TIDMTRT

RNS Number : 7175A

Transense Technologies PLC

27 September 2022

The information communicated within this announcement is deemed

to constitute inside information as stipulated under the Market

Abuse Regulations (EU) No. 596/2014 which is part of UK law by

virtue of the European Union (withdrawal) Act 2018. Upon the

publication of this announcement, this inside information is now

considered to be in the public domain.

27 September 2022

Transense Technologies plc

("Transense" or the "Company")

Final results for the year ended 30 June 2022

& notice of investor presentation

Transense Technologies plc (AIM: TRT), the provider of

specialist sensor systems, reports another year of strong financial

results. The directors are pleased with the solid progress made in

each of the Company's three business segments, and are confident of

expanding on this in the current financial year. Accordingly, they

propose to invest a portion of internally generated cash flow in a

new GBP650,000 share buy-back programme announced today.

Financial highlights:

-- Revenue up 49% to GBP2.63m (FY21: GBP1.77m)

-- iTrack royalty increased 88% to GBP1.56m (FY21: GBP0.83m)

-- Translogik probe revenue up 16% to GBP0.88m (FY21: GBP0.76m)

-- SAW revenue up 11% to GBP0.20m (FY21: GBP0.18m) with

substantially increased customer engagement

-- Profit before taxation of GBP0.27m (FY21: loss of GBP0.16m)

-- Earnings per share up more than fivefold to 5.36 pence (FY21: 0.96 pence)

-- Cash and cash equivalents at year end of GBP1.06m (FY21: GBP1.05m)

-- Completed share buybacks of GBP0.30m (FY21: GBPNil)

-- Distributable reserves at year end of GBP1.20m (FY21: GBP0.63m)

Executive Chairman of Transense, Nigel Rogers, said:

"The annualised rate of iTrack royalty income now exceeds GBP2m,

which more than covers the fixed overhead costs of the Company, and

Translogik probes revenues are approaching GBP1m per annum with

ample scope for further growth. We are now also achieving real

traction with SAW technology across our target industry sectors,

illustrated most recently with the collaboration with Meggitt in

aerospace, supported by a growing pipeline of new potential

customer engagements.

"The directors are confident that the Company's business model

is resilient, that further increases in profitability and cash flow

are deliverable, and that the long term prospects for the Company

continue to build."

Investor Presentation: 4pm today, Tuesday 27 September 2022

Nigel Rogers (Executive Chairman) and Melvyn Segal (Chief

Financial Officer) will provide a presentation to review the

Company's results and prospects at 4pm on Tuesday 27 September

2022. The presentation will be hosted through the online platform

Investor Meet Company.

To attend the presentation, investors can sign up to Investor

Meet Company for free and select to meet Transense Technologies plc

via the following link:

https://www.investormeetcompany.com/transense-technologies-plc/register-investor

. Investors who have already registered and selected to meet the

Company will automatically be invited to the presentation.

Questions can be submitted before the event to

transense@walbrookpr.com or in real time during the presentation

via the "Ask a Question" function.

For further information please visit www.transense.com or

contact:

Transense Technologies plc Tel: Via Walbrook PR

Nigel Rogers (Executive Chairman)

Melvyn Segal (CFO)

Allenby Capital (Nominated Adviser and Tel: +44 (0)20 3328

Broker) 5656

Jeremy Porter/George Payne (Corporate Finance)

Tony Quirke (Sales& Corporate Broking)

Walbrook PR Tel: +44 (0)20 7933

Tom Cooper/Nick Rome 8780

Transense@walbrookpr.com

Notes to Editors:

Transense is a developer of specialist wireless sensor systems

used to enable real-time data gathering and monitoring. Products

include the patent protected Surface Acoustic Wave (SAW) sensor

technology, used to improve equipment power, performance,

reliability and efficiency; iTrack, Transense 's Tyre Pressure

Monitoring System, licensed to Bridgestone Corporation, the world's

largest tyre producer, under a ten-year deal in June 2020; and a

range of intelligent tyre monitoring equipment under the Translogik

brand. Target sectors include aerospace, electric motors &

drives, industrial machinery and performance automotive.

The Company's strategy is to maximise shareholder value through

the delivery of sustained revenue growth from all three principal

technologies - SAW, iTrack and Translogik probes - through

leveraging excellence in innovation, know-how in commercialising

technologies, industry partnerships and exposure to global growth

markets.

Transense is headquartered in Oxfordshire, UK, and was admitted

to trading on AIM, a market operated by the

London Stock Exchange (AIM: TRT), in 1999. www.transense.com

For further information please contact transense@walbrookpr.com .

Chairman's statement for the year ended 30 June 2022

I am pleased to report another year of strong financial results

and good further progress in the development of each of the

company's three business segments. The latest post year end monthly

iTrack royalty income has an annualised rate of in excess of GBP2m,

Translogik probes revenues are approaching GBP1m per annum with

ample scope for further growth, and increased business development

activities for Surface Acoustic Wave (SAW) sensor technology are

building a pipeline of potential customers in our key target market

sectors.

