Pensana Plc US$4M Equity Placement to M & G Investment Management

21 Dezembro 2022 - 4:00AM

UK Regulatory

TIDMPRE

21 December 2022

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION

Pensana Plc

("Pensana" or the "Company")

US$4 Million Equity Placement to M & G Investment Management

Pensana announces that M&G Investment Management ("M&G"), one of the UK's

largest fund managers and a long standing Pensana shareholder, has agreed to

invest US$4 million (£3.19 million) in the Company by way of a placement of

7,250,000 new ordinary shares of £0.001 each in the capital of Pensana

("Ordinary Shares") (the "Placing Shares") at a price of 44 pence per share

(the "Placing Price"). Following admission of the Placing Shares to trading M&G

will have an interest in approximately 7.7% of the Company's enlarged issued

share capital.

Pensana Chairman, Paul Atherley noted:

"We very much appreciate M&G's continuing support as a major shareholder over

the past 12 months. Initial site works are underway at Saltend and Longonjo,

and this additional investment will take us through to main financing and the

commencement of main construction at both projects during Q1 of 2023. We look

forward to delivering on the strong support from major shareholders and

developing an independent and sustainable rare earth supply chain based in the

UK to meet the burgeoning demand from automotive and wind turbine OEMs."

Application has been made for the Placing Shares to be admitted to the Official

List (Standard Listing Segment) and to trading on the London Stock Exchange's

Main Market for listed securities. Admission is expected to occur on or about

8.00 a.m. on Thursday 5 January 2023 ("Admission"). The Placing Shares will

rank pari passu in all respects with each other and with the existing Ordinary

Shares, including, without limitation, the right to receive all dividends and

other distributions declared, made or paid after the date of issue.

Following Admission, the Company's issued share capital will consist of

255,180,873 Ordinary Shares. No shares are held in treasury and, therefore, the

total number of voting rights of the Company on Admission will be 255,180,873.

This figure may be used by shareholders as the denominator for the calculations

by which they will determine if they are required to notify their interest in,

or a change in their interest in, the Company under the Financial Conduct

Authority's Disclosure Guidance and Transparency Rules.

The information contained within this announcement is considered by the Company

to constitute inside information as stipulated under the Market Abuse

Regulations (EU) No.596/2014. Upon the publication of this announcement via a

Regulatory Information Service, this inside information will be considered to

be in the public domain. The person responsible for arranging for the release

of this announcement on behalf of the Company is Paul Atherley (Chairman).

- ENDS -

For further information, please contact:

Shareholder/analyst enquiries:

Pensana Plc

Paul Atherley,

Chairman

IR@pensana.co.uk

Tim George, Chief Executive Officer

Rob Kaplan, Chief Financial Officer

George Zacharias, Group Company Secretary

Media enquiries:

FGS Global:

Gordon Simpson / Richard Crowley

Pensana-LON@fgsglobal.com

About Pensana Plc

The electrification of motive power is the most important part of the energy

transition if we are to tackle climate change and one of the biggest energy

transitions in history. Magnet metal rare earths are central to that

transition, forming a critical part of the technology for efficient electric

vehicle motors and offshore wind turbines.

Pensana plans to establish its Saltend processing hub as an independent and

sustainable supplier of the key rare earth magnet metal oxides to a market

which is currently dominated by China.

The US$195 million Saltend facility is being designed to produce circa 12,500

tonnes per annum of rare earth products, of which 4,500 tonnes will be

neodymium and praseodymium oxide (NdPrO), representing over 5% of the world

market in 2025.

Pensana's plug-and-play facility is located within the world-class Saltend

Chemicals Park, a cluster of leading chemicals and renewable energy businesses

in the Humber Freeport and will create over 500 jobs during construction and

over 125 direct jobs once in production.

Powered by low-carbon offshore wind, it will be the first major separation

facility to be established in over a decade and will become one of the few

major producers located outside China.

Feedstock will be shipped as a clean, high purity mixed rare earth sulphate

(MRES) from the Company's Longonjo low-impact operations in Angola. The mine's

state-of-the-art concentrator and proprietary MRES processing plant are

designed by Wood to the highest international standards.

The operations will be powered by renewable energy from hydroelectric power and

connected to the Port of Lobito by the recently upgraded Benguela railway line.

Pensana believes that provenance of critical rare earth materials supply, life

cycle analysis and GHG Scope 1, 2 and 3 emissions will all become significant

factors in supply chains for major customers.

The Company intends to offer customers an independently and sustainably sourced

supply of the metal oxides and carbonates of increasing importance to a range

of applications central to addressing the energy transition.

Pensana is also aiming to establish Saltend as an attractive alternative to

mining houses that may otherwise be limited to selling their products to China,

having designed the facility to be easily adapted to cater for a range of rare

earth feedstocks.

www.pensana.co.uk

END

(END) Dow Jones Newswires

December 21, 2022 02:00 ET (07:00 GMT)

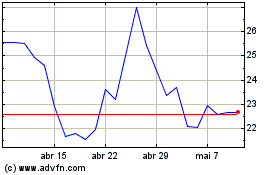

Pensana (LSE:PRE)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

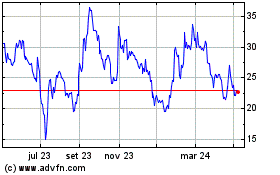

Pensana (LSE:PRE)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024