TIDMMDZ

FINANCIAL RESULTS FOR THE YEARED 30 SEPTEMBER 2022

MEDIAZEST PLC

1 March 2023

This announcement contains inside information for the purposes of Article 7 of

the Market Abuse Regulation (EU) 596/2014 as it forms part of UK domestic law

by virtue of the European Union (Withdrawal) Act 2018 ("MAR"), and is disclosed

in accordance with the Company's obligations under Article 17 of MAR.

MediaZest PLC

("MediaZest", the "Company" or the "Group"; AIM: MDZ)

Final Results for the Year ended 30 September 2022

MediaZest, the creative audio-visual company, is pleased to provide

shareholders with final results for the year ended 30 September 2022.

Highlights:

£'000 FY22 FY21 Change

Revenue 2,820 2,246 +26%

Gross Profit 1,499 1,075 +39%

Gross Margin 53.2% 47.9% +5.3%

EBITDA 220 78 +184%

Profit after tax 12 (140) £152k

Earnings/(Loss) 0.0009 (0.0101) 0.011

per ordinary 0.1p

share (pence per

share)

* Strong top line performance with a year-on-year revenue growth at +26%

* Gross margins up 39% to £1,499k, margin percentage strengthens to 53.2%

* EBITDA of £220k an increase of 184% year on year

* Recovering well post Covid-19 Pandemic

* Strengthening relations with long term clients, Pets at Home, Hyundai,

Lululemon & HMV

* Multiple new business wins outside of the UK, with subsidiary established

in the Netherlands post year end

Chairman's Statement

for the Year Ended 30 September 2022

Introduction

The Board presents the consolidated audited results for the year ended 30

September 2022 for MediaZest plc ("MDZ" or the 'Company') and its wholly owned

subsidiary company MediaZest International Ltd ("MDZI"), which together

constitute the "Group".

MDZ Group Results for the year and Key Performance Indicators ("KPIs")

* Revenue for the year grew 26% to £2,820,000 (2021: £2,246,000).

* Gross profit increased by 39% to £1,499,000 (2021: £1,075,000).

* Gross margins improved to 53% (2021: 48%).

* Administrative expenses excluding depreciation and amortisation were £

1,279,000 (2021: £998,000). These expenses were particularly low in the

prior year due to the impact of strong cost control in the wake of the

Covid-19 Pandemic (the 'Pandemic').

* Depreciation and amortisation costs were £63,000 (2021: £74,000).

* EBITDA improved by 184% to a profit of £220,000 (2021: £78,000).

* Profit After Tax for the period was £12,000 (2021: loss of £140,000).

- The basic and fully diluted earnings per share was a profit per share of

0.0009 pence (2021: loss per share 0.0101 pence).

* Net assets of the group are £1,241,000 (2021: £1,229,000).

* Cash in hand at 30 September 2022 was £45,000 (2021: £120,000).

MDZ Group Summary

The Group's financial results for the year ended 30 September 2022 showed a

strong bounce back from the effects of the Pandemic in the previous year, with

significant improvements in revenue, gross profit, gross margin, EBITDA and

profit after tax. All of these metrics show considerable positive change from

the previous 12 months and the 18 month period before that.

Continued growth in the operating subsidiary, MDZI, led to an increase in

EBITDA to £497,000 (2021: £330,000) and profit after tax of £384,000 (2021: £

206,000).

This enabled the Group to deliver a substantial positive swing in financial

results as the difficulties of the Pandemic eased, with a best-ever EBITDA of £

220,000 (2021: £78,000), and a profit after tax of £12,000 (2021: loss of £

140,000).

Client demand in all three key sectors in which the Company operates - Retail,

Automotive and Corporate Office spaces - continued to be encouraging with new

project briefs and new client pitches seen consistently throughout the year.

There has been a notable increase in incoming opportunities post the year end

as a result of additional investment in marketing activity. The Company intends

to continue its marketing push throughout 2023.

