtain actual R&D tax

credit cash refunds to maximise liquidity. An R&D tax credit

claim will be submitted for FY21 in the usual course. R&D

claims for the years ended September 2019 and September 2020 were

submitted in FY21 with repayment having subsequently been received.

R&D activities continue and this, together with recognition and

use of available brought forward losses when profitability

increases, will mean that the effective tax rate will remain below

the UK statutory level for the short to medium term with an

unrecognised deferred tax asset of GBP0.95 million in the UK (FY20:

GBP0.77 million).

The Group's German subsidiary is expected to fully utilise its

remaining tax losses in FY21 which will result in a degree of tax

at a higher rate on future profits in Germany whilst brought

forward taxable losses available in Sweden will, in the short term,

at least partially offset expected trading profits. The Group has a

further GBP0.3 million (FY20: GBP0.03 million) unrecognised tax

asset in respect of Swedish tax losses.

Earnings per share

Loss per share was 2.74 pence (FY20: loss per share 4.35 pence)

reflecting the loss in the year. The weighted average number of

shares was 39,600,984 in the year (FY20: 39,600,984). Calculations

of earnings per share and the potential dilution arising from the

senior management share option scheme in future periods are

presented in the note below.

Dividends

The Board are not proposing a final dividend for the current

year (FY20: GBPnil) and no interim dividend was paid (FY20:

GBPnil).

Net debt and working capital

The Group ended the year with net debt of GBP2.7 million (FY20:

GBP1.9 million) excluding the IFRS16 calculated lease liabilities

of GBP5.6 million as disclosed in the reconciliation of movements

in cash and financing liabilities.

No additional borrowing facilities were obtained or utilised

during the year. In the prior year the Group secured a GBP1.5

million five-year term loan from MEIF, and GBP2.75 million of UK

CBILS loan funding. Of the CBILS funding GBP0.75 million was a

one-year bullet loan and was repaid to terms in August, with the

balance of GBP2 million outstanding as at the year end. Hire

Purchase liabilities were reduced by GBP0.1m. Total debt was

reduced by GBP0.9m.

The Group has GBP0.2 million (FY20: GBP0.3 million) of hire

purchase agreements in the UK. There were no new hire purchase

agreements in the year and the short-term trade import facility was

not utilised (FY20: GBP0.1 million was utilised).

The Group has continued with working capital optimisation in the

year, which has been partially described above. Trade debtors

improved in the year with a reduction of overdue balances from

additional focus and applied resource. There was a release from the

bad debt provision in the year of GBP0.1 million (FY20: GBP0.0

million). Some of the prior year's provision has been retained

against historic overdue invoices which the Group continues to

steadily resolve.

Trade creditors reduced in line with activity levels in the

year, with payments being made to terms, usually on a weekly cycle.

The net movement of debtors and creditors was a GBP0.2 million

inflow. Stocks were increased by GBP0.5 million, primarily owing to

additional buffers being held, as described earlier.

Going concern

The Board have concluded, on the basis of current and forecast

trading and related expected cash flows and available sources of

finance, that it remains appropriate to prepare these financial

statements on the basis of a going concern.

The Group completed an equity placing with gross proceeds of

GBP3.0 million (GBP2.8 million net) in December 2021, primarily

with the participation and support of its existing shareholders. In

addition dual lender support has been agreed in the form of

covenant waivers with testing to resume at the end of March 2023.

In light of the external trading environment the bank has also

indicated a willingness to revise the covenants to better reflect

the Group's forecasted trading levels once there is improved

visibility over the resolution of the semi-conductor disruption,

which is anticipated to occur in advance of the next covenant test

date in March 2023. The waivers are coupled with a minimum 6 month

capital deferment holiday on both the outstanding CBILS and MEIF

term loans. As at 14 January 2022, shortly before the reporting

date, the prevailing cash headroom for the Group is in excess of

GBP5.0 million (FY20: GBP5.6 million). This includes undrawn

balances on the UK invoice financing facility which has in excess

of GBP2 million available, with its operational limit currently

agreed at GBP3.5 million against relevant trade receivables.

Despite the Covid trading backdrop, the Group reported positive

operating cash flows of GBP0.9 million, and GBP0.75 million of

CBILS loans were repaid during the year.

