TIDMAAL

RNS Number : 8971R

Anglo American PLC

06 March 2023

Anglo American plc

(the "Company")

Registered office: 17 Charterhouse Street, London EC1N 6RA

Registered number: 3564138 (incorporated in England and

Wales)

Legal Entity Identifier: 549300S9XF92D1X8ME43

6 March 2023

ANNUAL FINANCIAL REPORT AND NOTICE OF AGM

In accordance with Listing Rule 9.6 and Disclosure Guidance and

Transparency Rule ("DTR") 4.1, the Company announces that the

following documents are today published on its website:

www.angloamerican.com

-- Integrated Annual Report for the year ended 31 December 2022 (the "2022 Annual Report")

-- Notice of the 2023 Annual General Meeting ("AGM") to be held on 26 April 2023

-- Sustainability Report 2022

-- Climate Change Report 2022

-- Ore Reserves and Mineral Resources Report 2022

-- Tax and Economic Contribution Report 2022

The 2022 Annual Report, Notice of the 2023 AGM and the 2023 AGM

proxy form ("Proxy Form") have been submitted to the Financial

Conduct Authority via the National Storage Mechanism and will

shortly be made available for inspection at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism.

The above mentioned documents (except for the Proxy Form) are

available on our website at

www.angloamerican.com/investors/annual-reporting and

www.angloamerican.com/investors/shareholder-information/agm/agm2023

respectively, and will be posted to shareholders on 24 March 2023.

Shareholders can obtain additional copies of the Proxy Form from

our Registrar, Equiniti Limited at Aspect House, Spencer Road,

Lancing, West Sussex BN99 6DA or view online at www.shareview.co.uk

.

This announcement should be read in conjunction with the

Company's Preliminary Results announcement issued on 23 February

2023. Together these constitute the material required by DTR 6.3.5

to be communicated to the media in full unedited text through a

Regulatory Information Service. This material is not a substitute

for reading the Company's 2022 Annual Report. Page references and

references to notes to the financial statements, refer to those

contained in the 2022 Annual Report.

An indication of the important events that occurred in 2022 and

their impact on the consolidated financial statements and the

consolidated financial statements themselves were announced to the

London Stock Exchange on 23 February 2023, forming part of the

Preliminary Results announcement for the year ended 31 December

2022. Additional content forming part of the management report are

set out in the appendices to this announcement.

AGM Timetable

In accordance with JSE Listing Requirement 18.20 the Company

confirms the following dates in respect of its AGM which will be

held at The Queen Elizabeth II Centre, Broad Sanctuary,

Westminster, London SW1P 3EE, and virtually via the Lumi platform

on Wednesday, 26 April 2023 at 11:00 UK time.

AGM Date

Wednesday, 26 April 2023

Record date - to determine which

shareholders were entitled to Friday, 24 February 2023

receive the notice of meeting

--------------------------------

Notice of Meeting Publication

date Monday, 6 March 2023

--------------------------------

Last day to trade to determine Wednesday, 19 April 2023 (for

eligible shareholders that may South Africa shareholders)

attend, speak and vote at the

Meeting Thursday, 20 April 2023 (for

UK shareholders)

--------------------------------

Record date - to determine eligible Monday 24 April 2023 at 18:30

shareholders that may attend, UK time

speak and vote at the meeting

--------------------------------

Meeting deadline date (for administrative Monday 24 April 2023 at 11:00

purposes, forms of proxy for UK time or 12:00 South African

the meeting to be lodged) time

--------------------------------

Results of meeting released As soon as practicable after

the conclusion of the AGM

--------------------------------

Clare Davage

Deputy Company Secretary

Anglo American is a leading global mining company and our

products are the essential ingredients in almost every aspect of

modern life. Our portfolio of world-class competitive operations,

with a broad range of future development options, provides many of

the future-enabling metals and minerals for a cleaner, greener,

more sustainable world and that meet the fast growing every day

demands of billions of consumers. With our people at the heart of

our business, we use innovative practices and the latest

technologies to discover new resources and to mine, process, move

and market our products to our customers - safely and

sustainably.

As a responsible producer of diamonds (through De Beers),

copper, platinum group metals, premium quality iron ore and

steelmaking coal, and nickel - with crop nutrients in development -

we are committed to being carbon neutral across our operations by

2040. More broadly, our Sustainable Mining Plan commits us to a

series of stretching goals to ensure we work towards a healthy

environment, creating thriving communities and building trust as a

corporate leader. We work together with our business partners and

diverse stakeholders to unlock enduring value from precious natural

resources for the benefit of the communities and countries in which

we operate, for society as a whole, and for our shareholders. Anglo

American is re-imagining mining to improve people's lives.

