TIDMSAV

RNS Number : 3957V

Savannah Resources PLC

05 April 2023

5 April 2023

Savannah Resources Plc

(AIM: SAV, FWB: SAV and SWB: SAV) ('Savannah', or the

'Company')

Financial Results for the Year Ended 31 December 2022

Savannah Resources, the European lithium development company, is

pleased to announce its audited financial results for the year

ended 31 December 2022.

2022 Summary

Corporate

-- Dale Ferguson appointed as Interim Chief Executive Officer in

July after David Archer stepped down. The search for a permanent

CEO replacement was initiated and remains ongoing

-- Mary Jo Jacobi and Diogo da Silveira joined the Board as

Independent Non-Executive Directors with Manohar Shenoy (formerly

Alternate Director to Maqbool Ali Sultan) appointed as a

Non-Executive Director; Maqbool Ali Sultan (Non-Executive Director)

and Murtadha Ahmed Sultan (Alternate Director for Imad Sultan)

retired from the Board

-- Finances robust: Loss from continuing operations reduced to

GBP2.7m (2021: GBP3.5m) and year end cash reserves of GBP7.2m

(2021: GBP13.0m). If a positive decision on the Project's

Environmental Report is received from the Portuguese environmental

regulator ('APA') , cash reserves will carry the Company into the

second phase of the environmental licencing process and allow

Savannah to progress the Definitive Feasibility Study ('DFS') on

the Barroso Lithium Project (the 'Project')

Barroso Lithium Project, Portugal

Technical

-- Agreed with APA to progress its review of the Project's

Environmental Impact Assessment ('EIA') via the time-controlled and

more interactive 'Article 16' process

-- A number of constructive meetings were held with APA and

members of its Evaluation Committee as part of the Article 16

process. Feedback from these meetings and other stakeholders was

used by Savannah and its consultants to optimise a range of design

elements which were captured in its revised Environmental Report

and Mine Plan for the Project

-- Design of process flowsheet finalised, based on standard

plant and environmentally friendly reagent regime

-- Decarbonisation Study initiated with results for the first

phase of the study announced in February 2023

Stakeholder and Government Engagement:

-- Relationships with a number of key stakeholders refreshed

after initiation of the Article 16 process and team changes within

Savannah

-- Opened an additional information centre in the local area,

recruited new staff from the local population, continued to give

preference to local suppliers of goods and services, and provided

support to local groups and events

-- Commissioned social performance consultancy, Community

Insights Group ('CIG'), to support with stakeholder engagement and

produce a Social Impact Assessment

-- Met with European Commission officials and Portuguese

Government Ministers and Secretaries of State responsible for

Economy, Environment, Energy and Infrastructure portfolios

Commercial

-- Offtake & Investment: Third party commercial interest in

the Project remains strong and Savannah maintained discussions with

multiple parties around future offtake and partnership

opportunities

-- Memberships: Savannah added to its memberships of relevant

trade bodies being accepted as a member of the European Association

of Mining, Metal Ores & Industrial Minerals ('Euromines')

-- EV sales: Global sales increased by 55% to reach 10.5m

vehicles during 2022. Europe remained the second largest market

behind China (6.2m vehicles), seeing growth of 15% to nearly 2.7m

vehicles.

-- Lithium prices: All three key lithium raw materials,

spodumene concentrate, lithium carbonate and lithium hydroxide saw

their prices more than double during 2022 as demand remained

extremely robust and supply challenged. The spodumene concentrate

price increased by over 150% to nearly US$7,000/t in December

2022

2023 Year to date summary

Barroso Lithium Project, Portugal

-- Article 16 process:

o Environmental Report, Mine Plan and associated documentation

for revised Barroso Lithium Project completed and submitted to APA

on 16 March 2023

o Submission of the documents initiated 50 business day

assessment period available to APA. Deadline for the notice of

APA's Environmental Impact Statement set at 31 May 2023

o Project documents made public by APA initiating public

consultation period

o Series of in-person Project-related meetings held with local

stakeholder groups

o Community Information Sheet summarising revised Project design

and operating plan posted to all households in Boticas Municipality

and made available on the Company's website; series of Fact Sheets

on the key individual elements of the Project's design and

Savannah's plans made available on the Company website and at

various locations within the local communities

o New corporate video released following submission of the

documents to APA

-- Social Impact Assessment: Completion of first phase 'Social

Issues Scoping Report' by CIG. Findings used to shape Savannah's

ongoing interaction and communication with stakeholders as well as

the specifics of its Project-related benefit-sharing plan

-- Decarbonisation study: First stage of study completed.

Concluded battery powered electric mining equipment represented

Savannah's best route to zero Scope 1 emissions. Scope 2 emissions

had already benefitted significantly from increasing renewable

energy contribution to Portuguese grid power and further work

should be undertaken to secure 100% renewable power for the

Project

-- European Critical Raw Materials ('CRM') Act: New Act

introduced by the European Commission seeking at least 10% of

Europe's future consumption of CRMs, including lithium, to be

supplied from domestic sources, such as the Barroso Lithium

Project

-- Project Scoping Study: Assuming APA issues a favourable

Environmental Impact Statement after the current review period,

Savannah will publish a new Scoping Study based on the revised

Project design submitted to APA which incorporates current

consensus spodumene concentrate price forecasts. Savannah would

expect to publish this study in early H2 2023.