Whilst the operating cash flows benefit from a combination of

improved working capital and cost management, they are also

impacted by significant decreases in revenues as a result of the

pandemic and semiconductor disruption. The Group has also made

further operational and overhead cost improvements, including

significant carefully considered headcount reductions which improve

the cost structure by more than GBP0.7 million per annum, with

continuing programmes in place to make additional cost and profit

improvements.

In undertaking their assessment of the future prospects for the

Group, the Directors have prepared trading and cash flow forecasts

for the period to 31 January 2023 for the purpose of assessing the

going concern basis of preparation, with further forecasts going

out to 30 September 2027. These take into consideration the current

and expected future impacts of the pandemic and semiconductor

supply recovery timelines, diversification and development of

customer product ranges and also have regard to the committed

business and enquiry levels from existing customers. The Directors

have also considered the impact of current and future demand levels

for new vehicles, the migration to EV's and publicly available

forward looking market information regarding market sizes and

dynamics. These forecasts have been compared, together with

considering a range of material but plausible downside

sensitivities, to the available bank facilities and the related

covenant requirements.

Notwithstanding the agreed deferments, the loan repayments and

interest costs are expected to be adequately covered by operating

cash generation over the period and the Group has significant

liquidity headroom within its facilities to accommodate all

reasonably foreseeable cash flow requirements in the event of

changes to its demand as a result of prevailing supply chain

conditions, or other economic factors, with further flexibility

also available to favourably manage the cost base in respect of

operating costs, should the need arise, or flex other payment

structures to increase cash headroom.

The most sensitive factor impacting the forecast period, and the

continued availability of the current facilities, is ensuring that

liquidity remains reliably positive for the Group, albeit the Board

has set a minimum target of GBP0.5 million. In the next financial

year, achievement of this minimum required UK (and group) liquidity

target, without significant further unplanned cost or efficiency

improvements, is predicated on minimum UK revenue levels of GBP9.4

million in FY22 and GBP14.4 million in FY23. These revenue levels

compare with UK revenues of GBP14.3 million in FY21, GBP16.8

million in FY20 and GBP21.3 million in FY19. This compares with UK

revenues of GBP14.3 million in FY21, GBP16.8 million in FY20 and

GBP21.3 million in FY19. New business continues to be won and,

accordingly, the Board are confident that the sales and liquidity

targets will be met, especially having regard to further additional

mitigating actions which remain available to the Group.

The Board continues to review the Group's banking and funding

arrangements with a view to ensuring that they remain appropriate

for the planned growth within mainland Europe and to allow for the

more volatile demand pattern in the current economic

environment.

Acquisitions, goodwill and intangible assets

There were no acquisitions made in the year, nor any adjustment

to fair values attributed to previous transactions.

The Board, acknowledging that this is a further year of reported

losses and that the Group's current market capitalisation is

currently less than the Group's net assets, has reviewed the

carrying value of goodwill and other intangible assets held at 30

September 2021 (both existing and generated in the year) by

reference to discounted cashflow forecasts for separately

identifiable cash generating units. These forecasts are based on

Board approved budgets, and extended forecasts where appropriate

considering an assessment of likely conversion from pipeline to

revenue.

Having considered the assumptions, headroom and a range of

reasonably foreseeable sensitivities indicated by these assessments

the Board are able to conclude that the carrying values are fully

recoverable.

Capital expenditure

Additions to tangible fixed assets were GBP0.4 million (FY20:

GBP0.2 million) in the year with no significant single items

acquired. The Group continues to benefit from investment in

equipment in recent years and therefore has capacity to address

current demand levels. Planning for additional investments designed

to improve operational performance is ongoing and the Board expects

expenditure to be incurred on an ongoing basis in FY22 in support

of further operational gains.

Research and development costs of GBP0.03 million (FY20: GBP0.13

million) have been capitalised in the period as the Board considers

they meet the Group's stated policy for recognition of internally

generated assets. The costs are focused on a range of projects

designed to further enhance the Group's current materials and

product ranges and improve production capabilities to derive volume

or cost reduction benefits.

Financial risk management

Details of our financial risk management policies are disclosed

in the Annual Report.