Business strategy

The business strategy of the Company remains to develop

innovative sensing solutions across a range of applications, which

are commercialised either through the launch of products and

services to customers or by forming strategic alliances with

partner organisations. Value is realised through a combination of

commercial income, royalties, licensing income and capital gains on

disposals.

There are currently three business segments comprising royalty

income from iTrack, Translogik tyre monitoring equipment, and the

commercialisation of Surface Acoustic Wave (SAW) sensor

technology.

Progress in the development of each of these segments during the

year, and plans for the future, are set out in the Operating and

Financial Review. The directors set out mid-term strategic goals

for the Company's businesses in June 2020, immediately following

the completion of the iTrack licence with Bridgestone. Since that

time, financial results have been in line with or ahead of

expectations, and the directors continue to be pleased with

progress.

Financial overview

Growth in revenue, profitability and cash generation were each

delivered at rates consistent with those set in the strategic goals

in June 2020. This resulted in net earnings of 5.36 pence per

share; a fivefold increase on the prior year level of 0.96

pence.

Net cash generation (before financing activities) in the year of

GBP0.30m was re-invested in the purchase of Company shares (which

were put into treasury) under the buy-back programme announced in

February 2022. At the end of the financial year, the Company had

net assets of GBP3.09m (FY21: GBP2.34m), reserves stood at

GBP1.50m, of which GBP1.20m are distributable (FY21: GBP0.63m), and

net cash and cash equivalents of GBP1.06m (FY21: GBP1.05m). The

directors are confident of further progress in the upcoming

financial year and propose to continue to re-invest a portion of

internally generated cash flow in a new share buy-back programme of

GBP0.65m announced today.

Corporate Governance, board structure and composition

The directors are committed to the framework and principles of

the QCA Corporate Governance Code ("the Code") and seek to apply

these wherever this is practicable. Full application of the Code,

with the implications that this may have on board and compliance

costs, is counterbalanced by the scale of the Company and the

relatively low risk profile of its operations.

The three directors who have served throughout the year each

have many years' experience as both executive and non-executive

directors of fully listed and AIM-quoted companies, and recognise

the broader needs of shareholders and other stakeholders in all of

their dealings. During the year the Board was further strengthened

by Nick Hopkins joining as Chief Operating Officer and Ryan Maughan

(in a part time capacity) as Business Development Director. At the

time of their appointment in December 2021 it was also announced

that the Board intends to appoint an additional independent

non-executive director, and this process is currently underway.

The directors maintain constructive dialogue with major

shareholders on the development of the business and associated

governance matters and will continue to ensure that any feedback is

addressed promptly and effectively. Furthermore, there are

opportunities for regular engagement with all shareholders with

full details set out on the Company's website.

Share buyback programme

In February 2022, the Company announced the commencement of a

programme to conduct market purchases of ordinary shares of 10

pence each in the Company up to maximum aggregate purchase value of

GBP0.30m. This programme was completed on 26 May 2022 with the

Company having acquired 434,000 ordinary shares for treasury at an

average price of 70 pence each.

During the financial year the share price fluctuated between

58.0 pence and 122.5 pence and averaged approximately 85 pence. The

directors consider that recent weakness in the share price reflects

macro-economic and stock market driven concerns which are unrelated

to the performance and prospects for the business. Accordingly, the

directors continue to view the Company's shares as undervalued and

have today announced a new programme of market purchases on similar

terms to the previous programme but with a maximum aggregate value

of GBP0.65m, of which GBP0.50m is subject to the renewal of

shareholder approval for such market purchases at the upcoming

Annual General Meeting.

Current trading and outlook

In the first two months of trading since the end of the

financial year the total revenues have increased year on year by

19%.

The royalty income stream from iTrack is proving reliable and

continuing to grow strongly with the post year annualised royalty

run rate now comfortably exceeding the fixed overheads of the whole

Company. In addition, our commercial relationships in Translogik

are continuing to strengthen and offer further growth potential as

fleet managers seek to make cost savings. Finally, we are achieving

real traction with SAW technology across a range of high growth

industry sectors, illustrated most recently with the collaboration

with Meggitt in aerospace, which provide a sound basis for optimism

for the future.

Accordingly, the directors are confident that the Company's

business model is sufficiently resilient to withstand the current

challenging global economic outlook and look to the future with

confidence.

Nigel Rogers

Executive Chairman

27 September 2022

Strategic Report

Operating and Financial Review

Results for the year

Revenues for the year increased by nearly 50% to GBP2.63m (FY21:

GBP1.77m), driven primarily by gathering momentum on royalty income

from iTrack. Gross margin improved to 84.9% of revenue (FY21:

78.3%) amounting to GBP2.23m (FY21: GBP1.39m).