Forward-looking statements and third-party information

This document includes forward-looking statements. All

statements other than statements of historical facts included in

this document, including, without limitation, those regarding Anglo

American's financial position, business, acquisition and divestment

strategy, dividend policy, plans and objectives of management for

future operations, prospects and projects (including development

plans and objectives relating to Anglo American's products,

production forecasts and Ore Reserve and Mineral Resource

positions) and sustainability performance related (including

environmental, social and governance) goals, ambitions, targets,

visions, milestones and aspirations, are forward-looking

statements. By their nature, such forward-looking statements

involve known and unknown risks, uncertainties and other factors

which may cause the actual results, performance or achievements of

Anglo American or industry results to be materially different from

any future results, performance or achievements expressed or

implied by such forward-looking statements.

Such forward-looking statements are based on numerous

assumptions regarding Anglo American's present and future business

strategies and the environment in which Anglo American will operate

in the future. Important factors that could cause Anglo American's

actual results, performance or achievements to differ materially

from those in the forward-looking statements include, among others,

levels of actual production during any period, levels of global

demand and commodity market prices, unanticipated downturns in

business relationships with customers or their purchases from Anglo

American, mineral resource exploration and project development

capabilities and delivery, recovery rates and other operational

capabilities, safety, health or environmental incidents, the

effects of global pandemics and outbreaks of infectious diseases,

the impact of attacks from third parties on our information

systems, natural catastrophes or adverse geological conditions,

climate change and extreme weather events, the outcome of

litigation or regulatory proceedings, the availability of mining

and processing equipment, the ability to obtain key inputs in a

timely manner, the ability to produce and transport products

profitably, the availability of necessary infrastructure (including

transportation) services, the development, efficacy and adoption of

new or competing technology, challenges in realising resource

estimates or discovering new economic mineralisation, the impact of

foreign currency exchange rates on market prices and operating

costs, the availability of sufficient credit, liquidity and

counterparty risks, the effects of inflation, terrorism, war,

conflict, political or civil unrest, uncertainty, tensions and

disputes and economic and financial conditions around the world,

evolving societal and stakeholder requirements and expectations,

shortages of skilled employees, unexpected difficulties relating to

acquisitions or divestitures, competitive pressures and the actions

of competitors, activities by courts, regulators and governmental

authorities such as in relation to permitting or forcing closure of

mines and ceasing of operations or maintenance of Anglo American's

assets and changes in taxation or safety, health, environmental or

other types of regulation in the countries where Anglo American

operates, conflicts over land and resource ownership rights and

such other risk factors identified in Anglo American's most recent

Annual Report. Forward-looking statements should, therefore, be

construed in light of such risk factors and undue reliance should

not be placed on forward-looking statements. These forward-looking

statements speak only as of the date of this document. Anglo

American expressly disclaims any obligation or undertaking (except

as required by applicable law, the City Code on Takeovers and

Mergers, the UK Listing Rules, the Disclosure and Transparency

Rules of the Financial Conduct Authority, the Listings Requirements

of the securities exchange of the JSE Limited in South

Africa, the SIX Swiss Exchange, the Botswana Stock Exchange and

the Namibian Stock Exchange and any other applicable regulations)

to release publicly any updates or revisions to any forward-looking

statement contained herein to reflect any change in Anglo

American's expectations with regard thereto or any change in

events, conditions or circumstances on which any such statement is

based.

Nothing in this document should be interpreted to mean that

future earnings per share of Anglo American will necessarily match

or exceed its historical published earnings per share. Certain

statistical and other information about Anglo American included in

this document is sourced from publicly available third-party

sources. As such it has not been independently verified and

presents the views of those third parties, but may not necessarily

correspond to the views held by Anglo American and Anglo American

expressly disclaims any responsibility for, or liability in respect

of, such information.

APPIX A - Principal risks

We define a principal risk as a risk or combination of risks

that would threaten the business model, future performance,

solvency or liquidity of Anglo American. In addition to these

principal risks, we

continue to be exposed to other risks related to currency,

inflation, community relations, environment, litigation and

regulatory proceedings, changing societal expectations,

infrastructure and human resources. These risks are subject to our

normal procedures to identify, implement and oversee appropriate

mitigation actions, supported by internal audit work to provide

assurance over the status of controls or mitigating actions. These

principal risks are considered over the next three years as a

minimum, but we recognise that many of them will be relevant for

a longer period.