Kamran Munir

Chief Financial Officer

Consolidated income statement

For the year ended 30 September

2021 202 1 2020

GBP000 GBP000

Note

Revenue 1 23,431 21,517

Cost of sales excluding exceptional

costs (17,103) (15,472)

Exceptional cost of sales - (164)

Total cost of sales (17,103) (15,636)

------------------------------------ ---- --------- ---------

Gross profit 6,328 5,881

Other operating income 649 787

Distribution expenses (604) (650)

------------------------------------ ---- --------- ---------

Administrative expenses excluding

exceptional costs and amortisation (6,890) (6,780)

Exceptional administrative

expenses 2 - (292)

Amortisation of acquired intangible

assets 2 (173) (238)

Total administrative expenses (7,063) (7,310)

------------------------------------ ---- --------- ---------

Operating loss 2 (690) (1,292)

Finance expense 3 (542) (523)

Share of post-tax profit of

equity accounted joint ventures 53 55

Loss before tax (1,179) (1,760)

Tax credit 95 37

Loss after tax for the year (1,084) (1,723)

Earnings per share for loss

attributable to the owners

of the parent during the year

Basic (pence) 4 (2.74)p (4.35)p

Diluted (pence) 4 (2.74)p (4.35)p

========= =========

All amounts relate to continuing operations.

Consolidated statement of comprehensive income

For the year ended 30 September

2021 2021 2020

GBP000 GBP000

Loss after tax for the year (1,084) (1,723)

Other comprehensive income

Items that may be reclassified subsequently to

profit or loss

Currency translation differences 2 18

Total comprehensive expense

for the year (1,082) (1,705)

Consolidated statement of financial position

As at 30 September 2021 2021 2020

GBP000 GBP000

Non-current assets

Property, plant and equipment 9,636 10,082

Right-of-use assets 4,876 5,001

Intangible assets 3,059 3,322

Investments in equity-accounted

joint ventures 120 147

Deferred tax asset 95 149

Total non-current assets 17,786 18,701

Current assets

Inventories 2,433 1,938

Trade and other receivables 3,630 4,339

Cash and cash equivalents 1,262 2,974

Total current assets 7,325 9,251

Total assets 25,111 27,952

Current liabilities

Trade and other payables 2,584 3,151

Loans and borrowings 719 1,027

Lease liabilities 842 917

Total current liabilities 4,145 5,095

Non-current liabilities

Trade and other payables 111 117

Loans and borrowings 3,248 3,847

Lease liabilities 4,794 4,970

Deferred tax liability 46 74

Total non-current liabilities 8,199 9,008

Total liabilities 12,344 14,103

Net assets 12,767 13,849

Equity attributable to

equity

holders of the company

Share capital 792 792

Share premium account 15,866 15,866

Other reserves 1,886 1,886

Currency differences reserve (125) (127)

Profit and loss account (5,652) (4,568)

Total equity 12,767 13,849

Consolidated statement of changes in equity

For the year ended 30 September 2021

Share Share Other Cumulative Profit Total

capital premium reserves currency and loss equity

account differences account

reserve

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

At 30 September 2020 792 15,866 1,886 (127) (4,568) 13,849

Comprehensive income for the

year

Loss for the year - - - (1,084) (1,084)

Other comprehensive income - - - 2 - 2

Total comprehensive expense

for the year - - - 2 (1,084) (1,082)

At 30 September 2021 792 15,866 1,886 (125) (5,652) 12,767

-------- -------- --------- ------------ --------- -------

Share Share Other Cumulative Profit Total

capital premium reserves currency and loss equity

account differences account

reserve

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

At 30 September 2019 792 15,883 1,886 (145) (2,313) 16,103

Effect of adoption of IFRS 16 - - - - (517) (517)

Comprehensive income for the

year

Loss for the year - - - - (1,723) (1,723)

Other comprehensive income - - - 18 - 18

Total comprehensive expense

for the year - - - 18 (1,723) (1,705)

Contributions by and distributions

to owners

Share issue expenses (re August

2019 placing) - (17) - - - (17)

Share based payment - - - - (15) (15)

Total contributions by and distributions

to owners - (17) - - (15) (32)

