TIDMYU.

RNS Number : 6034N

Yu Group PLC

24 January 2023

Prior to publication the information communicated in this

announcement was deemed by the Company to constitute inside

information for the purposes of article 7 of the Market Abuse

Regulations (EU) No 596/2014 as amended by regulation 11 of the

Market Abuse (Amendment) (EU Exit) Regulations No 2019/310 ('MAR').

With the publication of this announcement, this information is now

considered to be in the public domain.

24 January 2023

Yü Group PLC

("Yü Group" or the "Group")

Trading Update

Continued strong momentum

Record-breaking financial performance achieved in FY22 that

surpasses market expectations

"I'm thrilled to report a fantastic, record-breaking performance

for FY22. While the Board modelled a strong outcome for FY22 we may

have underestimated the accelerated contribution our strengthened

business would have on the Group's FY financial metrics. Record

breaking organic revenues, profitability and forward contracted

revenues have all exceeded management expectations. We are now in

the fast lane of growth and expect to exceed current guidance that

had already been upgraded in March, July, September and November

2022.

Our balance sheet is very strong, with excellent cash conversion

and I'm very pleased to report a fourth consecutive year of EBITDA

improvement. Cash has also far exceeded management expectations,

more than doubling from FY21. Net customer contribution (being

gross margin less bad debt) is being managed as we grow. Adjusted

EBITDA margin has also dwarfed the 2.1% achieved in H122 (FY21:

1.1%) and as such we have clear visibility of our stated GBP500m

revenue at 4%+ target.

As a consequence of our strong cash generation, management

intends to make a modest shareholder distribution in respect of the

financial performance achieved in FY22, details of which will be

announced alongside publication of the Company's audited results

for FY22. In considering the level of dividend management will

ensure it does not constrain or hinder our growth ambitions or

abilities to take advantage of corporate and other growth

opportunities as they arise.

The impact of our "digital by default" transformation has

exceeded management expectations in terms of its contribution to

margin and efficiency. Our single platform seamless onboarding has

created operational leverage alongside opening up additional

profitable sales streams. The full impact will become materially

beneficial in 2023 and beyond.

I'm pleased to welcome the Yü Smart team to our family, after

completing the purchase from Magnum Utilities in May 2022 using

cash from our balance sheet. The management have worked hard to

achieve, from a standing start, full industry accreditation and the

necessary licences to install and maintain metering infrastructure.

Yü Smart installed its first SMETs meter in August 2022 and by year

end was achieving hundreds of installs a month. As Yü Smart gains

national coverage and full operational scale in 2023 it will

complement our retail business in contributing significant Group

profitability.

As always delivering such positive results takes a huge team

effort and I would like to thank all of my team for trusting the

Board and believing management's vision. The hard yards continue to

bear fruit."

Financial & Operational Highlights

-- Very strong operating cash performance with net cash of

GBP18.8m as at 31 December 2022, an increase of GBP12.0m in the

year (FY21: GBP6.8m).

-- Extremely strong organic growth with full year revenue to

exceed GBP275m (FY21: GBP155m) an increase of over 76% on FY21.

-- Adjusted EBITDA margin for the year expected to be

significantly ahead of current market expectations.

-- Record breaking annualised contracts signed up in year has

delivered average monthly bookings of GBP24.5m (FY21: GBP13.8m), an

increase of 78% in the year. Particularly strong performance in Q4

2022 with average monthly bookings of GBP48.6m.

-- Commercially leveraging a reduction in meter points in favour

of better value, better credit higher consumption meters has seen

profitable volume growth.

-- Continued strong customer service performance, delivered

through an improved digital customer journey.

-- Hedging strategy has continued to protect the Group from energy market volatility.

-- Government's Energy Bill Relief Scheme providing significant

support to customers over Winter. Recent softening of forward

commodity markets provides some relief for customers, enabling the

Group to lock in new contracts, improving visibility for FY23 and

beyond.

-- National coverage of our smart metering installation

services, Y Smart, now fully operational and expected to scale

profitably in 2023.

Outlook

-- High organic growth expected to continue in to FY23 and over the medium term.

o Very strong forward revenue visibility, exiting 2022 with

GBP246.8m of contracted revenue for FY23, up 57% on prior year

(FY21: GBP156.5m for FY22).

o Further revenue expected as the company continues to sell

contracts that will commence during FY23:

-- Management target annualised monthly bookings to continue the

positive momentum from FY22

-- Variable and out of contract revenue customers expected to

provide further revenue enhancement

-- Continued improvement expected in EBITDA profitability for

FY23 and beyond, as benefits are realised from our investments in Y

Smart and digital by default.

-- The Board will, on release of the Company's FY22 results,

provide further guidance on the Company's ongoing capital

allocation policy given the Company's strong cash generation and

growth prospects.

o The Board currently intend to declare a modest dividend with

the view to adopting a progressive dividend policy thereafter,

whilst ensuring the Company's growth prospects are not

constrained.

o The Group is currently debt free but will examine the use of

leverage to support the growth of our meter asset business which

will serve as an annuity revenue stream.

Yü Group PLC

Bobby Kalar

Paul Rawson +44 (0) 115 975 8258

Liberum - Nominated Adviser

and Broker

Edward Mansfield

William Hall

Cara Murphy +44 (0) 20 3100 2000

--------------------

Tulchan Group

Giles Kernick

Olivia Peters +44 (0) 20 7353 4200

--------------------

Notes to Editors

Information on the Group

Yü Group PLC, trading as Yü Energy, is a leading supplier of gas

and electricity focused on servicing the corporate sector

throughout the UK. We drive innovation through a combination of

user-friendly digital solutions and personalised, high quality

customer service. The Group plays a key role supporting businesses

in their transition to lower carbon technologies with a commitment

to providing sustainable energy solutions.

Yü Group has a clear strategy to deliver sustainable profitable

growth and value for all of our stakeholders built on strong

foundations and with a robust hedging policy. In 2022 the Group

launched Yü Smart to support growth through new opportunities in

smart metering and EV charge installation. With a significant

opportunity in a GBP50bn addressable market Yü Group continues to

deliver on the medium-term goal of GBP500m of revenues with an

adjusted EBITDA margin in excess of 4%.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTBRGDBDDDDGXX

(END) Dow Jones Newswires

January 24, 2023 02:00 ET (07:00 GMT)

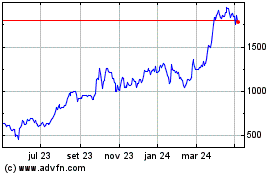

Yu (LSE:YU.)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

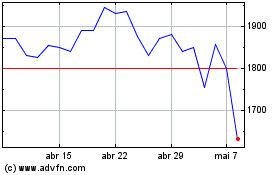

Yu (LSE:YU.)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024