Electronic Communications

The Company's full Annual Report and Financial Statements are

available for download on the Company's website at:

https://www.savannahresources.com/investors/corporate-documents/

In accordance with the Company's Articles of Association and

both section 1143 and 1259 of the Companies Act 2006, the Company

is to elect to distribute company communications electronically or

via a website rather than by sending printed copies of all

documents by post. This will reduce the Company's carbon footprint

and as a result, in future all company communications, including

the Annual Report and Financial Statements and Notice of AGMs will

only be mailed to shareholders who elect to opt out of receiving

electronic communication. The Company's Share Registrars will be

distributing letters to registered shareholders to obtain their

preference for future Company communications.

Notice of the Company's AGM will be announced in due course.

Regulatory Information

This Announcement contains inside information for the purposes

of the UK version of the market abuse regulation (EU No. 596/2014)

as it forms part of United Kingdom domestic law by virtue of the

European Union (Withdrawal) Act 2018 ("UK MAR").

Savannah - Enabling Europe's energy transition.

Follow @SavannahRes on Twitter

Follow Savannah Resources on LinkedIn

For further information please visit www.savannahresources.com

or contact:

Savannah Resources PLC Tel: +44 20 7117 2489

Dale Ferguson, CEO

SP Angel Corporate Finance LLP (Nominated Tel: +44 20 3470 0470

Advisor & Joint Broker)

David Hignell/ Charlie Bouverat (Corporate

Finance)

Grant Barker/Abigail Wayne (Sales & Broking)

RBC Capital Markets (Joint Broker) Tel: +44 (0) 20 7653 4000

Farid Dadashev/ Jamil Miah

Camarco (Financial PR) Tel: +44 20 3757 4980

Gordon Poole/ Emily Hall / Fergus Young

CHAIRMAN'S STATEMENT

The energy transition accelerates

The global energy transition, in which lithium is set to play

such a critical role, moved forward rapidly in 2022. Russia's

invasion of Ukraine, which is now sadly into its second year, has

led western nations to rapidly reduce their reliance on Russia's

production of oil & gas. As energy prices have soared as a

result, this has placed even greater emphasis on the need for

significant, and rapid, increases in domestic renewable energy

generation capacity and accompanying energy storage methods.

Lithium batteries have a key role to play in renewable energy

storage, in addition to the critical role they are already playing

in the ever-growing electric vehicle market.

This global geopolitical backdrop continues to create a

favourable economic environment for Savannah's planned development

of the Barroso Lithium Project (the 'Project') in Portugal. As was

the case in 2021, EV sales have seen significant year-on-year

growth (55% to 10.5m worldwide) and the suite of lithium raw

material products - spodumene concentrate, lithium carbonate and

lithium hydroxide saw further notable price rises during the year,

as supply struggled to keep pace with the rising level of demand.

The price rises weren't quite as marked as those seen as the global

economy began to reawaken in 2021 (+250%-500%). However, all three

key raw materials saw their prices more than double during 2022,

with the spodumene concentrate price, which is the particular focus

of Savannah, increasing by over 150% (source: S&P Global

Platts) to nearly US$7,000/t in December 2022.

During 2022, there was also a notable change in the level of

government support in certain western countries for strategic

mineral production and industries key to the energy transition. The

US, Canada and Australia began to catalyse the energy transition

they are targeting for their economies, with the provision of

funding for projects deemed critical to its successful execution.

The EU's 'Critical Raw Materials Act' which was published in

mid-March 2023 identifies lithium as both a critical and a

strategic raw material and calls for at least 10% of the EU's

annual demand for strategic raw materials, such as lithium, to be

sourced from domestic supplies by 2030. Among many other measures

the Act also talks of selected 'Strategic Projects' benefiting from

support for access to finance and shorter permitting timeframes.

Whether our own Project receives financial support will come down

to specific factors no doubt, but we were pleased to see that a

clear message in support of domestic, responsibly managed

production of critical raw materials for use in Europe was given by

the region's governing body. We firmly believe that our industry,

particularly when focused on provision of the 'new' raw materials

which society so desperately needs if it is to effectively tackle

climate change, can sit comfortably alongside communities and other

industries and earn a valued place in society.

Transition within a transition

While the market backdrop to our efforts grew stronger in 2022,

and commercial interest in the Project remained very encouraging,

two events specific to our own situation last July required us to

adapt rapidly and effect our own transition to keep our goal of

responsible lithium raw material production on track. As

shareholders will remember, the first event was the proposal from

Portugal's environmental regulator that the evaluation process of

the Project's Environmental Impact Assessment ('EIA'), the major

step in obtaining the Environmental licence required, should

continue under 'Article 16' of the relevant legislation. Following

the previous phases of the EIA review process, which began in 2020,

we took the decision to accept this proposal as this option

featured both a fixed time period, 180 working days, and provided

Savannah with greater opportunity to engage directly with

Portugal's environmental regulator, Agência Portuguesa do Ambiente

('APA') than in previous phases. The second event was the departure

of David Archer from the CEO role, after nearly nine years at the

helm. Both events created a sizeable challenge for our Company but

pleasingly, as I discuss below, our team have shown great fortitude

and commitment when it has been needed and have led us to the point

we have now reached, awaiting a decision on the Project's future in

just a few weeks.

