TIDMPIP

RNS Number : 7004U

PipeHawk PLC

30 March 2023

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse (Amendment) (EU EXIT) Regulations 2019/310.

30 March 2023

PipeHawk plc

("PipeHawk" or the "Company")

Unaudited results for the six months ended 31 December 2022

Chairman's Statement

The Company's turnover in the six months ended 31 December 2022

was GBP2,239,000 (December 2021: GBP3,247,000), a reduction of 28

per cent over the comparable period last year, resulting in a loss

before taxation of GBP1,797,000 (2021: loss of GBP457,000) and a

loss after taxation of GBP1,440,000 (2021: loss GBP284,000).

As indicated in my November Chairman's Statement accompanying

the annual accounts for the year ended 30 June 2022, the challenges

faced within the first half of 2022 calendar year continued further

into the second half of 2022 than originally expected resulting in

a significant drop in turnover compared with the six months to 31

December 2021 and an accompanying significant pre-tax loss for the

six months ended 31 December 2022. War in Ukraine, fuel cost

spikes, interest rate rises, three UK Prime Ministers - all are

contributing factors for delays that a number of the group

businesses have faced in receiving contract awards from clients. It

has been very challenging to manage resource levels across the

group where we have protected staffing levels to be able to switch

on quickly where contract award appeared imminent. Nevertheless,

also as previously reported, Rishi Sunak introduced a degree of

confidence into the marketplace which appears to have provided a

level of confidence for our clients to again start to award

contracts and work started to flow in the later part of 2022. This

appears to be accelerating into the start of 2023 with several

contacts being awarded, with the result that we have recruited

significant additional staff in order to be able to cope with the

current and anticipated workload. It now appears that the move by

QM Systems to premises five times the size of its previous premises

and TED to premises three times the size of its previous premises

was well judged and both premises are nearing a far more

satisfactory level of occupation. Orderbooks are healthy, time

charged and revenue recognised from existing projects is greatly

improved and order pipeline appears healthy.

The Directors of PipeHawk therefore believe that the outlook

does look very positive for the remainder of this year and

beyond.

QM Systems ("QM")

As reported in the accounts for the year ended 30 June 2022 (the

"2021/22 FY"), QM witnessed an order intake that was significantly

below management expectations. Whilst quotations and the expected

orderbook through the latter part of 2021/22 FY increased

dramatically, the gestation period from quotation to order

placement remained protracted as our clients continued to grapple

with the material uncertainties within their markets created

initially by Covid-19 and then aggravated further by the invasion

of Ukraine by Russia. In 2021/22 FY, we reported that order intake

had increased significantly in the first four months of this

current financial year. In this regard, I am pleased to say that

this trend has continued with a number of projects moving forward

from a protracted quotation phase to order placement. New orders

received this financial year up to 29 March 2023 stood at over

GBP5.8M. Quotation activity remains buoyant and we have a

significant expected orderbook that we are confident in converting

to orders during this [financial year], providing fuel for further

growth at QM.

Timescales for projects over the last 18 months have increased

significantly, predominantly due to extended timescales surrounding

material and component availability. This hampers our ability to

generate revenue at a quicker rate as we experience longer periods

of waiting time for materials to be delivered following the release

from the design phase. Consequently, the effects of increases in

order intake to positively ripple through all areas of our business

is longer than that ordinarily anticipated. In addition, given the

reduced orderbook in 2021/22 FY we had reduced staffing levels to

accommodate the workload at that time. This workforce reduction has

further impacted our ability to realise revenue quickly,

particularly in being able to respond to sudden and significant

increases in order placement. The result of the aforementioned

conditions has contributed to the reduction in revenue in the first

part of the 2022/23 FY and this is reflected in the figures

published.

We are however pleased to report that material and component

delivery times are improving and we have recruited a number of

additional mechanical, electrical and software engineers for both

our engineering and manufacturing teams. Since 30 June 2022, the QM

workforce has increased from 44 to 55 despite recruitment of high

calibre engineers being and continuing to remain difficult. We

continue to recruit as we anticipate our workload to further

increase. These factors are anticipated to enable us to

significantly accelerate revenue recognition during the final six

months of this current FY and the current orderbook and forecasts

indicate that we anticipate to be able to generate profit within

the final 6 months of this FY with a large uptick in revenue

anticipated to be recognised within this next period.

