TIDMALBA

RNS Number : 7411X

Alba Mineral Resources PLC

31 August 2022

Alba Mineral Resources plc

("Alba" or the "Company")

HALF-YEARLY REPORT

The Board of Directors of Alba Mineral Resources plc (the

"Company" or "Alba") is pleased to report the Company's interim

results for the six months ended 31 May 2022. They incorporate the

results of its subsidiary companies Aurum Mineral Resources Limited

("AMR"), Mauritania Ventures Limited ("MVL"), Dragonfire Mining

Limited ("DML"), the Gold Mines of Wales group of companies

("GMOW"), GMOW (Gwynfynydd) Limited, GreenRoc Mining Plc, Obsidian

Mining Limited ("OML"), White Eagle Resources Limited ("WERL") and

White Fox Resources Limited ("WFRL") (together, the "Subsidiary

Companies", collectively with Alba, the "Group").

CHAIRMAN'S STATEMENT

I am pleased to present shareholders with a review of our

activities in the six months to 31 May 2022.

Strong progress has been made during this period. At the

Clogau-St David's Gold Project, the analytical work we carried out

on our drill core has given us further confidence in the potential

of our two primary targets, the Lower Llechfraith and the Main Lode

Extension, to host high-grade gold resources. Regarding the Lower

Llechfraith target, we recently announced that good progress has

been made in completing further ecological surveying and data

generation in support of our plan to dewater the Llechfraith Shaft

and that we expect to submit an updated technical report and

renewed permit applications to the regulator in the first half of

September.

Outside of the mine area at Clogau, the second phase of our

exploratory work at the historic waste tip was very successful. We

returned average assay grades of 3.5 g/t and the gold concentrates

that we produced at our on-site pilot plant had an average grade of

502 g/t, indicating that there is real potential for the waste tip

to be mined for gold as a standalone exercise to the rest of the

mine.

Great progress has also been made at GreenRoc Mining Plc, which

listed last year and in which we hold a majority interest. A maiden

JORC Resource was announced at GreenRoc's exceptionally high-grade

Amitsoq Island graphite deposit and, as I write, a follow-up

drilling campaign is well underway at Amitsoq, and with more

drilling still to be completed, already looks to have doubled the

footprint of the deposit.

1. REVIEW OF ACTIVITIES

1.1 WELSH GOLD

(Clogau-St David's, Gwynfynydd, Dolgellau Exploration

Project)

In December 2021, we announced that an analysis of the assays

from our Phase 1 & 2 underground and surface drill core and

additional in-mine rock samples had identified four distinct

geochemical groupings, with the most important grouping, the

auriferous vein ("AV") group, being directly comparable to the

basket of metals found in the bonanza-grade gold stage described in

historical ore mineralogy assessments for the Dolgellau Gold Field,

as well as being present in all key target structures identified to

date.

This detailed multi-element analysis of the core samples from

all our drilling at Clogau has provided further validation of the

key targets we have identified from that work. This includes our

two priority targets: the Lower Llechfraith, below the Llechfraith

Adit, where drilling has proven vein continuity up to 122 m below

existing workings; and the Main Lode System Extension, where

drilling has defined a previously unknown Lode (termed the New

Branch Lode) whilst also intercepting the 7-10 Lode and

Grandfathers Payshoot at up to 60 m below existing workings.

The fact that we have identified the same multi-element

signature in these areas as was found in the bonanza-grade gold

stage at Clogau gives us a great deal of confidence in the

prospects for these new zones to host high-grade gold deposits.

As shareholders will be aware, prior to the reporting period the

regulator, Natural Resources Wales ('NRW'), turned down our permit

application to dewater the Llechfraith Shaft situated below the

Llechfraith Adit level. The dewatering exercise is a necessary

first step in gaining access to the Lower Llechfraith area. During

the reporting period, Alba submitted additional supporting data and

analysis to NRW and, following the receipt of subsequent feedback

from the latter, the Company and its professional consultants have

extended the programme of ecological and species surveys to add to

the ecological dataset generated by the Company during the past 3-4

years.

