Ironveld PLC Result of Broker Option and Posting of Circular (6847S)

15 Julho 2022 - 9:00AM

UK Regulatory

TIDMIRON

RNS Number : 6847S

Ironveld PLC

15 July 2022

NOT FOR PUBLICATION, DISTRIBUTION OR RELEASE DIRECTLY OR

INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO THE UNITED STATES,

CANADA, AUSTRALIA, JAPAN OR THE REPUBLIC OF SOUTH AFRICA OR IN ANY

OTHER JURISDICTION IN WHICH OFFERS OR SALES WOULD BE PROHIBITED BY

APPLICABLE LAW. THIS ANNOUNCEMENT IS NOT AN OFFER TO SELL OR A

SOLICITATION TO BUY SECURITIES IN ANY JURISDICTION, INCLUDING THE

UNITED STATES, CANADA, AUSTRALIA, JAPAN AND THE REPUBLIC OF SOUTH

AFRICA. NEITHER THIS ANNOUNCEMENT NOR ANYTHING CONTAINED HEREIN

SHALL FORM THE BASIS OF, OR BE RELIED UPON IN CONNECTION WITH, ANY

OFFER OR COMMITMENT WHATSOEVER IN ANY JURISDICTION.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF REGULATION 2014/596/EU. IN ADDITION, MARKET

SOUNDINGS WERE TAKEN IN RESPECT OF THE MATTERS CONTAINED IN THIS

ANNOUNCEMENT, WITH THE RESULT THAT CERTAIN PERSONS BECAME AWARE OF

SUCH INSIDE INFORMATION. UPON THE PUBLICATION OF THIS ANNOUNCEMENT,

THIS INSIDE INFORMATION IS NOW CONSIDERED TO BE IN THE PUBLIC

DOMAIN AND SUCH PERSONS SHALL THEREFORE CEASE TO BE IN POSSESSION

OF INSIDE INFORMATION.

Ironveld plc

Result of Broker Option and Posting of Circular

Ironveld plc ("Ironveld" or "the Company"), announces that it

has raised GBP500,000 (before expenses) pursuant to a Broker Option

following the conditional Placing announced on 13 July 2022.

The Company granted an option to Turner Pope Investments Limited

("Turner Pope") under the Placing Agreement to enable them to deal

with additional demand under the Placing in the event that requests

to participate in the Placing from existing shareholders who are

qualifying investors were received during the period from the time

of the announcement of the Placing to close of business on 14 July

2022, up to a maximum of GBP1,000,000. Turner Pope has exercised

the Broker Option in respect of 166,666,666 Broker Option Shares at

the same price as the Placing.

Accordingly, the total number of new Ordinary Shares to be

issued by the Company pursuant to the Second Placing and the Broker

Option is 1,379,999,999. The aggregate gross proceeds of the

Placing and the Broker Option is GBP4.50 million. Aggregate

proceeds, net of expenses, are expected to be approximately GBP4.20

million.

Under the fee arrangements in place with Turner Pope, the

Company will issue Turner Pope, conditional on Second Admission,

Broker Warrants to subscribe for a total of 375,000,000 new

Ordinary Shares at the Placing Price for a period of 36 months from

Admission. In the event that the Placing is completed but relevant

resolutions necessary for the issue of Ordinary Shares pursuant to

the Broker Warrants are not passed at the General Meeting on 1

August 2022, each Broker Warrant will entitle the holder to

subscribe for two new Ordinary Shares (ie a total of 750,000,000

new Ordinary Shares could be allotted pursuant to the Broker

Warrants) and the Company has agreed to propose the necessary

resolutions at the Company's next Annual General Meeting.

General Meeting

The Second Placing and issue of all the Second Placing Shares

and Broker Option Shares are conditional, inter alia, on the

approval by shareholders of the requisite resolution(s) at a

General Meeting.

The General Meeting will be held at 10.00 am at the offices of

Kuit Steinart Levy LLP, 7(th) Floor, Blackfriars House, The

Parsonage, Manchester M3 2JA on 1 August 2022. A Circular will be

posted to Shareholders today and will shortly be available on the

Company's website.

Once issued, the rights of new Ordinary Shares will rank pari

passu with the Company's existing Ordinary Shares. Application will

be made for the new Ordinary Shares to be admitted to trading on

AIM

Settlement and dealings

Application will be made for the Second Placing Shares to be

admitted to trading on AIM in due course. Dealings in the Second

Placing Shares on AIM are expected to commence at 8:00 am on or

around 2 August 2022 and the Company will make a further

announcement in due course.

Capitalised terms used in this announcement have the meanings

given to them in the announcement of the Placing on 13 July

2022.

**ENDS**

For further information, please contact:

Ironveld plc c/o BlytheRay

Giles Clarke, Chairman +44 20 7138 3204

Martin Eales, Chief Executive Officer

finnCap (Nomad and Joint Broker)

Christopher Raggett / Charlie Beeson +44 20 7220 0500

Turner Pope (Joint Broker)

James Pope/Andrew Thacker +44 20 3657 0050

BlytheRay

Tim Blythe / Megan Ray +44 20 7138 3204

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEEAFXSFSDAEFA

(END) Dow Jones Newswires

July 15, 2022 08:00 ET (12:00 GMT)

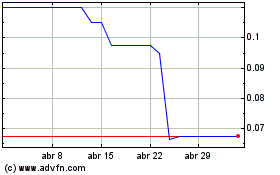

Ironveld (LSE:IRON)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Ironveld (LSE:IRON)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024