For more on Principal risks see pages 69 - 73

Catastrophic risks

We also face certain risks that we deem catastrophic risks.

These are very high severity, very low likelihood events that could

result in multiple fatalities or injuries, an unplanned fundamental

change to strategy or the way we operate, and have significant

financial consequences. We do not consider likelihood when

assessing these risks, as the potential impacts mean these risks

must be treated as a priority. Catastrophic risks are included as

principal risks.

For more on catastrophic risks see page 69

Risk appetite

We define risk appetite as 'the nature and extent of risk Anglo

American is willing to accept in relation to the pursuit of its

objectives'. We look at risk appetite from the context of severity

of the consequences should the risk materialise, any relevant

internal or external factors influencing the risk, and the status

of management actions to mitigate or control the risk. A scale is

used to help determine the limit of appetite for each risk,

recognising that risk appetite will change over time.

If a risk exceeds appetite, it will threaten the achievement of

objectives and may require a change to strategy. Risks that are

approaching the limit of the Group's risk appetite may require

management actions to be accelerated or enhanced to ensure the

risks remain within appetite levels.

For catastrophic and operational risks, our risk appetite for

exceptions or deficiencies in the status of our controls that have

safety implications is very low. Our internal audit programme

evaluates these controls with technical experts at operations and

the results of that audit work will determine the risk appetite

evaluation, along with the management response to any issues

identified.

For more on the risk management and internal control systems and

the review of their effectiveness See pages 157-159

Summary

Our risk profile evolved in 2022, mainly due to external

factors. Macro-economic uncertainty increased as a result of the

Russia's invasion of Ukraine, global inflation and economic

slowdowns in key markets. The regulatory environment in which we

operate remains impacted by political and societal changes in key

countries, which could affect future production and delay the

deployment of new technologies to support future production and

sustainability objectives. Operationally, we have identified

reliance on third-party infrastructure and power supply as a

heightened risk, particularly in South Africa. Climate change

remains one of the defining challenges of our era and our

unequivocal commitment to being part of the global response

presents both opportunities and risks. A number of our principal

risks are directly or indirectly related to climate change and our

strategies to reduce its impact on our business, and the

planet.

Our catastrophic risks are the highest priority risks, given the

potential consequences.

1. Catastrophic risks

We are exposed to Impact: Multiple Risk appetite: Operating

the following risks fatalities and injuries, within the limits

we deem as potentially damage to assets, of our appetite.

catastrophic: tailings environmental damage,

dam failure; geotechnical production loss, reputational Commentary: These

failure; mineshaft damage and loss of very high impact but

failure; and fire licence to operate. very low frequency

and explosion. Financial costs risks are treated

associated with recovery with the highest priority.

Root cause: Any of and liability claims

these risks may result may be

from inadequate significant. Regulatory

design or construction, issues may result

adverse geological and community

conditions, relations may be affected.

shortcomings in operational

performance, natural Mitigation: Technical

events standards exist that

such as seismic activity provide

or flooding, and failure minimum criteria for

of structures or machinery design and operational

and equipment performance

requirements, the

implementation of

which is regularly

inspected by technical

experts. Additional

assurance work is

conducted to assess

the adequacy of controls

associated with these

risks.

-------------------------------- -------------------------------

2. Product prices

Global macro-economic Impact : Low product Risk appetite: Operating

conditions leading prices can result within the limits

to sustained low product in lower levels of of our appetite.

prices and/or volatility. cash flow, profitability

and valuation. Debt Commentary: Macro-economic

Root cause: Factors costs may rise conditions remain

that could contribute owing to ratings agency uncertain; that may

to this risk include downgrades and the result in price volatility

a deep and protracted possibility in the products

slowdown in economic of restricted access mined, and marketed,

growth, to funding. The Group by Anglo American.

armed conflict involving may be unable

major world powers, to complete any divestment

trade war programme within the

between major economies desired

and a disrupted recovery timescales or achieve

from expected values. The

the Covid-19 pandemic capacity to invest

as a result of new in growth projects

variants being is constrained during

resistant to vaccines. periods

of low product prices

- which may, in turn,

affect future

performance.