Alba's ecological consultants are in the process of updating our

previously submitted Report to Inform a Habitat Regulations

Assessment. We intend to submit the revised Report and renewed

dewatering applications in the first half of September, and we

remain confident that we will ultimately be successful in our bid

to dewater the shaft.

Since 2021, we have been engaged in the exploration of the

historic Waste Tip at Clogau as a stand-alone project outside the

envelope of the mine. During the reporting period, a second phase

pitting and sampling exercise was completed at the Waste Tip,

focusing on the higher-grade zones identified from our previous

work. Following clearance from NRW, five pits were dug within an

area of 400m(2), with 60 kg samples of fines material from each pit

then being submitted for independent assaying.

The assay results returned gold grades of up to 11.35 g/t, with

whole-sample analysis averaging up to 3.50 g/t, in line with the

Phase 1 results. Further size fraction analysis has highlighted how

gold is concentrated in the finest material (<1 mm) extracted

from the Waste Tip.

Subsequent independent assays of the gold concentrates produced

from the processing of the fines material at our on-site pilot

plant returned gold concentrate grades of up to 1,000 g/t with an

average grade of 502 g/t. This average concentrate grade translates

to an average head grade of 1.7 g/t, significantly higher than the

average of 0.95 g/t achieved from the first phase sampling of the

same pits, indicating that the sampling exercise under-represented

the overall grade due to the nuggety effect of the ore.

The Company is now engaged in an economic assessment of the

Waste Tip and the formulation of a mining plan, which will lead to

a formal planning application to commercially produce gold from the

Waste Tip's estimated 4,000 tonnes of fines material.

In other developments outside of the main mine area, our

aeromagnetic survey contractor, UAVE Limited, has been engaged in

the process for obtaining permission to carry out an unmanned

aerial vehicle ("UAV")-borne geophysical survey to map the magnetic

properties of the subsurface below the key targets which we

identified in our extensive 2019 geochemical survey programme .

Being able to pinpoint the bedrock sources of these geochemical

anomalies will have significant implications for both regional

exploration and the identification of further near-mine resource

opportunities. However, the UK Civil Aviation Authority having

notified us that the next available slot to carry out the survey

would be in November 2022, when the weather window for completing

the flights is likely to be limited, it has been decided to defer

the survey till next spring.

1.2 GREENROC MINING PLC

(Amitsoq Graphite, Thule Black Sands Ilmenite, Melville Bay Iron

and Inglefield Multi-Element)

Alba holds a 54% majority interest in GreenRoc Mining Plc

("GreenRoc"). Because of this, Alba's consolidated financial

statements include GreenRoc and its subsidiaries.

GreenRoc was admitted to trading on AIM last September with the

objective of becoming a key supplier of critical, high-demand

minerals and has already made great strides towards this goal.

During the reporting period, GreenRoc made significant progress in

relation to its flagship projects, Amitsoq (graphite) and Thule

Black Sands ("TBS") (ilmenite), as summarised below.

At Amitsoq, a maiden JORC Resource was announced in March 2022

at the Amitsoq Island deposit of 8.3 million tonnes ("Mt") at an

average grade of 19.75% graphitic carbon ("Cg"), confirming Amitsoq

to be among the very highest-grade graphite deposits in the world.

Meanwhile, the Exploration Target for the Amitsoq Island deposit

has increased to 5-15Mt at a grade range of 18-22% Cg, and for the

separate Kalaaq deposit has increased to 6-10 Mt at a grade range

of 17-33% Cg.

A drilling programme is ongoing at the Amitsoq Island deposit

this summer, targeting a significant increase in the JORC Resource

there. As of 14 August 2022, nine holes had been completed for a

total of 1,360m, with all holes intersecting the targeted graphite

layers, thereby extending the deposit to the west by about 100m and

to the northwest by about 150m, essentially doubling the deposit

footprint and supporting the significant additional resource

potential in the project.

To date, 16 intersections of UGL and LGL greater than 3.0m each

have been drilled at Amitsoq this summer, with all holes having at

least one mineable graphite layer intersection greater than 5.25m.

Drilling to date gives strong confidence that a higher-tonnage,

higher-category Resource can be established in support of

feasibility studies.