Our preparations for the start of our contract manufacturing

business continues to gain momentum as we move towards production

start dates later this year. One of our contract manufacturing

opportunities which will involve the filling and assembly of vials

for PCR testing of respiratory diseases in humans and animals has

led to us invest in the installation of a Clean Room at QM's

Hartlebury facility. This will be the first of our contract

manufacturing business to start production towards the end of the

2022/23 FY. Our other contract manufacturing business (including

Ventive) are now due to enter production in the second half of

2023.

Thomson Engineering Design ("TED")

Following a very buoyant end to the 2021/22 FY at TED, order

intake for the first part of the 2022/23 FY has been below

management expectations. Despite healthy quotation activity, a

number of the orders that were anticipated have been slow to

materialise. TED's projects tend to have relatively short

timescales (e.g. 1-4 months) and, hence unlike QM Systems, a

downturn in order intake at TED can have a relatively quick

consequences on revenue recognition and profitability for TED.

However, order intake for TED post 2021/22 FY has seen a

significant increase and this is anticipated to enable us to

accelerate revenue recognition through the second part of the

financial year. Combined with this change in momentum, the

relationship with Unipart Rail is gaining traction and a number of

quotations totalling over GBP1.6M have now been provided for the

export product that is far in excess of export quotations delivered

previously. We remain hopeful that a number of these quotations

will convert to orders in this second half of the current FY.

Furthermore, Unipart Rail is currently conducting a major marketing

campaign to push our products worldwide. Accordingly, with this

increase in exposure, we are confident that this will contribute to

further significant sales in the next financial year's figures.

Previously we stated that TED had entered a partnership to

design and manufacture Rail conversions for Kawasaki Mule vehicles.

We are pleased to report that TED has since been awarded the first

order for 10 units with a further 10 [expected] to follow shortly.

In addition to the Mule conversions, TED has also been developing

with our partner a rail conversion for a trailer assembly to be

towed by the Mule. This combination provides an easy to deploy, low

cost solution that can be driven on road direct to the rail work

site and can be quickly and easily mounted to a rail track for

maintenance purposes.

In anticipation of the growth expected above, we have recently

expanded our design capacity by the addition of two extra people

and two new SolidWorks seats. Furthermore, we have expanded our

machining capacity with two additional CNC machines and operators

to match.

Adien

As previously reported, the reduced work volumes as a result of

continual delays in contract start dates in the first half of

calendar year 2022 continued into the second half and then volumes

picked up significantly in the fourth quarter. The pickup has

continued into the first months of 2023 and is anticipated to

continue.

Confidence in the demand for our services is such that we have

invested in new vehicles, new survey equipment, new CAD hardware

and software and renewed sales training. We have also recruited

additional surveyors to enable an additional team to be deployed

thereby increasing our total turnover capacity.

We therefore believe that the outlook for Adien for the rest of

this year and next year is positive.

Utsi/PipeHawk Technology

Our work to move Utsi & PipeHawk products toward utilising a

common architecture while progressing greatly, but our ability to

complete has been greatly impacted by the continuing long lead

times of some component lines and the advanced redundancy of

others.

While good management of resources has achieved some control

over our own rising energy costs, the effect on supply chain prices

have been far more significant, placing increased pressure on

margins and our ability to remain competitive.

A mid year switch of focus from our general use products to

bespoke products for more specialist markets, has succeeded in

drawing new opportunities from industrial clients however,

continuing market uncertainty has stretched client timelines for

delivery beyond those initially required, into the new year.

While traditional R&D opportunities routed in academia

continue to be on hold or awaiting grant funding, we continue to

seek opportunities within new fields of endeavour, where our

experience of developing innovative sensor technology may provide

an alternative income stream.

Related party transactions

As announced on 29 November 2022, my letter of financial support

dated 6 September 2021 was renewed on 11 October 2022 to provide

the group with financial support until 31 December 2024.

In addition to the loans I have provided to the Company in

previous years, my fellow directors and I have deferred a certain

proportion of our fees and interest payments until the Company is

in a suitably strong position to make the full payments. During the

six months ended 31 December 2022, these deferred fees and interest

payments amounted to approximately GBP3,000 in total, all of which

have been accrued in the Company's interim results, and at 31

December 2022 amounted in total to GBP1,640,000.

