TIDMBT.A

RNS Number : 2400L

BT Group PLC

12 May 2022

Financial results

Results for the full year to 31 March 2022

BT Group plc

12 May 2022

Philip Jansen, Chief Executive, commenting on the results, said

"BT Group has again delivered a strong operational performance

thanks to the efforts of our colleagues across the business. Openreach

continues to build like fury, having now passed 7.2m premises with

1.8m connections; a strong and growing early take-up rate of 25%.

Meanwhile, our 5G network now covers more than 50% of the UK population.

We have the best networks in the UK and we're continuing to invest

at an unprecedented pace to provide unrivalled connectivity for

our customers. At the same time we're seeing record customer satisfaction

scores across the business.

"We have finalised the sports joint venture with Warner Bros. Discovery

to improve our content offering to customers, aligning our business

with a new global content powerhouse. Separately, we have strengthened

our strategic partnership and key customer relationship with Sky,

having now extended our reciprocal channel supply deal into the

next decade and agreed a MoU to extend our co-provisioning agreement.

"Our modernisation continues at pace and we are extending our cost

savings target of GBP2bn by end FY24 to GBP2.5bn by end FY25. We

delivered EBITDA growth of 2% this year as strong savings from

our modernisation programme more than offset weaker revenues from

our enterprise businesses due to well-known market challenges.

"While the economic outlook remains challenging, we're continuing

to invest for the future and I am confident that BT Group is on

the right track. As a result, we are today reconfirming our FY23

outlook for revenue growth, EBITDA of at least GBP7.9bn and also

the reinstatement of our full year FY22 dividend, as promised,

at 7.7 pence per share."

BT Group plc (BT.L) today announced its results for the full

year to 31 March 2022.

Strong progress in strategic priorities:

-- Positive leading indicators: Highest ever BT Group NPS

results; low Ofcom complaints; churn near record lows

-- BT Group and Warner Bros. Discovery agreed to form a new

premium sports joint venture bringing together BT Sport and

Eurosport UK

-- Agreed with Sky a new longer-term reciprocal channel supply deal beyond 2030

-- Openreach signed a MoU on a framework with Sky on FTTP

co-provisioning; Sky engineers to complete the majority of their

FTTP in-premises provisioning activities on Openreach's FTTP

network

-- FTTP footprint at 7.2m with annualised Q4 build rate of over

3m premises; take up of 1.8m driven by Equinox

-- 5G network now covers over 50% of the UK population; our 5G

ready customer base is over 7.2m and EE is once again named as

having the best 5G and 4G network by RootMetrics

-- Achieved gross annualised cost savings now totalling

GBP1.5bn; increased target to GBP2.5bn by end FY25, within the

previously communicated cost to achieve of GBP1.3bn

Adjusted EBITDA growth and return of full year dividend:

-- Revenue GBP20.9bn, down 2%, reflecting revenue decline in

Enterprise and Global offset by growth in Openreach, with Consumer

flat for the year and returning to growth in Q4; adjusted(1)

revenue down 2%

-- Adjusted(1) EBITDA GBP7.6bn, up 2%, with revenue decline more

than offset by lower costs from our modernisation programmes, tight

cost management, and lower indirect commissions

-- Reported profit before tax GBP2.0bn, up 9%, due to increased

EBITDA offsetting higher finance expense

-- Reported profit after tax GBP1.3bn, down 13%, due to remeasurement of our deferred tax balance

-- Net cash inflow from operating activities GBP5.9bn;

normalised free cash flow(1) GBP1.4bn, down 5%, due to higher cash

capital expenditure, offset by higher EBITDA and lower tax and

lease payments

-- Capital expenditure GBP5.3bn, up 25%. Capital expenditure

excluding spectrum GBP4.8bn, up 14% primarily due to continued

higher spend on our fibre infrastructure and mobile networks

-- IAS 19 gross pensions deficit GBP1.1bn, (31 March 2021:

GBP5.1bn) due to an increase in real discount rate, deficit

contributions paid, changes to demographic assumptions and positive

asset returns

-- FY22 final dividend declared at 5.39p per share, bringing the

full year total, as promised, to 7.70p per share

-- Outlook for FY23: adjusted(1) revenue to grow year on year;

adjusted(1) EBITDA of at least GBP7.9bn; capital expenditure

excluding spectrum of around GBP4.8bn; normalised free cash flow of

GBP1.3bn to GBP1.5bn.

(1) See Glossary on page 3.

Full year to 31 March 2022 2021 Change

=============== ===============

GBPm GBPm %

================================= =============== =============== ==================

Reported measures

Revenue 20,850 21,331 (2)

Profit before tax 1,963 1,804 9

Profit after tax 1,274 1,472 (13)

Basic earnings per share 12.9p 14.8p (13)

Net cash inflow from operating

activities 5,910 5,963 (1)

Full year dividend 7.70p - N/A

Capital expenditure(1,2) 5,286 4,216 25

================================= =============== =============== ==================

Adjusted measures

Adjusted(1) Revenue 20,845 21,370 (2)

Adjusted(1) EBITDA 7,577 7,415 2

Adjusted(1) basic earnings

per share 20.3p 18.9p 7

Normalised free cash flow(1) 1,392 1,459 (5)