As for TBS, following the 2021 drill programme there, a revision

to the current maiden JORC Resource of 19Mt at 8.9% in-situ

ilmenite is expected in the coming weeks. Bathymetric surveying is

being undertaken at TBS this summer to provide data for the

planning of port facilities.

Environmental and Social Impact Assessment consultants have been

engaged to commence work on the EIA and SIA studies necessary for

future exploitation licence applications, and this will be the

focus of work following the end of the summer field programmes.

Stefan Bernstein, a senior geologist with considerable

experience in the Greenland mining sector, was appointed CEO of

GreenRoc in May 2022.

Further details are set out in GreenRoc's interim results

announcement of 10 August 2022.

1.3 IRISH BASE METALS

Post period end, the mineral exploration licence for Alba's 100%

owned Limerick Base Metals Project, PL 3824, was renewed until 26

May 2024.

We have identified three principal exploration target areas for

follow-up drilling at Limerick. Applications for the necessary

drill permits have been submitted and we remain on track to

commence drilling before the end of this year.

1.4 HORSE HILL

On 18 February 2022, the Operator of the Horse Hill Oil Field,

in which Alba holds an 11.765% interest, announced that the Court

of Appeal had confirmed that the existing production licence had

been granted lawfully and that the field could remain in production

until the end of its commercial life. The Operator has since

announced that the claimant has been given a final legal avenue to

appeal to the Supreme Court, which if pursued would be expected to

be heard some time from Q2 2023 onwards.

On 5 May 2022, the Operator announced the grant of a full

Production Permit ("PP") from the Environment Agency, enabling

production and water re-injection operations, incineration of waste

gas, maintenance/workovers and the drilling of further development

wells under a single permit, an improvement from the umbrella of

testing permits previously in place.

Later that month, the Operator announced a one-year extension to

the Retention Area work programme, granting an additional year in

which to drill a second Horse Hill Kimmeridge well, with the

commencement of drilling to be prior to 30 September 2023.

2. CORPORATE

On 19 January 2022, the Company announced that the Chairman,

George Frangeskides, had purchased 10,221,909 ordinary shares in

the Company at an average price of 0.1475p per share, taking his

holding to 48 million shares or 0.75% of the Company's issued share

capital.

Post-period end (see the RNS of 23 August 2022), Alba announced

the acquisition of the remaining 10% minority interest in the

Clogau-St David's Gold Project, resulting in Alba moving to 100%

ownership of the Project. The Company now owns 100% of all of its

Welsh gold projects. As part of the acquisition, Alba also bought

back 3% of the net smelter return ("NSR") royalty held by the

minority party, leaving it with a 1% NSR royalty. The reduction in

the royalty is regarded as important for the future economics of

the Project. The t otal consideration payable by Alba is

GBP400,000, to be settled in Alba ordinary shares at a price per

share of 0.2p, a premium of 25% above the closing share price of

0.16p on 22 August 2022, plus 81,930,830 two-year share warrants

with an exercise price of 0.4p per share. The consideration shares

will be subject to a 12-month lock-up/orderly marketing

restriction.

3. RESULTS

The Group made a loss of GBP815,000 after tax (2021:

GBP568,000), reflecting increased costs due to there being a second

AIM-listed entity within the Group in the period under review, of

which the loss attributable to equity holders of the parent for the

period were GBP592,000 after taxation (2021: GBP567,000).

Administrative costs were lower for the period under review, but

certain transaction fees relating to the GreenRoc IPO had been

incurred.

At the end of the reporting period, the Group's cash was

GBP2,024,000. Net cash outflows were GBP1.9m, including GBP0.94m

expenditure on exploration projects and fixed assets in the six

months being reported.

Intangible assets increased by GBP3m from the comparative

interim period last year, reflecting the Group's investment in

exploration in Wales and in Greenland since 31 May 2021.

The basic and diluted loss per share was 0.009 pence (2021:

0.009 pence).

4. OUTLOOK

Alba remains in a strong position to generate real and sustained

growth across its portfolio of assets and investments and also

continues to assess opportunities to expand its portfolio value by

the acquisition of additional complementary assets.

On behalf of the entire Board, I would like to take this

opportunity to thank our shareholders for all their support.

George Frangeskides

31 August 2022

Executive Chairman

This announcement contains inside information for the purposes

of the UK Market Abuse Regulation and the Directors of the Company

are responsible for the release of this announcement.