Mitigation: Maintaining

a conservative balance

sheet and proactive

management of debt

facilities and the

delivery

of cash improvement

and operational performance

targets are the key

mitigation strategies

for this risk.

Regular updates of

economic analysis

and product price

assumptions are discussed

with executive management

and the Board.

-------------------------------- -------------------------------

3. Cyber security

Loss or harm to our Impact: Theft or Risk appetite: Operating

technical infrastructure loss of intellectual within the limits

and the use of technology property, financial of our appetite.

within the organisation losses, increased

from malicious or costs, reputational Commentary: During

unintentional sources. damage, operational 2022, we further strengthened

disruption and compromise our

Root cause: Attacks of safety systems. control environment.

motivated by fraud, Our controls responded

ransomware, and/ Mitigation: We have as planned

or access to sensitive a dedicated Global and no cyber attack

data or information. Information attempt resulted in

Management Security negative impacts

team with appropriate for Anglo American.

specialist

third-party support

to oversee our network

security. We

have aligned to the

internationally recognised

NIST Cyber Security

Framework, as well

as ISO27001 in sensitive

areas. Additionally,

we employ the IRAM2

risk assessment

methodology to large

scale projects and

maintain an

ongoing cyber awareness

programme across the

Group.

-------------------------------- -------------------------------

4. Political

Global, regional Impact: Global supply Risk appetite: Operating

and chains may be impacted within the limits

national political by the of our appetite.

tensions and disputes threat of or actual

may negatively impact disputes between major Commentary: Global

our business. economies. economic conditions

Regional and national can have a significant

Root cause: Geopolitical political tensions impact on countries

disputes between major may result in whose economies are

economic countries, social unrest affecting exposed to commodities,

regional and national our operations and placing greater pressure

political employees. on

tensions. The effectiveness Uncertainty over future governments to find

of national governance business conditions alternative means

in leads to a lack of of raising revenues,

countries in which confidence in making and increasing the

we operate may be investment decisions, risk of social and

compromised which can influence labour unrest.

by corruption, weak future financial performance.

policy framework and Increased costs

ineffective can be incurred through

enforcement of the additional regulations

law. or resource taxes,

while the ability

to execute strategic

initiatives that reduce

costs or divest assets

may also be restricted,

all of which may reduce

profitability and

affect future

performance. These

may adversely affect

the Group's

operations or performance

of those operations.

Mitigation: Anglo

American has an active

engagement

strategy with governments,

regulators and other

stakeholders within

the countries in which

we operate,

or plan to operate,

as well as at an international

level. We make significant

efforts to contribute

to public policy

objectives such as

socio-economic development

to

demonstrate the broader

value of our presence.

We assess

portfolio capital

investments against

political risks and

avoid

or minimise exposure

to jurisdictions with

unacceptable

risk levels. We actively

monitor regulatory

and political developments

at a national level,

as well as global

themes

and international

policy trends, on

a continuous basis.

See

page 16 for more detail

on how we engage with

our key

stakeholders.

-------------------------------- -------------------------------

5. Community and Social Relations

Failure to maintain Impact: A breakdown Risk appetite: Operating

healthy in trust with local within the limits

relationships with communities and of our appetite.

local society at large threatens

communities and society Anglo American's 'licence Commentary: Through

at large. to the Social Way 3.0,

operate', potentially we ensure that

Root cause: Failure leading to increased policies and systems

to identify, understand costs, future growth are in place at all

and respond to community being impacted, business Anglo American

and societal needs interruption and reputational managed sites to support

and expectations. damage. effective engagement

with

Mitigation: The Anglo communities, avoid

American Social Way or minimise adverse

3.0 is our social impacts,

integrated management and maximise development

system for social opportunities. For

performance, further

adopted and implemented information on how

at all managed sites. we engage with key

In addition, the commitments stakeholders, see

we have made as part pages 16-19. For more

of the Thriving Communities information on our

pillar of our Sustainable Sustainable

Mining Plan will deliver Mining Plan commitments,

tangible and valued see page 42.

benefits to host communities.

-------------------------------- -------------------------------

6. Regulatory and permitting

Failure to comply Impact: Delays to Risk appetite: Operating

with permitting and projects and disruption within the limits

other mining regulations. to existing operations of our appetite.

may impact future

Root cause: Regulations production, delays Commentary: Annual

impacting the mining in deploying new technologies assessments of compliance

industry are evolving that support future with the Anglo American

as a result of political growth and sustainability Minimum Permitting

developments, changes objectives, legal Requirements are

in societal expectations claims and regulatory undertaken, as well

and the public perception actions, fines and as periodic independent

of mining activities. reputational damage. audits.