At 30 September 2020 792 15,866 1,886 (127) (4,568) 13,849

-------- -------- --------- ------------ --------- -------

Consolidated statement of cash flows

For the year ended 30 September 2021

2021 2020

GBP000 GBP000

Operating activities

Loss after tax (1,084) (1,723)

Adjustments for:

Income tax (95) (37)

Finance expense 542 523

Employee share based payment (credit)/charge - (15)

Non-cash element of other income - (109)

Depreciation of property, plant and

equipment 788 836

Depreciation of right-of-use assets 825 851

Loss on disposal of tangible fixed 25 -

assets

Amortisation and impairment of intangible

assets 282 317

Share of post-tax profit of equity

accounted joint ventures (53) (55)

1,230 588

Decrease in trade and other receivables 725 2,296

(Increase)/decrease in inventories (515) 23

Decrease in trade and other payables (538) (1,426)

(328) 893

Cash generated from operations 902 1,481

Income taxes received/(paid) 92 (5)

Net cash flows from operating activities 994 1,476

Investing activities

Purchase of property, plant and equipment (405) (154)

Purchase of intangible assets (30) (125)

Proceeds from disposal of tangible 8 -

fixed assets

Dividend received from equity-accounted

for joint venture 80 125

Net cash used in investing activities (347) (154)

Financing activities

Interest paid (380) (421)

Share issue expenses paid - (17)

Bank loans advanced - 4,523

Loan issue expenses paid - (66)

Bank loans repaid (753) (213)

Principal paid on lease liabilities (951) (549)

Hire purchase and finance leases

repaid (108) (168)

Decrease in invoice discounting - (3,716)

Net cash used in financing activities (2,192) (627)

Net (decrease)/increase in cash and

cash equivalents (1,545) 695

Cash and cash equivalents at beginning

of year 2,820 2,125

Foreign exchange movements (37) -

Cash and cash equivalents at end

of year 1,238 2,820

======== ========

2021 2020

GBP000 GBP000

Cash and cash equivalents comprise:

Cash balances 1,262 2,974

Bank overdrafts (24) (154)

-------- ---------

1,238 2,820

======== =========

Reconciliation of movements in net cash/financing

liabilities

Year ended 30 September Opening Cash flows Non-cash Closing

2021 GBP000 GBP000 movements GBP000

GBP000

Cash and cash equivalents

Cash balances 2,974 (1,675) (37) 1,262

Bank overdrafts (154) 130 - (24)

--------- ----------- ----------- ---------

2,820 (1,545) (37) 1,238

Financing liabilities

Bank loans (4,383) 753 (84) (3,714)

Hire purchase liabilities (337) 108 - (229)

Lease liabilities (5,887) 1,221 (970) (5,636)

--------- ----------- ----------- ---------

(10,607) 2,082 (1,054) (9,579)

(7,787) 267 (821) (8,341)

--------- ----------- ----------- ---------

Year ended 30 September Opening Cash flows Non-cash Closing

2020 GBP000 GBP000 movements GBP000

GBP000

Cash and cash equivalents 3,132 (158) - 2,974

Cash balances (1,007) 853 - (154)

Bank overdrafts 2,125 695 - 2,820

--------- ----------- ----------- ---------

Financing liabilities

Invoice discounting (3,716) 3,716 - -

Bank loans (216) (4,244) 77 (4,383)

Hire purchase liabilities (505) 168 - (337)

Lease liabilities - 854 (6,741) (5,887)

--------- ----------- ----------- ---------

(4,437) 494 (6,664) (10,607)

(2,312) 1,189 (6,664) (7,787)

--------- ----------- ----------- ---------

Material non cash transactions

Financing liabilities now include lease liabilities, primarily

in respect of property leases, following the adoption of IFRS 16

from 1 October 2019. Additions of GBP705,000 net of foreign

exchange movements of GBP5,000 are shown in non cash movements

together with financing charges of GBP270,000 (2020: The discounted

liability at the transition date of 1 October 2019 of GBP6,422,000

is shown in non-cash movements together with a GBP14,000 foreign

exchange movement and financing charges of GBP305,000).

Basis of preparation of financial statements

While the financial information included in this annual

financial results announcement has been prepared in accordance with

the recognition and measurement principles of International

Accounting Standards in conformity of the requirements of the

Companies Act 2008, this announcement does not contain sufficient

information to comply therewith.