Long term clients including Pets at Home, Lululemon, Hyundai, Ted Baker and HMV

all progressed roll out programmes or ongoing works during the financial year,

which has continued into the new financial year ending 30 September 2023.

New business wins outside of the UK have also been notable, with projects

delivered in Spain, the Netherlands, France and Germany. Further overseas

projects in Slovakia and the USA have been won post the period end, with a

number of other significant new opportunities already pitched to clients and

awaiting a decision. To better deliver to EU based clients, the Group has set

up a Dutch subsidiary which will enable it to be more efficient when working in

the region. This EU presence is expected to facilitate an increased number of

client opportunities and projects accordingly.

Recurring revenue streams remain strong and a key focus of management. Several

customer contracts run in excess of twelve months and additional new contracts

are written alongside the majority of permanent installation projects as the

Group progresses and the digital signage market continues to mature.

The Group continues to operate in three core sectors:

Retail - Digital transformation continues as retailers deploy digital signage

displays including window displays, self-service kiosks and large scale

displays such as LED and videowalls.

Automotive - As this sector evolves rapidly, the role of technology in the

showroom journey increases. As a result, many of the audio-visual solutions

deployed in general Retail are being seen in these markets.

Corporate Offices - typical projects in this sector include hybrid meeting

rooms, video conferencing technology and innovation centres - all of which are

undergoing radical transformation that in many cases have been accelerated by

the additional demands that the Pandemic and subsequent widespread Hybrid

working needs have put upon office building technology.

As expected, demand in all three sectors continues to grow and enquiries are

continuing to increase as audio- visual technology plays a greater role in day

to day operations.

Group Strategy

The Board's strategy continues to be focussed on growing revenues and client

numbers, with emphasis on those with long-term opportunities to deploy

solutions across multiple sites at scale. The quality of revenue and duration

of recurring revenue streams remain a key focus to enable the Group to generate

long term value.

The Group's market positioning is to provide a high-quality Managed Service

offering wrapped around hardware and software delivery that generates ongoing

contractual revenues from the customer base over several years. Supply chain

issues, felt across many industries, have enabled the Group to add further

value in the consultation and specification areas of client work as businesses

look to rebound from the Pandemic.

In the longer-term, the aim is to cover the Group's costs with recurring

contractual revenues to achieve consistent profitability, supplemented by one

or more 'game changing' large scale roll-out projects.

Due to the improved performance in the financial year, further fundraising

efforts were not necessary.

The Board believes that in addition to organic growth, the current state of the

digital signage market is well suited to a 'buy-and-build' acquisition strategy

to take advantage of economies of scale and the maturing market. As one of very

few listed vehicles in this space, the Company is in an advantageous position

to take advantage of this opportunity and generate substantial shareholder

value accordingly. As such the Board has held discussions with a number of

suitable parties and continues to do so, with the intention of consummating at

least one revenue enhancing, synergistic acquisition in 2023.

MDZ Group Operational Review

Long standing clients in the automotive sector such as Hyundai continued to

work with the Group during the year, continuing the roll out of interactive

touchscreen technology in showrooms to assist with Electric Vehicle ('EV')

sales. During the year, a refresh of the ground-breaking dealership in the

Bluewater shopping centre was completed to transform it into an EV based

showroom. Post year end, a similar installation was completed in Glasgow as the

market evolves focussing increasingly on these new technologies.

Pets at Home continued to roll out digital signage solutions to stores and the

Company has now deployed these to over 70 of their stores with more in the

pipeline.

Lululemon Athletica projects in the UK were also supplemented by new stores in

European locations such as Barcelona and Madrid. Post year end the Company was

pleased to help deliver innovative LED technology into their new Champs Elysees

flagship store in Paris.

In addition to established digital signage technologies, the Group continued to

deliver innovation for many clients including holographic displays for

Mastercard and Vodafone. Lift and learn RFID tags, movement sensors and

augmented reality solutions are a handful of other cutting-edge techniques

deployed for clients in the last 12 months.