Failure to comply

with management processes Mitigation: All operations

will threaten the must comply with our

ability to adhere Minimum

to regulations and Permitting Requirements,

permits. which is a management

system to ensure necessary

permits and other

regulatory

requirements are identified

and embedded in life

of asset

plans and management

routines. Through

our Sustainable Mining

Plan, we make considerable

efforts to meet community

aspirations for socio-economic

development

and carefully manage

the environmental

impacts of our

business to avoid

causing harm and nuisance.

-------------------------------- -------------------------------

7. Operational Performance

Unplanned operational Impact: Inability Risk appetite: Operating

stoppages affecting to achieve production, within the limits

production and profitability. cash flow or of our appetite.

profitability targets.

Root cause: We are There are potential Commentary: There

exposed to risks of safety-related risks were no material unplanned

interruption to associated with unplanned operational incidents

power supply and the operational stoppages, in 2022, although

failure of critical along power outages in South

third-party-owned with a loss of investor Africa impacted our

and -operated infrastructure; confidence. operations.

e.g. rail networks

and ports. Mitigation: We maintain

Failure to implement ongoing engagement

and embed our Operating with

Model, critical power and

maintain critical infrastructure suppliers

plant, machinery and and maintain

infrastructure, and appropriate business

operate in compliance continuity and emergency

with Anglo American's preparedness plans.

Technical Implementation of

Standards, will affect our Operating Model

our performance levels. and compliance with

Our Technical Standards,

operations may also supported by operational

be exposed to natural risk management and

catastrophes and extreme assurance processes,

weather events. are key to the mitigation

against this risk.

Regular tracking and

monitoring of progress

against the underlying

production plans is

undertaken.

-------------------------------- -------------------------------

8. Safety

Failure to eliminate Impact: A fatal incident Risk appetite: Operating

fatalities. is devastating for within the limits

the bereaved of our appetite.

Root cause: Fatalities family, friends and

may result from operational colleagues. Over the Commentary: During

leaders, longer term, failure 2022, there were two

employees and contractors to provide a safe work-related

failing to apply safety working environment fatalities in our

rules threatens our licence managed operations.

and poor hazard identification to operate. Management remains

and control, including fully committed to

non -- compliance Mitigation: All operations the elimination of

with critical controls. continue to implement fatalities.

safety

improvement plans,

with a focus on: effective

management of critical

controls required

to manage significant

safety risks; learning

from high potential

incidents and hazards;

embedding a safety

culture; and leadership

engagement and accountability.

Our Elimination of

Fatalities Taskforce

oversees targeted

improvement initiatives

to further improve

safety performance.

-------------------------------- -------------------------------

9. Climate Change

Climate change is Impact: Potential Risk appetite: Operating

the defining challenge loss of stakeholder within the limits

of our era and our confidence, negative of our appetite.

commitment to being impact on reputation,

part of the global financial performance Commentary: For more

response presents and valuation. information on our

both opportunities Sustainable

and risks. Mitigation: We have Mining Plan and approach

articulated our climate to climate change,

Root cause: We are change plans, policies see pages 42

committed to the alignment and progress and engage and 45-49, and for

of with key stakeholders further information

our portfolio with to ensure they understand on how we engage

the needs of a low them. Our Sustainable with key stakeholders,

carbon world in a Mining Plan includes see pages 16-19. For

responsible manner; operation-specific more on the

however, different and Group targets extreme weather events

stakeholder expectations for reductions in that have affected

continue to evolve carbon emissions, the operating

and are not always power and water usage. performance of our

aligned. Long term business units, see

demand for metals pages 84-111.

and minerals mined

and marketed by Anglo

American may deviate

from assumptions based

on climate change

abatement initiatives.

Changing weather patterns

and an increase in

extreme weather events

may impact operational

stability and our

local communities.

Our Scope 1 and 2

carbon emission reduction

targets are partly

reliant on new technologies

that are at various

stages of development,

and our Scope 3 reduction

ambition is reliant

on the adoption of

greener technologies

in the steelmaking

industry.