Administrative expenses underwent a planned increase to GBP1.97m

(FY21: GBP1.58m), mainly as a result of additional headcount and

travel to support development of the SAW business. The Earnings

before Interest, Taxation, Depreciation and Amortisation adjusted

for the charge for share-based payments was GBP0.62m (FY21:

GBP0.10m), and the net profit before taxation was GBP0.27m (FY21:

net loss of GBP0.16m).

There was a credit for taxation of GBP0.61m (FY21: GBP0.31m)

arising from the increase in the deferred taxation asset relating

to the use of previous years' tax losses in future. As the Board

has growing confidence in the future profitability, the deferred

taxation asset now reflects a forecast period of two years rather

than the use of one year previously. In total, the Company has UK

tax losses available to carry forward at 30 June 2022 in excess of

GBP22m, which are available for offset against future profits

subject to HMRC agreement, of which approximately GBP2.58m is

currently recognised for deferred taxation purposes (FY21:

GBP0.19m).

The resulting net total comprehensive income attributable to

equity shareholders was GBP0.88m (FY21: GBP0.16m) resulting in

earnings per share of 5.36 pence (FY21: 0.96 pence).

Segmental review

iTrack royalty income

Royalty income from iTrack generated income of GBP1.56m during

the year, representing an increase of 88% over the level in the

first year of the licence to 30 June 2021 (FY21: GBP0.83m). By the

end of the year, the installed base had risen to more than 2.75

times that which prevailed at the outset of the licence, and the

annualised royalty run rate had increased to GBP1.88m, compared

with GBP1.12m at 30 June 2021, and GBP0.64m at inception in June

2020.

Royalty income is denominated in United States Dollars (US$).

The rate of exchange changed adversely in the first year of the

licence as Sterling strengthened against the US$, however in the

year to 30 June 2022 this reversed to close in the Company's

favour. During the year the directors implemented a policy of

hedging forward around 80% of estimated future income by up to one

year to take advantage of this opportunity and achieved an average

rate around USD1.20 to GBP1 which compared very favourably with the

opening rate at the time of the deal being USD1.25 and the peak

rate during the financial year being just under USD1.4. However

since securing these rates the directors note that GBP has fallen

by a further 10% against USD.

Bridgestone Corporation, Japan, continues to indicate that

iTrack is a key strategic component of their mobility solutions

business and expresses confidence in the future growth potential

for this technology.

Translogik tyre monitoring

Our range of tyre monitoring equipment marketed under the

Translogik brand generated revenue of GBP0.88m; an increase of

almost 16% over the prior year (FY21: GBP0.76m), and the segmental

result was up by a third to GBP0.36m (FY21: GBP0.27m).

The modular TLGX range is now firmly established and this has

facilitated the decision to phase out the TL-G1 range which is now

well underway. This process has provided many opportunities to

up-sell products with more sophisticated features, which together

with favourable exchange rates increased gross margins in this

segment from 50.4% of revenue in FY21 to 55.7% in FY22.

The Directors believe that working closely with the leading

global tyre manufacturers has resulted in the Translogik probe

becoming a tool of choice to diagnose mandatory commercial vehicle

tyre safety and condition inspection data for their fleet

management systems, and this has substantially increased sales

opportunities. The technology has been shown to deliver reduced

costs and improved collection of data which helps commercial

vehicle fleets comply with safety inspection regulations and manage

the significant costs of their tyres more effectively, again, key

objectives for the future. As market penetration continues to

build, we are also becoming increasingly aware of opportunities for

additional features and enhanced software compatibility to maintain

leadership in this market sector. This process further cements our

relationships with major tyre manufacturers. The business has

continued to expand beyond these important clients, and has new

relationships in the fleet management arena, including software

developers and manufacturers of complementary hardware

products.

Surface Acoustic Wave (SAW)

SAW generated revenue of GBP0.20m (FY21: GBP0.18m) and operating

overheads for the segment increased slightly from GBP0.92m to

GBP1.14m, reflecting increased headcount adding new senior people

to both business and technical development. Revenue was derived

mainly from low volume production of instrumented shafts either for

motorsport or for customer evaluation projects, whilst increased

headcount was required to manage new business opportunities and

technical support which are yet to deliver revenue.

There is a broad range of potential market applications for SAW

technology which have been explored fully, especially over the past

two years with the support of the commercial advisory panel

(SAWCAP). Our market focus for SAW technology has now settled on

four sectors in which there are applications with clear

differentiated benefits.

Target market sectors for SAW technology:

Aerospace

The measurement of torque is common practice in all types of

aerospace engines, and is used to improve safety, pilot control and

engine reliability. Our SAW technology offers advantages in these

applications due to its accuracy over other technologies. Our

sensor system is robust, and compact in size and weight. Its

ability to measure or compensate for temperature fluctuations, and

immunity from background electromagnetic interference, make it the

ideal choice.

The case for using SAW in aerospace applications was proven in

2016 by the specification of SAW sensor technology under licence

from Transense on the GE ITEP programme to re-engine Apache and

Blackhawk helicopters for the US Army. The First Engine to Test

under this programme was built successfully earlier this year, and

low volume production is planned to commence in 2024/25.