The financial information set out above does not constitute the

Company's statutory accounts for the years ended 30 September 2021

or 2020 but is derived from those accounts. Statutory accounts for

the year ended 30 September 2020 have been delivered to the

Registrar of Companies and those for the year ended 30 September

2021 will be delivered following the Company's annual general

meeting.

The auditors have reported on those accounts; their reports were

unqualified and did not include references to any matters to which

the auditors drew attention by way of emphasis without qualifying

their reports.

Their reports for the year end 30 September 2021 and 30

September 2020 did not contain statements under s498 (2) or (3) of

the Companies Act 2006.

The consolidated financial statements are drawn up in sterling,

the functional currency of Autins Group plc. The level of rounding

for the financial statements is the nearest thousand pounds.

Changes in accounting policies

These financial statements have been prepared in accordance with

International Accounting Standards in conformity with the

requirements of the Companies Act 2006 for periods beginning on or

after 1 October 2020 with no new standards adopted in these

financial statements.

New accounting standards applicable to future periods

There are no new standards, interpretations and amendments which

are not yet effective in these financial statements, expected to

have a material effect on the Group's future financial statements.

After Brexit, the UK will continue to apply International

Accounting Standards in conformity with the requirements of the

Companies Act 2006.

1. Revenue and segmental information

Revenue analysis

2021 2020

GBP000 GBP000

Revenue, recognised at a point in

time, arises from:

Sales of components 23,084 20,192

Sales of tooling 347 1,325

23,431 21,517

======= =======

Segmental information

The Group currently has one main reportable segment in each

year, namely Automotive (NVH) which involves provision of

insulation materials to reduce noise, vibration and harshness to

automotive manufacturing. Turnover and operating profit are

disclosed for other segments in aggregate, mainly flooring sales

together with Personal Protective Equipment ('PPE') in the prior

year, as they individually do not have a significant impact on the

Group result. These segments have no material identifiable assets

or liabilities.

Factors that management used to identify the Group's reportable

segments

The Group's reportable segments are strategic business units

that offer different products and services.

Measurement of operating segment profit or loss

The accounting policies of the operating segments are the same

as those described in the summary of significant accounting

policies.

The Group evaluates performance on the basis of operating

profit/(loss). Automotive remained the only significant segment in

the year although there has been investment and costs incurred in

the development and commissioning of equipment which can

manufacture both automotive and other products.

The Group's non-automotive revenues, including acoustic flooring

and personal protective equipment in FY20 are included within the

others segment.

Segmental analysis for the year ended 30 September 2021

Automotive Others 2021

NVH GBP000 Total

GBP000 GBP000

Group's revenue per consolidated

statement of comprehensive income 18,659 4,772 23,431

Depreciation 1,613 -

Amortisation 235 47

Segment operating (loss)/profit (971) 281 (690)

Finance expense (542)

Share of post-tax profit of equity

accounted joint ventures 53

Group loss before tax (1,179)

========

Additions to non-current assets 1,140 - 1,140

Reportable segment assets 24,991 - 24,991

Investment in joint ventures 120

Reportable segment assets/total

Group assets 25,111

Reportable segment liabilities/total

Group liabilities 12,344 12,344

=========== ======== ========

Segmental analysis for the year ended 30 September 2020

Automotive Others 2020

NVH GBP000 Total

GBP000 GBP000

Group's revenue per consolidated

statement of comprehensive income 18,446 3,071 21,517

Depreciation 1,600 -

Amortisation 301 16

Segment operating (loss)/profit (1,504) 212 (1,292)

Finance expense (523)

Share of post-tax profit of equity

accounted joint ventures 55

Group loss before tax (1,760)

========

Additions to non-current assets 279 - 279

Reportable segment assets 27,805 - 27,805

Investment in joint ventures 147

Reportable segment assets/total

Group assets - 27,952

Reportable segment liabilities/total

Group liabilities 14,103 - 14,103

=========== ======== ========

Revenues from one UK customer in FY21 total GBP9,991,000 and

GBP2,968,000 of revenue arose from another European customer (FY20:

one UK customer GBP10,895,000). This largest customer purchases

goods from Autins Limited in the United Kingdom and there are no

other customers which account for more than 10% of total

revenue.