-------------------------------- -------------------------------

10. Pandemic

Large scale outbreak Impact: As has been Risk appetite: Operating

of infectious disease witnessed by the Covid-19 within the limits

increasing morbidity pandemic, widespread of our appetite.

and consequences include

mortality over a the physical and mental Commentary: For more

wide health and well-being information on our

geographic area. of our people and response to the Covid-19

local communities; pandemic, see pages

Root cause: Human economic shocks and 59-60.

population growth, disruption; social

urbanisation, changes unrest; an increase

in land use, loss in political stresses

of biodiversity, exploitation and tensions, a rise

of the natural environment, in criminal acts;

viral disease from and the potential

animals, and increased for increased resource

global travel and nationalism.

integration are all

contributory causes Mitigation: Anglo

of health pandemics. American actively

monitors global

pandemic-potential

diseases. In the event

of a pandemic,

our Group Crisis Management

Team is activated

at an early stage

to direct the Group's

response, prioritising

the well-being of

our people, their

families and our host

communities, and ensuring

the continuity of

the operations.

-------------------------------- -------------------------------

11. Corruption

Bribery or other Impact: Potential Risk appetite: Operating

forms of corruption criminal investigations, within the limits

committed by an employee adverse media of our appetite.

or agent of Anglo attention and reputational

American. damage. A possible Commentary: Group

negative Compliance Committee

Root cause: Anglo impact on licensing oversees the organisation's

American has operations processes and valuation. anti-bribery management

in some countries system to ensure its

where there is a higher Mitigation: A comprehensive continuing suitability,

prevalence of corruption. anti-bribery and corruption adequacy and

policy and programme, effectiveness.

including risk assessment,

training and awareness,

with active monitoring,

are in place.

-------------------------------- -------------------------------

12. Water

Inability to obtain Impact: Loss of production Risk appetite: Operating

or sustain the level and inability to achieve within the limits

of water security cash flow or volume of our appetite.

needed to support improvement targets.

operations over the Damage to stakeholder Commentary: This

current life of asset relationships or reputational continues to be a

plan or future growth damage can result risk to the majority

options. from failure to manage of

this critical resource. our operations. For

Root cause: Poor more information on

water resource management Mitigation: Various our Sustainable

or projects have been Mining Plan, see page

inadequate on site implemented at 42.

storage, combined operations most exposed

with reduced water to this risk, focused

supply at some operations on: water

as weather patterns efficiency; water

change, can affect security; water treatment;

production. Water and discharge management;

is a shared resource as well as alternative

with local communities supplies. New

and permits to use technologies are being

water in our operations developed that will

are at risk if we reduce water demand.

do not manage the

resource in a responsible

and sustainable manner.

-------------------------------- -------------------------------

13. Future demand

Demand for metals Impact: Potential Risk appetite: Operating

and minerals produced for negative impact within the limits

and marketed by Anglo on revenue, cash flow, of our appetite.

American may deviate profitability and

from our assumptions. valuation. Commentary: We monitor

new business opportunities

Root cause: Technological Mitigation: Regular in line with our strategy

developments and/or reviews of production to secure, develop

product and financial and operate a portfolio

substitution leading plans, as well as of high quality and

to reduced demand, longer term portfolio long life mineral

growth in the decisions, are based assets, from which

circular economy and on extensive research. we will deliver leading

shifts in consumer Our businesses invest shareholder returns.

preferences. in marketing Our Ethical Value

and other activities Chain commitments

to enhance the inherent within the Trusted

value of Corporate Leader pillar

the products we produce, of our Sustainable

including building Mining Plan

consumer ensure we operate

confidence in the in line with stakeholder

ethical provenance expectations for responsible

of our products. mining. For more information

on our ethical

value chains and responsible

mining certification,

see page

54.

-------------------------------- -------------------------------

APPIX B - Related party transactions

The Group has related party relationships with its subsidiaries,

joint operations, associates and joint ventures (see notes 34 and

35). Members of the Board and the Group Management Committee are

considered to be related parties.

The Company and its subsidiaries, in the ordinary course of

business, enter into various sale, purchase and service

transactions with joint operations, associates, joint ventures and

others in which the Group has a material interest. These

transactions are under terms that are no less favourable to the

Group than those arranged with third parties.