In May 2022, an amending agreement was signed between Transense

and GE Aviation to extend the scope of the field of use of their

licence to encompass work for the Hybrid Electric Altitude Testbed

flight demonstrator (HEAT) Programme. This programme covers the

build of a SAW torque measurement system for evaluation in both

test laboratory and flight test conditions. Although there is no

current intention for this programme to directly enter commercial

production, Transense is involved in the development phase over the

period to 2024 to provide technical know-how, limited supply of

critical components and the provision of calibration services at

agreed commercial rates.

More recently, in September 2022, the Company entered into an

important collaboration with Meggitt SA, the leading designer and

manufacturer of complete condition monitoring, vibration monitoring

and measurement solutions for the aerospace and energy markets.

Under a new Memorandum of Understanding, the Company will support

Meggitt's evaluation of potential future market opportunities in

the aerospace sector. Meggitt has indicated that our SAW technology

has the potential to become a great addition to its Engine Sensing

portfolio as part of its strategy to support global engine OEM

customers. There is a shared aim to enter into a licensing

agreement prior to 31 December 2023 covering one or more fields of

use in aerospace.

Electric Motors and Drives (EMD)

As the market for electrified vehicle powertrain develops

rapidly, the quest to deliver improved efficiency and performance

in electric drive systems is paramount. Maximising vehicle range

for a given battery capacity is a key target of every powertrain

development programme, alongside maintaining and improving the

safety integrity of the powertrain system.

The present state of the art is to use advanced torque

estimation techniques based on electrical current and rotational

speed measurements. Accurate torque measurement is desirable but

has not been possible using competing torque measurement systems.

Using SAW sensors eliminates the need for estimation and gives

reliable torque and temperature measurement from the motor rotor

that can be used to improve both motor efficiency and safety.

In May 2022, the Company secured a place on the Advanced

Propulsion Centre (APC) Technology Developer Accelerator Programme

(TDAP) in a competitive process. Alongside grant funding of up to

GBP0.13m, this programme provides access to advice and support from

the APC and their delivery partners focusing on product

development, market strategy, intellectual property management and

networking. The initial phase of this work is underway and it will

progress through the current financial year. Grant income of

GBP0.02m was recognised in the year ended 30 June 2022, and the

remaining available funding is expected to be realised in the year

to 30 June 2023 and 2024.

EMD also has links into the other sectors with increasing

electrification in aerospace and industrial machinery.

Industrial Machinery (including Off-Highway Vehicles, Heavy

Industrial Engines and Robotics)

Industrial Machinery provides the backbone of many sectors, from

mining and construction to agriculture, materials handling and

logistics. Industrial machines are becoming increasingly complex

with more features and controls and are being developed to do more

work for a given amount of power. There is also a clear drive to

partly or fully automate machinery and deploy more robotics in

industry.

The propulsion systems in off-highway vehicles and other

machines transmit drive forces through a rotating shaft to drive

the wheels or other systems such as hydraulic pumps and gas

turbines. The demanding nature of these heavy-duty applications

means that implementing traditional torque sensor technology is

difficult and it is more common to rely on shaft speed data as an

alternative.

The use of SAW sensing of torque and/or temperature can improve

accuracy, efficiency and power distribution, all of which can also

contribute to the ability to operate such machines remotely or on a

fully autonomous basis. Transense SAW sensor technology is under

ongoing trial by a major producer of agricultural machinery. The

project is progressing on schedule and is expected to strengthen

the business case for the use of SAW in this sector.

The global market for industrial robotics is expanding rapidly

and is accelerated by the advent of lower cost collaborative robots

that are easier and less costly to deploy. These robots have a

position and torque sensing system embedded into every joint to

allow automated control and safe operation, which are generally

reliant on strain gauge or displacement sensors. Whilst these

sensors are low cost and suitable for simple applications, they

lack the robustness required in some harsh environments and can be

susceptible to electromagnetic interference. Furthermore, each of

these existing technologies requires an element of twist or flex in

the robot's joints, which means that the robotic arm will flex in

operation, limiting performance and repeatability, yet increasing

safety and reliability.

Transense SAW sensor technology can provide an improved way to

measure torque, rotation and temperature in a robotic system,

virtually eliminating flex and creating high performing and more

repeatable robots with more compact joints than has been possible

previously.

Motorsport and high-performance vehicles

Transense SAW technology has been in use for several years in

premium motor sport driveline applications to measure delivered

torque in race vehicle drivetrain for monitoring and regulatory

compliance purposes. In September 2021, the Company entered into a

five-year Joint Collaborative Agreement (JCA) with McLaren Applied

Ltd to further develop non-contact torque products for this sector.

Under the JCA. McLaren has exclusive access to the technology for

the premium motor sport market in exchange for meeting minimum

target revenues on an annual basis over five years. Progress under

the JCA has been in line with our initial expectations and a number

of new customer opportunities are in development.