HMV, the Group's longest standing client, continued to open and refurbish new

stores with audio solutions across the UK, provided by MediaZest.

New areas of expertise continued to flourish including work with digital

artists which included the installation and design of an immersive art gallery

in London, to be completed in January 2023.

Current trading and outlook into Financial Year Q2 23 (January to March 2023)

At present, the number of client projects and new business opportunities remain

encouraging. Although macro- economic conditions are expected to remain

challenging in 2023, this does not yet appear to be negatively affecting demand

for the Group's services. However, the Board continues to monitor performance

and its cost base very carefully.

In the meantime, the Group's target is to build on the recent progress and look

to generate both organic growth and evaluate potential acquisition targets to

supplement that growth where suitable.

Ongoing long term project roll outs with customers including Hyundai, Pets at

Home, Lululemon and HMV have continued into Financial Year 2023 with further

installations planned or underway.

The Group retains its facilities with an Invoice Financing facility and

continued support from shareholders by extending shareholder loans.

The Group at 30 September 22 had net assets of £1,241,000 (2021: £1,229,000).

The Board remains positive about the Group's future growth potential.

Lance O'Neill Chairman

28 February 2023

Consolidated Statement of Profit or Loss

for the Year Ended 30 September 2022

2022 2021

£'000 £'000

CONTINUING OPERATIONS

Revenue 2,820 2,246

Cost of sales (1,321) (1,171)

GROSS PROFIT 1,499 1,075

Administrative expenses - excluding

depreciation & amortisation (1,279) (997)

EBITDA 220 78

Administrative expenses - depreciation

& amortisation (63) (74)

OPERATING PROFIT 157 4

Finance costs (145) (144)

PROFIT/(LOSS) BEFORE INCOME TAX 12 (140)

Income tax - -

PROFIT/(LOSS) FOR THE YEAR 12 (140)

Owners of the parent 12 (140)

Earnings per share expressed

in pence per share:

Basic 0.0009 (0.0101)

Diluted 0.0009 (0.0101)

Consolidated Statement of Profit or Loss and Other Comprehensive Income

for the Year Ended 30 September 2022

2022 2021

£'000 £'000

PROFIT/(LOSS) FOR THE YEAR 12 (140)

OTHER COMPREHENSIVE INCOME FOR THE YEAR, - -

NET OF INCOME TAX

TOTAL COMPREHENSIVE INCOME FOR THE YEAR 12 (140)

Total comprehensive income attributable to:

12 (140)

Consolidated Statement of Financial Position

30 September 2022

2022 2021

£'000 £'000

ASSETS

NON-CURRENT ASSETS

Goodwill 2,772 2,772

Owned

Intangible assets - -

Property, plant and equipment 34 18

Right-of-use

Property, plant and equipment 83 127

Investments - -

2,889 2,917

CURRENT ASSETS

Inventories 121 150

Trade and other receivables 674 414

Cash and cash equivalents 45 120

840 684

TOTAL ASSETS 3,729 3,601

EQUITY

SHAREHOLDERS' EQUITY

Called up share capital 3,656 3,656

Share premium 5,244 5,244

Share option reserve 146 146

Retained earnings (7,805) (7,817)

TOTAL EQUITY 1,241 1,229

LIABILITIES

NON-CURRENT LIABILITIES

Financial liabilities - borrowings

Interest bearing loans and borrowings 83 272

CURRENT LIABILITIES

Trade and other payables 1,101 1,114

Financial liabilities - borrowings

Interest bearing loans and borrowings 1,304 986

2,405 2,100

TOTAL LIABILITIES 2,488 2,372

TOTAL EQUITY AND LIABILITIES 3,729 3,601

Consolidated Statement of Changes in Equity

for the Year Ended 30 September 2022

Called up Retained Share premium Share Total equity

share earnings option

capital reserve

£'000 £'000 £'000 ££'000 £'000

Balance at 3,656 (7,677) 5,244 146 1,369

1 October 2020

Changes in equity

Total - (140) - - (140)