Forward Looking Statements

This announcement contains forward-looking statements relating

to expected or anticipated future events and anticipated results

that are forward-looking in nature and, as a result, are subject to

certain risks and uncertainties, such as general economic, market

and business conditions, competition for qualified staff, the

regulatory process and actions, technical issues, new legislation,

uncertainties resulting from potential delays or changes in plans,

uncertainties resulting from working in a new political

jurisdiction, uncertainties regarding the results of exploration,

uncertainties regarding the timing and granting of prospecting

rights, uncertainties regarding the Company's ability to execute

and implement future plans, and the occurrence of unexpected

events. Actual results achieved may vary from the information

provided herein as a result of numerous known and unknown risks and

uncertainties and other factors.

For further information, please visit

www.albamineralresources.com or contact:

Alba Mineral Resources plc

George Frangeskides, Executive Chairman +44 20 3950 0725

SPARK Advisory Partners Limited (Nomad)

Andrew Emmott +44 20 3368 3555

OvalX (Broker)

Thomas Smith +44 20 7392 1494

St Brides Partners (Financial PR)

Isabel de Salis / Catherine Leftley alba@stbridespartners.co.uk

Alba's Projects and Investments

Mining Projects Operated Location Ownership

by Alba

Clogau (gold) Wales 90%

----------- ----------

Dolgellau Gold Exploration

(gold) Wales 90-100%

----------- ----------

Gwynfynydd (gold) Wales 100%

----------- ----------

Limerick (zinc-lead) Ireland 100%

----------- ----------

Investments Held by Alba Location Ownership

----------- ----------

GreenRoc Mining Plc (mining) Greenland 54%

----------- ----------

Horse Hill (oil) England 11.765%

----------- ----------

UNAUDITED CONSOLIDATED INCOME STATEMENT

FOR THE SIX MONTHSED 31 MAY 2022

Unaudited Unaudited Audited Year

6 months ended 6 months ended 30

31 May 2022 ended 31 Nov 2021

May 2021

GBP'000 GBP'000 GBP'000

Other income - - 23

Administrative expenses (814) (372) (1,067)

Transaction-related professional - (196) -

fees

Operating (loss)/profit (814) (568) (1,044)

Revaluation of financial

liability - (180)

Revaluation of investment - - (615)

Finance costs (1) - (1)

---------------- -------------- --------------

(Loss)/profit before tax (815) (568) (1,840)

Taxation - - -

---------------------------------- ---------------- -------------- --------------

(Loss)/profit for the

year (815) (568) (1,840)

----------------------------------- ---------------- -------------- --------------

Attributable to:

Equity holders of the

parent (592) (567) (1,699)

Non-controlling interests (223) (1) (141)

---------------- -------------- --------------

(815) (568) (1,840)

---------------- -------------- --------------

Loss per ordinary share

Basic and diluted (0.009) pence (0.009) pence (0.027) pence

UNAUDITED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 31 MAY 2022

Unaudited Unaudited Audited Year

6 months ended 6 months ended ended 30

31 May 2022 31 May 2021 Nov 2021

GBP'000 GBP'000 GBP'000

Non-current assets

Property, plant and equipment 153 140 137

Intangible fixed assets 7,030 4,106 6,110

Investments - Horse Hill

Developments 3,385 4,000 3,385

Investments -other - - -

Total non-current assets 10,568 8,246 9,632

---------------- ---------------- -------------

Current assets

Trade and other receivables 211 269 178

Cash and cash equivalents 2,024 1,620 3,948

---------------- ---------------- -------------

Total current assets 2,235 1,889 4,126

---------------- ---------------- -------------

Current liabilities

Trade and other payables (383) (475) (671)

Financial liabilities (221) (41) (221)

---------------- ---------------- -------------

Total current liabilities (604) (516) (892)

---------------- ---------------- -------------

Net current assets / (liabilities) 1,631 1,373 3,234

---------------- ---------------- -------------

Net assets 12,199 9,619 12,866

------------------------------------- ---------------- ---------------- -------------