The motorsport market offers limited scale as a consequence of

the relatively low number of vehicles in operation but is a proving

ground for new automotive technology which may subsequently be

adopted in mainstream vehicles. There is strong overlap with EMD as

high volume performance vehicles are increasingly being developed

using electric drivetrain.

Business development activities

In view of the positive indications for the development of

applications in which SAW offers benefits over other methods of

torque measurement, and with clear target market sectors in view,

it became appropriate during the year to inject additional business

development resource. Ryan Maughan joined the Board in a part-time

role as Business Development Director in December 2021, and his

involvement has generated a growing pipeline of potential customer

engagements which can be summarised as follows:

Number of potential customers by sector as at 26 September 2022

(July 2021)

Electric Industrial Performance

Aerospace Motors & Machinery Automotive Total

Drives

Stage 4 - Contracted 1 (1) 0 (0) 0 (0) 1 (1) 2 (2)

------------ ---------- ----------- ------------ --------

Stage 3 - Contract

under negotiation 1 (0) 0 (0) 0 (0) 0 (0) 1 (0)

------------ ---------- ----------- ------------ --------

Stage 2 - In development 1 (0) 1 (0) 1 (1) 0 (1) 3 (2)

------------ ---------- ----------- ------------ --------

Stage 1 - Active enquiry 4 (3) 10 (0) 4 (0) 0 (0) 18 (3)

------------ ---------- ----------- ------------ --------

Total 7 (4) 11 (0) 5 (1) 1 (2) 24 (7)

------------ ---------- ----------- ------------ --------

There is now a healthy and growing pipeline of active customer

engagement, where the minimum requirements for an enquiry to be

considered active are met. These include pre-qualification that the

project is technically feasible, and is known to be supported by

decision makers and budget holders in the customer

organisation.

There will normally be a significant time lag in progressing

enquiries from stage 1 to stage 4, and much more work to be done.

It is also more than likely that timescales can be extended, and

that some will not mature into revenue. Nevertheless, the progress

made in recent months provides indication of future growth

potential, and a number of projects are close to moving from

enquiry stage to some form of paid engineering project, which will

increase the revenue of this segment with no significant additional

costs.

Operations and engineering activities

Nick Hopkins, who joined the Company to lead the SAW business

during the reorganisation phase in 2020, became Chief Operating

Officer and joined the Board in December 2021.

In parallel with the opening up of new commercial opportunities,

resources have been applied in developing the technical and

operational capabilities that will be required to satisfy

increasing customer demand for chargeable development projects,

leading into engineering support for transfer of SAW into

production.

Unlike some alternative torque and temperature sensing devices,

SAW components require a degree of customisation in order to unlock

their unique benefits specific to each application and are

therefore not sold "out of the box". This calls for detailed

application engineering, covering for example the methods for

bonding components to OEM equipment, and calibrating the output

signal for accuracy and repeatability across the temperature

cycle.

To advance our knowledge and experience in these areas, Andy

Bullock joined the Company in July 2022 in the newly created role

of Technical Director. He brought a proven record of leading the

design and development of complex electronic solutions and

associated manufacturing processes. The primary focus is to build

the engineering capability of the business to meet customer demand

for practical support in application of SAW technology, both

in-house for proto-typing, development and pilot production, and

through the provision of technology transfer to potential

licencees.

Working in partnership

It has been an important feature of the Company's business model

to work closely with some of the world's largest and most respected

companies in collaborative partnerships to facilitate market access

that would otherwise challenge the financial resources of a

specialist innovator. This has led to the successful licensing of

SAW technology to GE and Emerson, and the iTrack licence granted to

Bridgestone in 2020.

This approach is maintained in our recent announcement of the

new collaboration with Meggitt in the aerospace sector. The

directors consider that working alongside a company of Meggitt's

stature will expand our capacity to develop customers in this

rapidly changing sector and will continue to support this

partnership approach in other segments where suitable opportunities

arise to increase access to markets, customers, supply chain and/or

engineering and production capabilities.

Prospects for SAW

Taken as a whole, there has been much progress during the year

and clear signs of traction across high value growth markets. The

level and quality of customer engagement has increased

substantially, and the engineering tasks required to enable

customers to apply our technology in a more accessible manner are

underway.

It will remain a time consuming process to convert qualified

enquiries into development projects, and transition these through

to full production, and doubtless not all will mature. The

directors consider, however, that the prospects of future

commercial success for SAW are building .

Financial position and cash flow

The Company's financial position strengthened further during the

year with net assets increasing to GBP3.09m (FY21: GBP2.34m) as a

result of the retention of net profits after taxation. Net

available cash balances amounted to GBP1.06m (FY21: GBP1.05m), and

the final quarter royalty income on iTrack receivable on 31 July

2022 stood at GBP0.47m (FY21: 0.26m).