External revenues by location of customers

2021 2020

GBP000 GBP000

United Kingdom 13,680 16,063

Sweden 680 322

Germany 6,753 3,197

Other European 2,318 1,913

Rest of the World - 22

23,431 21,517

The only material non-current assets in any location outside of

the United Kingdom are GBP900,000 (2020: GBP899,000) of fixed

assets and GBP540,000 (2020: GBP551,000) of goodwill in respect of

the Swedish subsidiary. GBP233,000 (2020: GBP775,000) of cash

balances were held in Germany which has been partly utilised to

repay intercompany debt owed to a UK group company.

2. Loss from operations

The operating loss is stated after charging/(crediting):

2021 2020

GBP000 GBP000

Foreign exchange losses 105 11

Depreciation of property, plant

and equipment 788 836

Depreciation of right-of-use

assets 825 851

Amortisation of intangible assets 282 317

Cost of inventory sold 15,663 14,573

Impairment of trade receivables (83) 17

Government job retention scheme

income (649) (672)

Other government assistance and

grants - (115)

Employee benefit expenses 6,499 6,822

Lease payments (short term leases

only) 109 120

Auditors' remuneration:

Fees for audit of the Group 90 85

Exceptional inventory provisions - 164

Exceptional restructuring costs

in respect of:

Restructuring programme, inc

severance costs - 132

Change of Chief Financial Officer - 160

------- -------

- 292

======= =======

Prior year exceptional costs

Overhead and operational restructuring programme

Following a detailed operational review initiated by the change

of Chief Financial Officer in January 2020 and in preparation for

the rationalisation of the UK premises, the Group reviewed its

inventory and identified GBP164,000, primarily in respect of

materials that were being held for development or aftermarket

service purposes, which are to be scrapped to allow floor space

rationalisation and an associated reduction in future premises

costs.

In the prior year, the Group also incurred exceptional

administrative costs of GBP160,000 in the year in respect of the

change of CFO, including recruitment fees and compensation costs.

As part of the operational review initiated by the new CFO and in

response to Covid, which necessitated further operational changes

and cost reductions, the Group incurred a further GBP132,000 of

severance related costs in FY20.

3. Finance expense

2021 2020

GBP000 GBP000

Bank interest 236 180

Amortisation of loan issue costs 14 7

Right-of-use asset financing charges 270 305

Interest element of hire purchase agreements 22 31

` 542 523

======= ========

4. Earnings per share

2021 2020

GBP000 GBP000

Loss used in calculating basic and

diluted EPS (1,084) (1,723)

Number of shares

Weighted average number of GBP0.02

shares for the purpose of basic earnings

per share ('000s) 39,601 39,601

Weighted average number of GBP0.02

shares for the purpose of diluted earnings

per share ('000s) 39,601 39,601

Earnings per share (pence) (2.74)p (4.35)p

Diluted earnings per share (pence) (2.74)p (4.35)p

========== ========

Earnings per share have been calculated based on the share

capital of Autins Group plc and the earnings of the Group for both

years. There are options in place over 2,523,648 (2020: 524,204)

shares that were anti-dilutive at the year end but which may dilute

future earnings per share.

5. Annual report and accounts

The annual report and accounts will be posted to shareholders

shortly and will be available to members of the public at the

Company's registered office at Central Point One, Central Park

Drive, Rugby, CV23 0WE and on the Company's website

www.autins.co.uk/investors .

6. Annual General Meeting

The Annual General Meeting of Autins Group plc will be held at

the Company's main offices at Central Point One, Central Park

Drive, Rugby, Warwickshire, CV23 0WE on 17 March 2022 commencing at

11.00am.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR SEMFALEESEIF

(END) Dow Jones Newswires

January 25, 2022 02:00 ET (07:00 GMT)

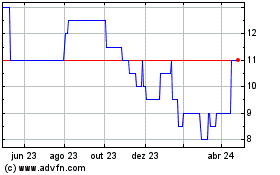

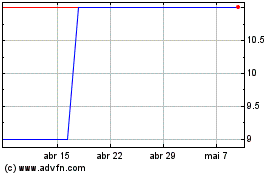

Autins (LSE:AUTG)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Autins (LSE:AUTG)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024