comprehensive

income

Balance at 3,656 (7,817) 5,244 146 1,229

30 September 2021

Changes in equity

Total - 12 - - 12

comprehensive

income

Balance at 3,656 (7,805) 5,244 146 1,241

30 September 2022

Consolidated Statement of Cash Flows

for the Year Ended 30 September 2022

2022 2021

£'000 £'000

Cash flows from operating activities

Cash generated from operations (24) 246

Net cash from operating activities (24) 246

Cash flows from investing activities

Purchase of tangible fixed assets (35) (8)

Net cash from investing activities (35) (8)

Cash flows from financing activities

Other loans repayments 1 (10)

Shareholder loan net receipt/(repayment) 15 (30)

Bounce back loan (repayment)/receipt (10) (3)

Payment of lease liabilities (46) (42)

Invoice financing (repayment)/receipt 98 (53)

Interest paid (74) (71)

Net cash from financing activities (16) (209)

(Decrease)/increase in cash and cash equivalents (75) 29

Cash and cash equivalents at beginning of year 120 91

Cash and cash equivalents at end of year 45 120

NOTES TO THE FINANCIAL STATEMENTS

The financial information set out in this announcement does not constitute

statutory accounts as defined in section 435 of the Companies Act 2006.

The financial information for the period ended 30 September 2021 is derived

from the statutory accounts for that year which have been delivered to the

Registrar of Companies. The auditors reported on those accounts; their report

was (i) unqualified, and (ii) did not contain a statement under section 498(2)

or 498(3) of the Companies Act 2006.

The statutory accounts for the year ended 30 September 2022 have not yet been

delivered to the Registrar of Companies. The auditors reported on those

accounts; their report was (i) unqualified, and (ii) did not contain a

statement under section 498(2) or 498(3) of the Companies Act 2006.

The 2022 accounts will be delivered to the Registrar of Companies following the

Company's Annual General Meeting, details of which will be announced shortly.

Going concern

The Group made a profit after tax of £12,000 (2021: loss of £140,000) and has

net current liabilities of £1,565,000 (2021: £1,416,000). The financial

statements are prepared on a going concern basis which the Directors believe to

be appropriate for the following reasons:

The Directors have carefully considered the going concern assumption on the

basis of financial projections and the factors outlined below.

The Directors have considered financial projections based upon known future

invoicing, existing contracts, pipeline of new business and the increasing

number of opportunities it is currently working on in 2023, across all main

sectors the company specialises in. Several substantial new contracts have been

won during the new financial year, ongoing roll out projects with existing

clients continue apace, and recurring revenues remain robust. Future operating

and capital costs have also been reviewed and included in the cash flow

forecast prepared by the Directors.

These forecasts indicate that the Group will generate sufficient cash resources

to meet its liabilities as they fall due over the 12-month period from the date

of the approval of the accounts.

The Directors have obtained letters of support from two shareholders who have

provided material loans to the Group, stating that they will not call for

repayment of the loan within the 12 months from the date of approval of these

financial statements or, if earlier, until the Group has sufficient funds to do

so. The balance of these loans at 30 September 2022 totalled £705,000 (2021: £

643,000).

As a result the Directors consider that it is appropriate to draw up the

accounts on a going concern basis. The financial statements do not include any

adjustments that would result from the basis of preparation being

inappropriate.

Whilst the financial information included in this announcement has been

computed in accordance with International Financial Reporting Standards (IFRS),

this announcement does not in itself contain sufficient information to comply

with IFRS. The accounting policies used in preparation of this announcement are

consistent with those in the full financial statements that have yet to be

published.