Gordon Watt

Chairman

Enquiries:

PipeHawk Plc Tel no. 01252 338 959

Gordon Watt (Chairman)

Allenby Capital (Nomad and Broker) Tel no. 020 3328 5656

David Worlidge/Vivek Bhardwaj

Consolidated Statement of Comprehensive Income

As at 31 December 2022

6 months 6 months Year ended

ended 31 December ended 31 December 30 June

2022 2021 2022 (audited)

(unaudited) (unaudited) GBP'000

GBP'000 GBP'000

------------------- ------------------- ----------------

Revenue 2,239 3,247 6,191

Staff costs (1,962) (1,903) (3,861)

General administrative expenses (1,902) (1,698) (3,642)

------------------- ------------------- ----------------

Loss on ordinary activities

before interest and taxation (1,625) (354) (1,312)

Finance costs (172) (103) (264)

------------------- ------------------- ----------------

Loss before taxation (1,797) (457) (1,576)

Taxation 357 173 708

------------------- ------------------- ----------------

Loss for the period attributable

to equity holders of the Company (1,440) (284) (868)

Other comprehensive income - - -

------------------- ------------------- ----------------

Total comprehensive expense

for the period net of tax (1,440) (284) (868)

=================== =================== ================

Loss per share (pence) - basic (3.97) (0.79) (2.42)

Loss per share (pence) - diluted (3.97) (0.79) (2.42)

=================== =================== ================

Consolidated Statement of Financial Position

As at 31 December 2022

As at As at As at

31 December 31 December 30 June

2022 2021

(unaudited) (unaudited) 2022 (audited)

GBP'000 GBP'000 GBP'000

Assets

-------------- -------------- -----------------

Non-current assets

Property, plant and equipment 814 585 828

Right of use 2,381 590 2,549

Goodwill 1,357 1,357 1,357

-------------- -------------- -----------------

4,552 2,532 4,734

-------------- -------------- -----------------

Current assets

Inventories 308 308 340

Current tax assets 1,067 182 710

Trade and other receivables 1,949 1,723 2,389

Cash 149 644 4

-------------- -------------- -----------------

3,473 2,857 3,443

-------------- -------------- -----------------

Total assets 8,025 5,389 8,177

============== ============== =================

Equity and liabilities

Equity

Share capital 363 358 363

Share premium 5,316 5,302 5,316

Other reserves (10,087) (8,068) (8,647)

-------------- -------------- -----------------

(4,408) (2,408) (2,968)

-------------- -------------- -----------------

Non-current liabilities

Borrowings 5,317 3,624 5,612

5,317 3,624 5,612

-------------- -------------- -----------------

Current liabilities

Bank overdrafts and loans 2,633 2,161 2,674

Trade and other payables 4,483 2,012 2,859

-------------- -------------- -----------------

7,116 4,173 5,533

-------------- -------------- -----------------

Total equity and liabilities 8,025 5,389 8,177

============== ============== =================

Consolidated Statement of Cash Flow

For the six months ended 31 December 2022

6 months 6 months Year ended

ended 31 December ended 30 June

2022 31 December 2022 (audited)

(unaudited) 2021 GBP'000

GBP'000 (unaudited)

GBP'000

------------------- ------------- ----------------

Cash inflow from operating

activities

Loss from operations (1,625) (354) (1,312)

Adjustment for:

Depreciation 271 162 424

------------------- ------------- ----------------

(1,354) (192) (888)

Decrease in inventories 32 65 33

Decrease/(Increase) in receivables 439 87 (580)

Increase/(Decrease) in liabilities 1,735 (88) 286

------------------- ------------- ----------------

Cash generated from/(used in)

operations 852 (128) (1,149)

Interest paid (91) (36) (124)

Corporation tax received - 433 440

------------------- ------------- ----------------

Net cash generated from/(utilised

in) operating activities 761 269 (833)

------------------- ------------- ----------------

Cash flows from investing

activities

Purchase of plant and equipment (47) (446) (325)

Net cash utilised in investing

activities (47) (446) (325)

------------------- ------------- ----------------

Cash flows from financing

activities

(Repayments)/Proceeds from

borrowings (218) 250 286

(Repayments)/Proceeds of bank

and other loans (158) (221) 119

Repayment of leases (193) (128) (163)

------------------- ------------- ----------------

Net cash (utilised in)/generated

from financing activities (569) (99) 242

------------------- ------------- ----------------

Increase/(Decrease) in cash

and cash equivalents 145 (276) (916)

Cash and cash equivalents at

beginning of period 4 920 920

Cash and cash equivalents

at end of period 149 644 4

=================== ============= ================

Consolidated Statement of Changes in Equity

For the six months ended 31 December 2022

Share

Share premium Retained

capital account earnings Total

GBP'000 GBP'000 GBP'000 GBP'000

---------- --------- ----------- --------

6 months ended 31 December

2021

As at 1 July 2021 349 5,215 (7,779) (2,215)

Loss for the period - - (284) (284)

Total comprehensive income - - (284) (284)