Capital and reserves

Called up share capital 5,005 4,987 5,005

Share premium account 9,877 9,444 9,877

Warrant reserve 1,444 1,385 1,425

Dilution of ownership reserve 991 - 991

Other reserve 115 - 89

Retained losses (7,958) (6,351) (7,421)

Foreign currency reserve 169 169 168

------------------------------------- ---------------- ---------------- -------------

Equity attributable to

equity holders of the parent 9,643 9,634 10,134

Non-controlling interests 2,556 (15) 2,732

------------------------------------- ---------------- ---------------- -------------

Total equity 12,199 9,619 12,866

------------------------------------- ---------------- ---------------- -------------

UNAUDITED CONSOLIDATED CASH FLOW STATEMENT

FOR THE SIX MONTHS ENDED 31 MAY 2022

Unaudited Unaudited Audited

6 months 6 months Year ended

ended 31 ended 31 30 Nov 2021

May 2022 May 2021

Cash flows from operating

activities

Operating loss (814) (568) (1,044)

Loss on disposal - - 9

Consulting fees settled in shares - - 32

Share based payment charge 147 52 237

Depreciation 3 - 5

Foreign exchange revaluation

adjustment 1 - (1)

Increase / (decrease) in creditors (288) 271 386

(Increase)/ decrease in debtors (33) (225) (110)

--------- ---------- -------------

Net cash used in operating

activities (984) (470) (486)

--------- ---------- -------------

Cash flows from investing

activities

Payments for deferred exploration

expenditure (919) (632) (2,544)

Payments for tangible fixed

assets (20) (5) (31)

--------- ---------- -------------

Net cash used in investing

activities (939) (637) (2,575)

--------- ---------- -------------

Cash flows from financing

activities

Proceeds from issue of shares

and warrants - 1,287 1,295

Cost of issue - (72) (72)

Proceeds from issue of shares

and warrants - Greenroc - - 5,075

IPO transaction costs - - (800)

Finance expense (1) - (1)

Net cash generated from financing

activities (1) 1,215 5,497

--------- ---------- -------------

Net increase in cash and cash

equivalents (1,924) 108 2,436

Cash and cash equivalents

at beginning of period 3,948 1,512 1,512

--------- ---------- -------------

Cash and cash equivalents

at end of period 2,024 1,620 3,948

--------- ---------- -------------

NOTES TO THE HALF-YEARLY FINANCIAL INFORMATION

1. Basis of preparation

The Group consolidates the financial statements of the Company

and its subsidiary undertakings.

The financial information has been prepared under the historical

cost convention in accordance with International Financial

Reporting Standards ("IFRS"), International Accountant Standards

("IAS") and IFRS Interpretations Committee ("IFRIC")

interpretations as adopted by the European Union. The financial

information set out in this half-yearly report does not constitute

statutory accounts as defined in Section 434 of the Companies Act

2006. The same accounting policies, presentation and methods of

computation are followed in this interim condensed consolidated

report as were applied in the Group's annual financial statements

for the year ended 30 November 2021. The auditor's report on those

financial statements was unqualified and did not contain any

statements under section 498(2) or section 498(3) of the Companies

Act 2006.

2. Taxation

No charge for corporation tax for the period has been made due

to the expected tax losses available.

3. Loss per share

Basic loss per share is calculated by dividing the loss

attributable to ordinary shareholders of GBP591,000 (May 2021: loss

of GBP567,000; November 2021: loss of GBP1,699,000) by the weighted

average number of shares of 6,404,645,919 (May 2021: 6,209,415,290;

November 2021: 6,303,890,811 ) in issue during the period. The

diluted loss per share calculation is identical to that used for

basic loss per share as the exercise of warrants would have the

effect of reducing the loss per ordinary share and therefore is not

dilutive under the terms of Financial Reporting Standard 22

"Earnings Per Share".

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR GIGDIBGXDGDB

(END) Dow Jones Newswires

August 31, 2022 04:06 ET (08:06 GMT)

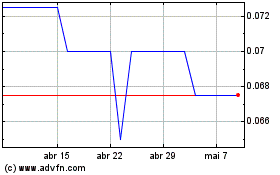

Alba Mineral Resources (LSE:ALBA)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Alba Mineral Resources (LSE:ALBA)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024