The Report and Consolidated Financial Statements for the year ended 30

September 2022 will be posted to shareholders shortly and will also be

available to download from the Company's website: www.mediazest.com

1. SEGMENTAL REPORTING

Revenue for the year can be analysed by customer location as follows:

2022 20021

£'000 £'000

UK and Channel Islands 2,718 2,178

Rest of Europe 102 66

North America - 2

2,820 2,246

An analysis of revenue by type is shown below:

2022 2021

£'000 £'000

Hardware and installation 2,191 1,714

Support and maintenance - recurring revenue 498 477

Other services (including software solutions) 131 55

2,820 2,246

Segmental information and results

The Chief Operating Decision Maker ('CODM'), who is responsible for the

allocation of resources and assessing performance of the operating segments,

has been identified as the Board. IFRS 8 requires operating segments to be

identified on the basis of internal reports that are regularly reviewed by the

Board. The Board have reviewed segmental information and concluded that there

is only one operating segment.

The Group does not rely on any individual client and there are seven clients

who have contributed over 5% of total revenue each. The following revenues

arose from sales to the Group's largest client:

2022 2021

£'000 £'000

Goods and services 589 228

Service and maintenance 117 131

Other services 40 -

746 359

2. EARNINGS PER SHARE

2022 2021

Profit/(Loss) £'000 £'000

Profit/(Loss) for the purposes of basic and

diluted earnings per share being net loss 12 (140)

attributable to equity shareholders

2022 2021

Number of shares Number Number

Weighted average number of ordinary shares for the

purposes of basic earnings per share 1,396,425,774 1,396,425,774

Number of dilutive shares under option or warrant -

2022 2021

Weighted average number of ordinary shares for the

purposes of dilutive loss per share 1,396,425,774 1,396,425,774

Basic earnings per share is calculated by dividing the profit after tax

attributed to ordinary shareholders of £12,000 (2021 loss: £140,000) by the

weighted average number of shares during the year of 1,396,425,774 (2021:

1,396,425,774).

The diluted loss per share is identical to that used for basic loss per share

as the options are "out of the money" and therefore anti-dilutive.

3. RECONCILIATION OF PROFIT/(LOSS) BEFORE INCOME TAX TO CASH GENERATED FROM

OPERATIONS

2022 2021

£'000 £'000

Profit/(Loss) before income tax 12 (140)

Depreciation charges 63 74

Finance charges - (90)

Finance costs 145 144

220 (12)

Decrease/(increase) in inventories 29 (57)

(Increase)/decrease in trade and other receivables (260) 79

(decrease)/increase in trade and other payables (13) 236

Cash (used in)/generated from operations (24) 246

4. CASH AND CASH EQUIVALENTS

The amounts disclosed on the Statements of Cash Flows in respect of cash and

cash equivalents are in respect of these Statement of Financial Position

amounts:

Year ended 30 September 2022

30.9.22 1.10.2021

£'000 £'000

Cash and cash equivalents 45 120

Enquiries

Company

Geoff

Robertson

0845 207 937

Chief Executive Officer

Nominated Adviser

David Hignell / Adam

Cowl

020 3470 0470

SP Angel Corporate Finance LLP

Broker

Claire

Noyce

020 3764 2341

Hybridan LLP

About MediaZest

MediaZest is a creative audio-visual systems integrator that specialises in

providing innovative marketing solutions to leading retailers, brand owners and

corporations, but also works in the public sector in both the NHS and Education

markets. The Group supplies an integrated service from content creation and

system design to installation, technical support, and maintenance. MediaZest

was admitted to the London Stock Exchange's AIM market in February 2005. For

more information, please visit www.mediazest.com

END

(END) Dow Jones Newswires

March 01, 2023 09:00 ET (14:00 GMT)

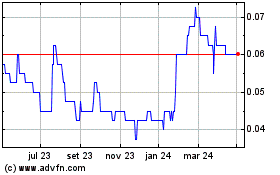

Mediazest (LSE:MDZ)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

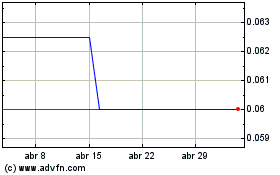

Mediazest (LSE:MDZ)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024