Net cash generated from operations amounted to GBP0.41m (FY21:

net cash used of GBP0.25m). This was re-invested in capital

expenditure of GBP0.10m (FY21: GBP0.05m) and in the share buy-back

programme during the final quarter of the year totaling GBP0.30m,

leaving net cash balances unchanged over the year.

The directors anticipate that the Company will continue to be

cash generative for the foreseeable future and will accumulate

further cash balances well in excess of the buy-back programme

currently proposed.

Going concern

The Company meets its day to day working capital requirements

through existing cash reserves and does not currently require an

overdraft or other borrowing facility. The directors have prepared

cash flow forecasts for the period to 30 June 2024 which indicate

that there is a reasonable expectation that the Company will

continue to operate within current and future cash resources

throughout this period Accordingly, these financial statements have

been prepared on the going concern basis.

Nigel Rogers Melvyn Segal

Executive Chairman Chief Financial Officer

27 September 2022 27 September 2022

Consolidated Statement of Comprehensive Income

For the year ended 30 June 202

Year ended Year ended

30 June 30 June

2022 2021

GBP'000 GBP'000

Continuing

operations

Revenue 2,632 1,773

Cost of sales (398) (385)

---------------------------------------------- ----------------------------------------------

Gross profit 2,234 1,388

Administrative

expenses (1,970) (1,581)

---------------------------------------------- ----------------------------------------------

Operating loss 264 (193)

Financial expense (12) (12)

Other income 16 48

---------------------------------------------- ----------------------------------------------

Profit/(Loss)

before taxation 268 (157)

Taxation 609 313

---------------------------------------------- ----------------------------------------------

Profit and total

comprehensive

income

for the year

attributable 877 156

To the equity

holders of the

parent ---------------------------------------------- ----------------------------------------------

Basic profit per

share for the

year

(pence) 5.36 0.96

============================================== ==============================================

Diluted profir

per share for

the

year (pence) 5.22 0.96

============================================== ==============================================

Consolidated Balance Sheet

At 30 June 2022

At 30 June At 30 June

2022 2022 2021 2021

GBP'000 GBP'000 GBP'000 GBP'000

Non current assets

Property, plant and

equipment 167 211

Intangible assets 671 770

Deferred tax 645 47

---------------------------------------------- ----------------------------------------------

1,483 1,028

Current assets

Inventories 88 73

Corporation tax - 60

Trade and other

receivables 1,133 564

Cash and cash

equivalents 1,055 1,046

---------------------------------------------- ----------------------------------------------

2,276 1,743

---------------------------------------------- ----------------------------------------------

Total assets 3,759 2,771

Current liabilities

Trade and other

payables (560) (260)

Lease liabilities (65) (65)

---------------------------------------------- ----------------------------------------------

(625) (325)

Non current liabilities

Lease liabilities (42) (104)

---------------------------------------------- ----------------------------------------------

Total liabilities (667) (429)

---------------------------------------------- ----------------------------------------------

Net assets 3,092 2,342

============================================== ==============================================

Equity

Issued share capital 1,644 1,631

Share premium 65 -

Treasury Shares (303)

Share based payments 180 82

Retained

earnings/(accumulated

loss) 1,506 629

---------------------------------------------- ----------------------------------------------

Total equity 3,092 2,342

============================================== ==============================================

Consolidated Statement of Changes in Equity

For the year ended 30 June 2022

Share Share Share Retained Treasury Total

capital premium based earnings Shares Equity

payments

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 July

2020 5,451 2,591 41 (5,900) - 2,183

Comprehensive

income for

the year:

Profit for the

year - - - 156 - 156

Share based

payment - - 41 - - 41

Share capital

reduction (3,820) (2,591) - 6,411 - -

Expenses of

capital

reduction - - - (38) - (38)

------------------------------------------ ---------------------------------------------- ---------------------------------------------- ---------------------------------------------- ---------------------------------------------- ----------------------------------------------

Balance at 30

June 2021 1,631 - 82 629 - 2,342

------------------------------------------ ---------------------------------------------- ---------------------------------------------- ---------------------------------------------- ---------------------------------------------- ----------------------------------------------

Comprehensive

income for

the year:

Profit for the

year - - - 877 - 877

Share based

payment - - 98 - - 98

Warrants

exercised 13 65 - - - 78

Treasury shares - - - - (303) (303)

------------------------------------------ ---------------------------------------------- ---------------------------------------------- ---------------------------------------------- ---------------------------------------------- ----------------------------------------------

Balance at 30

June 2022 1,644 65 180 1,506 (303) 3,092

========================================= ============================================== ============================================== ============================================== ============================================== ==============================================

Consolidated Cash Flow Statement

For the year ended 30 June 2022

Year ended Year ended

30 June 30 June

2022 2021

GBP'000 GBP'000

Profit/(loss) from

operations 877 156

Adjustments for:

Taxation (609) (313)

Net financial expense 12 12

Share based payment 98 41

Depreciation 88 85

Amortisation and

impairment of

intangible

assets 155 121

---------------------------------------------- ----------------------------------------------