Associates Joint ventures Joint operations

------------- ------------------- -------------------

US$ million 2022 2021 2022 2021 2022 2021

----------------------------------- ------ ----- ------- ---------- --------- --------

Transactions with related parties

Sale of goods and services - - 16 - 181 158

Purchase of goods and services - - (190) (169) (4,253) (3,466)

Balances with related parties

Trade and other receivables

from related parties - - 7 1 17 18

Trade and other payables to

related parties - - (18) (16) (250) (273)

Loans receivable from related

parties 2 2 147 76 - -

----------------------------------- ------ ----- ------- ---------- --------- --------

Balances and transactions with joint operations or joint

operation partners represent the portion that the Group does not

have the right to offset against the corresponding amount recorded

by the respective joint operations. These amounts primarily relate

to purchases by De Beers and Platinum Group Metals from their joint

operations in excess of the Group's attributable share of their

production.

Loans receivable from related parties are included in Financial

asset investments on the Consolidated balance sheet.

Remuneration and benefits received by directors are disclosed in

the Remuneration report. Remuneration and benefits of key

management personnel, including directors, are disclosed in note

26. Information relating to pension fund arrangements is disclosed

in note 27.

APPENDIX C - Statement of directors' responsibilities in respect

of the financial statements

The directors are responsible for preparing the Integrated

Annual Report and the financial statements in accordance with

applicable law and regulations.

Company law requires the directors to prepare financial

statements for each financial year. Under that law the directors

have prepared the Group financial statements in accordance with

UK-adopted International Accounting Standards and the Parent

Company financial statements in accordance with United Kingdom

Generally Accepted Accounting Practice (United Kingdom Accounting

Standards, comprising FRS 101 "Reduced Disclosure Framework", and

applicable law).

Under company law, directors must not approve the financial

statements unless they are satisfied that they give a true and fair

view of the state of affairs of the Group and Parent Company and of

the profit or loss of the Group for that period.

In preparing the financial statements, the directors are

required to:

-- Select suitable accounting policies and then apply them

consistently

-- State whether applicable UK-adopted International Accounting

Standards have been followed for the Group financial statements

and United Kingdom Accounting Standards, comprising FRS

101 have been followed for the Parent Company financial

statements, subject to any material departures disclosed

and explained in the financial statements

-- Make judgements and accounting estimates that are reasonable

and prudent

-- Prepare the financial statements on the going concern basis

unless it is inappropriate to presume that the Group and

Parent Company will continue in business

The directors are responsible for safeguarding the assets of the

Group and Parent Company and hence for taking reasonable steps for

the prevention and detection of fraud and other irregularities.

The directors are also responsible for keeping adequate

accounting records that are sufficient to show and explain the

Group's and Parent Company's transactions and disclose with

reasonable accuracy at any time the financial position of the Group

and Parent Company and enable them to ensure that the financial

statements and the Directors' Remuneration Report comply with the

Companies Act 2006.

The directors are responsible for the maintenance and integrity

of the Parent Company's website. Legislation in the United Kingdom

governing the preparation and dissemination of financial statements

may differ from legislation in other jurisdictions.

Directors' responsibility statement

for the year ended 31 December 2022

The directors consider that the Integrated Annual Report and

accounts, taken as a whole, is fair, balanced and understandable

and provides the information necessary for shareholders to assess

the Group's and Parent Company's position and performance, business

model and strategy.

We confirm that to the best of our knowledge:

-- the Group financial statements, which have been prepared

in accordance with UK-adopted international accounting

standards, give a true and fair view of the assets, liabilities,

financial position and profit of the Group

-- the Parent Company financial statements, which have been

prepared in accordance with United Kingdom Accounting

Standards, comprising FRS 101, give a true and fair view

of the

assets, liabilities and financial position of the Parent

Company and

-- the Strategic Report includes a fair review of the development

and performance of the business and the position of the

Group and Parent Company, together with a description

of the principal risks and uncertainties that it faces.

By order of the Board

Duncan Wanblad Stephen Pearce

Chief Executive Finance Director

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACSEASDDEEDDEFA

(END) Dow Jones Newswires

March 06, 2023 04:00 ET (09:00 GMT)

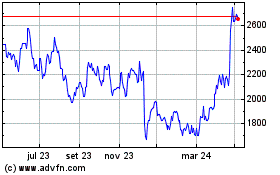

Anglo American (LSE:AAL)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

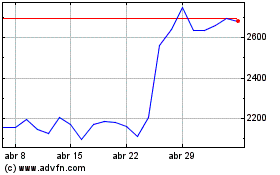

Anglo American (LSE:AAL)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024