Capital expenditure(1) excluding

spectrum 4,807 4,216 14

Net debt(1) 18,009 17,802 GBP207m

================================= =============== =============== ==================

Customer-facing unit results for the full year to 31 March

2022

Adjusted(1) revenue Adjusted(1) EBITDA Normalised free

cash flow(1)

Full year

to 31 March 2022 2021 Change 2022 2021 Change 2022 2021 Change

============

GBPm GBPm % GBPm GBPm% GBPm GBPm %

============ ========== ========== =========== ========== ========== ========== ========== ========== ===========

Consumer 9,858 9,885 - 2,262 2,128 6 917 714 28

Enterprise 5,157 5,449 (5) 1,636 1,704 (4) 791 1,352 (41)

Global 3,362 3,731 (10) 456 596 (23) 131 187 (30)

Openreach 5,441 5,244 4 3,179 2,937 8 448 486 (8)

Other 27 23 17 44 50 (12) (895) (1,280) 30

Intra-group

items (3,000) (2,962) (1) - - - - - -

============ ========== ========== =========== ========== ========== =========== ========== ========== ===========

Total 20,845 21,370 (2) 7,577 7,415 2 1,392 1,459 (5)

============ ========== ========== =========== ========== ========== =========== ========== ========== ===========

Fourth

quarter

to 31 March 2022 2021 Change 2022 2021 Change 2022 2021 Change

============

GBPm GBPm % GBPm GBPm% GBPm GBPm %

============ =========== =========== =========== ========== =========== ========== ========= ========= ===========

Consumer 2,416 2,391 1 557 518 8

Enterprise 1,290 1,363 (5) 384 436 (12)

Global 837 908 (8) 135 156 (13)

Openreach 1,373 1,346 2 811 726 12

Other 7 5 40 (18) (24) 25

Intra-group

items (755) (727) (4) - - -

============ =========== =========== =========== ========== =========== =========== ========= ========= ===========

Total 5,168 5,286 (2) 1,869 1,812 3 513 629 (18)

============ =========== =========== =========== ========== =========== =========== ========= ========= ===========

Performance against FY22 outlook

FY22 performance FY22 outlook

================ =================

Change in adjusted(1) revenue Down (2)% Down c.(2)%

Adjusted(1) EBITDA GBP7.6bn GBP7.5bn-GBP7.7bn

Capital expenditure(1) GBP4.8bn c.GBP4.9bn

Normalised free cash flow(1) GBP1.4bn GBP1.1bn-GBP1.3bn

============================= ================ =================

(1) See Glossary on page 3.

(2) Includes investment in spectrum of GBP479m.

Glossary of alternative performance measure

Adjusted Before specific items. Adjusted results are consistent

with the way that financial performance is measured

by management and assist in providing an additional

analysis of the reported trading results of the Group.

EBITDA Earnings before interest, tax, depreciation and amortisation.

Adjusted EBITDA EBITDA before specific items, share of post tax profits/losses

of associates and joint ventures and net non-interest

related finance expense.

Free cash Net cash inflow from operating activities after net

flow capital expenditure.

Capital expenditure Additions to property, plant and equipment and intangible

assets.

Normalised Free cash flow (net cash inflow from operating activities

free cash flow after net capital expenditure) after net interest paid

and payment of lease liabilities, before pension deficit

payments (including cash tax benefit), payments relating

to spectrum, and specific items. For non-tax related

items the adjustments are made on a pre-tax basis.

It excludes cash flows that are determined at a corporate

level independently of ongoing trading operations such

as dividends, share buybacks, acquisitions and disposals,

and repayment and raising of debt.

Net debt Loans and other borrowings and lease liabilities (both

current and non-current), less current asset investments

and cash and cash equivalents, including items which

have been classified as held for sale on the balance

sheet. Currency denominated balances within net debt

are translated into sterling at swapped rates where

hedged. Fair value adjustments and accrued interest

applied to reflect the effective interest method are

removed.

Specific items Items that in management's judgement need to be disclosed

separately by virtue of their size, nature or incidence.

In the current period these relate to retrospective

regulatory matters, restructuring charges, divestment-related

items, Covid-19 related items, net interest expense

on pensions, tax charge on specific items and the impact

of the change in tax rate on our deferred tax balances.

BT Group NPS Group NPS tracks changes in our customers' perceptions

of BT. This is a combined measure of 'promoters' minus

'detractors' across our business units. Group NPS measures

Net Promoter Score in our retail business and Net Satisfaction

in our wholesale business.

5G ready EE consumer customers receiving or capable of receiving

5G network connection using one or both of a 5G enabled

handset and a 5G enabled SIM.

=================== ===============================================================

We assess the performance of the Group using a variety of

alternative performance measures. Reconciliations from the most

directly comparable IFRS measures are in Additional Information on

pages 33 to 34.

Click on, or paste the following link into your web browser, to

view the associated PDF document.

http://www.rns-pdf.londonstockexchange.com/rns/2400L_1-2022-5-12.pdf

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR ELLBFLELBBBD

(END) Dow Jones Newswires

May 12, 2022 02:02 ET (06:02 GMT)

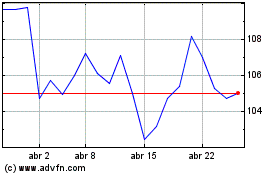

Bt (LSE:BT.A)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Bt (LSE:BT.A)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024