Operating cash flows

before movements

in working capital 621 102

(Iincrease) in

receivables (569) (124)

Increase/(Decrease) in

payables 300 (594)

(Increase) in

inventories (15) (10)

---------------------------------------------- ----------------------------------------------

Cash generated/(used)

in operations 337 (626)

Taxation received 71 381

---------------------------------------------- ----------------------------------------------

Net cash

generated/(used) in

operations 408 (245)

---------------------------------------------- ----------------------------------------------

Investing activities

Acquisitions of

property, plant and

equipment (44) (6)

Acquisitions of

intangible assets (56) (47)

Proceeds from disposal

of trade and

assets - 1,237

---------------------------------------------- ----------------------------------------------

Net cash (used

in)/generated from

investing

activities (100) 1,184

---------------------------------------------- ----------------------------------------------

Financing activities

Capital reduction

expenses - (38)

Treasury shares (303) -

Warrants exercised 78 -

Loans repaid - (976)

Interest paid (12) (12)

Payment of lease

liabilities (62) (60)

---------------------------------------------- ----------------------------------------------

Net cash used in

financing activities (299) (1,086)

---------------------------------------------- ----------------------------------------------

Net

increase/(decrease)in

cash and

cash equivalents 9 (147)

Cash and equivalents at

the beginning

of year 1,046 1,193

---------------------------------------------- ----------------------------------------------

Cash and equivalents at

the end of

year 1,055 1,046

============================================== ==============================================

NOTES RELATING TO THE COMPANY FINANCIAL STATEMENTS

BASIS OF PREPARATION

Both the Parent Company financial statements and the Company

financial statements have been prepared and approved by the

Directors in accordance with International Financial Reporting

Standards as adopted by the United Kingdom ("Adopted IFRSs") and

those parts of the Companies Act 2006 that are relevant to

companies preparing accounts under IFRS. On publishing the Parent

Company financial statements here together with the Company

financial statements, the Company is taking advantage of the

exemption in s408 of the Companies Act 2006 not to present its

individual statement of comprehensive income and related notes that

form a part of these approved financial statements.

1 SEGMENT INFORMATION

The Company had three reportable segments being the unique

trading divisions, SAW and Translogik, which make use of technology

developed by the Company to measure and record temperature,

pressure and torque, and the iTrack royalty activity in respect of

income from licensed technology.

Revenue and EBITDA are the Company's key focus and in turn is

the main performance measure adopted by management.

The tables below set out the Company's revenue split and

operating segments. These disclose information for continuing

operations and in view of their relative size, information for

discontinued operations. The disposal of iTrack operations will

result in future royalty income replacing direct sales income and

costs.

Revenue

Year ended Year ended

30 June 30 June

2022 2021

Continuing Continuing

GBP'000 GBP'000

North America 323 244

South America 123 83

Australia 41 28

Europe 387 228

UK 92 90

Rest of the World 109 268

---------------------------------------------- ----------------------------------------------

1,075 941

============================================= =============================================

iTrack Royalty 1,557 832

Note: comparatives are restated as they were shown incorrectly

last year.

Segments

Translogik SAW iTrack Unallocated Total

GBP'000 GBP'000 royalties GBP'000 GBP'000

GBP'000

Year ended 30

June

2022

Sales 875 200 1,557 - 2,632

===================== ===================== ===================== ===================== ====================

Gross profit 484 193 1,557 - 2,234

Overheads (126) (1,142) (44) (658) (1,970)

------------------------------ ------------------------------ ----------------------------- ------------------------------ -----------------------------

Operating

profit/(loss) 358 (949) 1,513 (658) 264

Other income - 16 - - 16

Net financial

expense - (12) - - (12)

Taxation - - - 609 609

------------------------------- ------------------------------- ------------------------------- ------------------------------- -------------------------------

Profit/(loss)

for the

year 358 (945) 1,513 (49) 877

========== =========== =========== =========== ===========

EBITDA

reconciliation

Operating loss 264

Other income 16

Depreciation

and

amortisation 243

------------------

EBITDA 523

===========

Note: Adjusted EBITDA (excluding share based payments) 621

Translogik SAW iTrack Unallocated Total

GBP'000 GBP'000 royalties GBP'000 GBP'000

GBP'000

Year ended 30

June

2021

Sales 764 177 832 - 1,773

===================== ===================== ===================== ===================== ====================

Gross profit 385 171 832 - 1,388

Overheads (114) (917) (47) (503) (1,581)

------------------------------ ------------------------------ ----------------------------- ------------------------------ -----------------------------

Operating

profit/(loss) 271 (746) 785 (503) (193)

Other income - 48 - - 48

Net financial

expense - - - (12) (12)

Taxation - 164 102 - 266

Deferred Tax - - - 47 47

------------------------------- ------------------------------- ------------------------------- ------------------------------- -------------------------------

Profit/(loss)

for

the year 271 (534) 887 (468) 156

===================== ===================== ===================== ===================== ====================