---------- --------- ----------- --------

Issue of shares 9 87 - 96

As at 31 December 2021 358 5,302 (8,063) (2,403)

========== ========= =========== ========

12 months ended 30 June 2022

As at 1 July 2021 349 5,215 (7,779) (2,215)

Profit for the period - - (868) (868)

Total comprehensive income - - (868) (868)

---------- --------- ----------- --------

Issue of shares 14 101 - 115

As at 30 June 2022 363 5,316 (8,647) (2,968)

========== ========= =========== ========

6 months ended 31 December

2022

As at 1 July 2022 363 5,316 (8,647) (2,968)

Loss for the period - - (1,440) (1,440)

Total comprehensive income - - (1,440) (1,440)

---------- --------- ----------- --------

Issue of shares - - -

As at 31 December 2022 363 5,316 (10,087) (4,408)

========== ========= =========== ========

Notes to the Interim Results

1. Basis of preparation

The Interim Results for the six months ended 31 December 2022

are unaudited and do not constitute statutory accounts in

accordance with section 240 of the Companies Act 2006.

Full accounts for the year ended 30 June 2022, on which the

auditors gave an unqualified report and contained no statement

under Section 498 (2) or (3) of the Companies Act 2006, have been

delivered to the Registrar of Companies.

The interim financial information has been prepared on a basis

which is consistent with the accounting policies adopted by the

Company for the last financial statements and in compliance with

basic principles of IFRS.

2. Segmental information

The Company operates in one geographical location being the UK.

Accordingly, the primary segmental disclosure is based on

activity.

Utility Development,

detection assembly Automation

and mapping and sale and test

services of GPR equipment system solutions

Total

GBP'000 GBP'000 GBP'000 GBP'000

------------- ------------------ ------------------- --------

6 months ended 31 December

2022

Total segmental revenue 449 79 1,711 2,239

============= ================== =================== ========

Segment result (164) (26) (1,435) (1,625)

Finance costs (16) (104) (52) (172)

Loss before taxation (180) (130) (1,487) (1,797)

------------- ------------------ ------------------- --------

Segment assets 441 1,872 5,712 8,025

Segment liabilities 544 5,079 7,027 12,650

Non-current asset additions - - 102 102

Depreciation and amortisation 30 9 232 271

============= ================== =================== ========

6 months ended 31 December

2021

Total segmental revenue 765 134 2,348 3,247

============= ================== =================== ========

Segmental result 104 (45) (413) (354)

Finance costs (16) (77) (10) (103)

Profit/(Loss) before taxation 88 (122) (423) (457)

------------- ------------------ ------------------- --------

Segment assets 654 2,301 2,434 5,389

Segment liabilities 515 4,895 2,387 7,797

Non-current asset addition 3 55 388 446

Depreciation and amortisation 47 9 106 162

============= ================== =================== ========

12 months ended 30 June 2022

Total segmental revenue 1,453 246 4,492 6,191

------------- ------------------ ------------------- --------

Segmental result 21 (323) (1,010) (1,312)

Finance costs (36) (171) (57) (264)

Loss before taxation (15) (494) (1,067) (1,576)

------------- ------------------ ------------------- --------

Segment assets 655 1,924 5,598 8,177

Segment liabilities 628 5,226 5,442 11,296

Non-current asset additions 17 55 2,941 3,013

Depreciation and amortisation 106 3 316 425

============= ================== =================== ========

3. Loss per share

This has been calculated on the loss for the period of

GBP1,440,000 (2021: loss GBP868,000) and the number of shares used

was 36,312,823 (2021: 35,812,823), being the weighted average

number of shares in issue during the period.

4. Dividends

No dividend is proposed for the six months ended 31 December

2022.

5. Copies of Interim Results

The Interim Results will be posted on the Company's website

www.pipehawk.com and copies will be available from the Company's

registered office at 4, Manor Park Industrial Estate, Wyndham

Street, Aldershot, GU12 4NZ.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR PPUAWWUPWPWB

(END) Dow Jones Newswires

March 30, 2023 02:00 ET (06:00 GMT)

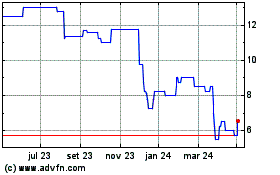

Pipehawk (LSE:PIP)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

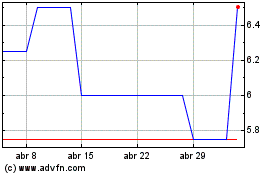

Pipehawk (LSE:PIP)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024