Infrastructure India plc Waiver of Long Stop Date (3943S)

15 Julho 2022 - 3:00AM

UK Regulatory

TIDMIIP TIDMTTM

RNS Number : 3943S

Infrastructure India plc

15 July 2022

15 July 2022

Infrastructure India plc

("IIP" or the "Company" or, together with its subsidiaries, the

"Group")

Waiver of Long Stop Date

Infrastructure India plc, an AIM quoted infrastructure fund

investing directly into assets in India, announces that it has been

granted a waiver of the long stop date in relation to the

conditional sale of Indian Energy (Mauritius) Limited's ("IEL")

assets. IEL, which is a wholly owned subsidiary of IIP, is an

independent power producer that owns and operates wind farms at two

sites in the states of Karnataka and Tamil Nadu. IEL holds each

wind farm asset within separate Special Purpose Vehicles ("SPV"),

Theni and Gadag, which are its only assets.

As announced on 28 February 2022, IIP entered into an agreement

for the conditional sale of its 100% interest in each SPV to AVSR

Constructions ("AVSR"), for a total consideration of INR 550

million (approximately GBP5.8 million) and the transaction is

structured with the separate sale of each SPV.

As announced on 20 April 2022, AVSR agreed to provide an

unsecured advance of INR 275 million (approximately GBP2.9

million), which is 50% of the agreed consideration for both SPVs.

The waiver of the long stop date has been granted by AVSR as a

result of slower than anticipated progress for third party

clearance certificates. IEL must still satisfy the remaining

outstanding conditions, including regulatory approvals, to complete

the sale of the SPVs, whereby the balance of the consideration will

be transferred to IEL. IIP's lenders have waived the requirement to

pay down a proportion of the Company's debt.

The completion of the transaction is expected in the coming

weeks. The Company's creditors continue to be supportive, however,

should the outstanding conditions not be met by IEL and

consequently the sale not proceed, the Company will not have

adequate funding to meet its liabilities when they fall due and

will need to identify other sources of financing.

The Board looks forward to providing shareholders with further

updates, as appropriate, in due course.

- Ends -

Enquiries:

Infrastructure India plc www.iiplc.com

Sonny Lulla Via Novella

Strand Hanson Limited

Nominated Adviser

James Spinney / James Dance +44 (0) 20 7409 3494

Singer Capital Markets

Broker

James Maxwell - Corporate Finance

James Waterlow - Investment Fund Sales +44 (0) 20 7496 3000

Novella

Financial PR

Tim Robertson / Safia Colebrook +44 (0) 20 3151 7008

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFLFVEDTIVLIF

(END) Dow Jones Newswires

July 15, 2022 02:00 ET (06:00 GMT)

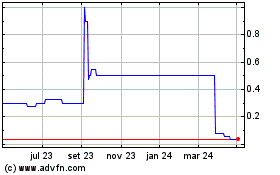

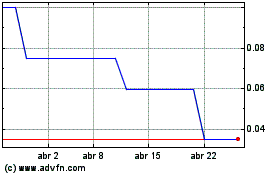

Infrastructure India (LSE:IIP)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Infrastructure India (LSE:IIP)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024