During the year ended 30 June 2022 there were 2 customers (2021:

2) whose turnover accounted for more than 10% of the Company's

total continuing revenue as follows:

Year ended 30 June 2022 Revenue Percentage

GBP'000 of total

Customer A 1,557 59

Customer B 339 13

Year ended 30 June 2021 Revenue Percentage

GBP000 of total

Customer A 915 52

Customer B 200 11

2 TAXATION

Recognised in the statement of comprehensive income in respect

of continuing operations

Year ended Year ended

30 June 30 June

2022 2021

GBP'000 GBP'000

Current tax

credit

Current year - (60)

Adjustment for

previous year (11) (206)

Deferred tax

credit

Current year (598) (47)

---------------------------------------------- ----------------------------------------------

Tax credit in

Statement of

Comprehensive

Income (609) (313)

============================================= =============================================

Reconciliation of effective tax rate

Year ended Year ended

30 June 30 June

2021 2021

GBP'000 GBP'000

Profit/(loss)

before tax 268 (157)

============================================= =============================================

Tax calculated at

the average

standard UK

corporation

tax rate of 19.00%

(2021: 19:00%) 51 (30)

Expenses not

deductible for tax

purposes 19 8

Additional

deduction for R&D

expenditure - (38)

Utilisation of

losses brought

forward for which

no deferred tax

asset was

recognised (23) -

Recognition of

deferred tax in

respect of prior

year losses (645) (47)

Prior year

adjustment (11) (206)

---------------------------------------------- ----------------------------------------------

Total tax credit (609) (313)

============================================= =============================================

Corporation tax

receivable - 60

Deferred tax assets

are

Recognised - in

respect of tax

losses 645 47

Unrecognised - in

respect of tax

losses and

other timing

differences 4,900 5,670

============================================= =============================================

The applicable UK corporation tax rate is 19% throughout the

reporting period. The Group has tax losses, subject to agreement by

HM Revenue and Customs, in the sum of GBP 22.8m (2021: GBP23.1m),

which are available for offset against future profits of the same

trade. There is no expiry date for tax losses. An appropriate

deferred tax asset is being recognised as the Group is able to

demonstrate a reasonable expectation of sufficient future taxable

profits arising in order to utilise the losses.

The Finance Act 2020 maintained the rate of UK Corporation Tax

at 19% and in May 2021 the Finance Act 2021 was substantively

enacted with a rate of 25% to apply from April 2023. Recognised and

unrecognised deferred tax balances at 30 June 2022 have been

calculated using a rate of 19% for reversals expected in the period

to April 2023 and 25% for reversals after that date (2021: 25%) as

this was the substantively enacted rate at the year end date. The

recent budget on 23 September 2022, the Chancellor of the Exchequer

announced that the corporation tax rate would not increase to a

maximum of 25% however this has not been enacted as at year end nor

at the time of signing the financial statements.

3 EARNINGS PER SHARE

Year ended Year ended

30 June 30 June

2022 2021

Number Number

Weighted average number of shares - basic 16,365,640 16,307,282

Share option adjustment for potentially dilutive

shares 431,808 30,206

------------------------------ ------------------------------

Weighted average number of shares - diluted 16,797,448 16,337,488

====================== ======================

Basic profit per share is calculated by dividing the profit by

the weighted average number of ordinary shares in issue during the

year of 16,365,640 (2021: 16,307,282). This excludes treasury

shares held by the Company.

Year ended Year ended

30 June 30 June

2022 2021

GBP'000 GBP'000

Proft/(loss) 877 156

------------------------------ ------------------------------

Basic profitper share 5.36 0.96

Diluted profit per share 5.22 0.96

There are 1,594,500 share options and no warrants in place at 30

June 2022 (1,435,085 share options and 130,458 warrants at 30 June

2021).

4 STATUTORY ACCOUNTS

The Financial information set out in this announcement does not

constitute the Company's Consolidated Financial Statements for the

financial years ended 30 June 2022 or 30 June 2021 but are derived

from those Financial Statements. Statutory Financial Statements for

2021 have been delivered to the Registrar of Companies and those

for 2022 will be delivered following the Company's AGM. The

auditors Cooper Parry Group Limited have reported on the 2021 and

2022 financial statements. Their reports were unqualified, did not

draw attention to any matters by way of emphasis without qualifying

their report and did not contain statements under Section 498(2) or

(3) of the Companies Act 2006 in respect of the Financial

Statements for 2020or 2019.

The Statutory accounts are available on the Company's website

and will be posted to shareholders who have requested a copy and

thereafter by request to the Company's registered office.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR FQLLLLKLLBBD

(END) Dow Jones Newswires

September 27, 2022 02:02 ET (06:02 GMT)

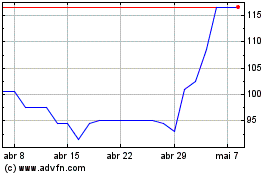

Transense Technologies (LSE:TRT)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Transense Technologies (LSE:TRT)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024