Taking responsibility and moving forward

During his long tenure as CEO, David Archer did much to progress

Savannah to a point where it wholly owns, in a stable European

jurisdiction, one of the most significant projects in one of the

market's most prized commodities. After his departure, it was

important that those remaining make the most of this opportunity.

It was also important that we quickly appointed a new CEO who could

not only take on the CEO's duties around market and stakeholder

engagement, but also take a leading role in the upcoming engagement

with APA in the Article 16 process.

Dale Ferguson, Savannah's long time Technical Director and a

significant shareholder, was the ideal candidate and I was

delighted he accepted the role on an interim basis to steer the

Company through the then unknown process of Article 16. With so

much to be done against the clock, it has been equally pleasing to

see other members of the team also step up and take on new and

greater responsibility. In many cases this has meant managing

relationships with key stakeholders and potential partners in

addition to other duties. While we don't shy away from the reality

of the challenge that faces us in terms of wider acceptance, I

believe that many of our relationships with key stakeholders are

improving, even when views on the Project may not always be

shared.

Beyond the CEO change, we have also made other changes to our

board with the focus on broadening the knowledge and relevant

experience of the Group in readiness for the much-desired move

towards production.

As Maqbool Ali Sultan (Non-Executive Director) and Murtadha

Ahmed Sultan (Alternate Director for Imad Sultan) retired from the

Board, Manohar Shenoy (Alternate Director to Maqbool Sultan) became

a Non-Executive Director and Mary Jo Jacobi joined last April as an

Independent Non-Executive Director. Mary Jo brings a wealth of

experience in business and ESG matters gained through time with

major energy companies and banks, as well as periods working in the

public sector both in the UK as a member of the UK Advisory

Committee on Business Appointments, and the US as Assistant United

States Secretary of Commerce, and Special Assistant to US President

Ronald Reagan. Mary Jo has already made a valuable contribution

providing sage advice around communication of our key messages and

helping to orientate our focus in the rapidly evolving landscape of

ESG guidelines and reporting.

In November, Diogo da Silveira joined as another Independent

Non-Executive Director. As a former McKinsey Partner, CEO of

Portuguese forestry operator, Navigator, and current Chair of

Floene Energias, the leading Gas Distribution System Operators in

Portugal, Diogo has significant business experience, particularly

within Portugal. As a result, he has a comprehensive network among

Portugal's leading players in multiple industries as well as

amongst politicians, key decision makers, and opinion leaders.

Diogo is now taking a leading role in communicating the key

messages from the revised EIA to the Portuguese political and

business communities and the media.

Meanwhile the search for a permanent CEO continues. If we are

fortunate enough to receive a positive decision from APA and can

move ahead with the Project's ongoing evaluation and development,

it would be ideal to have a new CEO in place as early as possible

for that journey. However, we are looking for a very specific

combination of skills, not least the ability to lead what is

effectively a Portuguese business, making sure it integrates

effectively into Portuguese business and social frameworks, while

also being comfortable with the technical and social challenges of

mining and dealing with international investors and other

stakeholders. We look forward to making an appointment during

2023.

EIA: We listened and responded

When writing my statement for last year's Annual Report I said

that our key focus for 2022 would be on getting the approval of the

EIA for the Barroso Lithium Project in Portugal. It was indeed the

main focus of all of 2022, but not in the way we expected at the

beginning of the year. At the start of 2022, we had expected to

receive a decision on the initial EIA during the year. However, as

shareholders will now be very well aware, the regulator, APA,

suggested in July that in order to progress its review of the EIA,

the application should move into the so-called 'Article 16'

process. Updates on this process are given throughout our Annual

Report but as we stated in our 6 July announcement, after the

extended previous phases of the review process we welcomed this

phase's strict time-control element and the opportunity it brings

to engage regularly in-person with APA. Having submitted our

revised EIA by the 17 March deadline set by the Article 16 process,

we now expect a decision from APA on or before 31 May 2023.

Dale Ferguson and his team have certainly taken on board the

feedback received from APA and have adapted the Project's design to

reflect these preferences including with respect to the road

layout, the storage of mine waste and tailings, protection of water

courses and aquatic ecosystems and shorter hours of operation in

the mining operations. We hope our team's effort has resulted in a

final design which is to APA's satisfaction so we can move forward

with the Project.

Being responsible and respectful to stakeholders

We have persistently tried to engage with all stakeholders,

particularly local communities, through a variety of formats during

our time on the Project. During the year, for example, we increased

the number of information centres in the area with shop space taken

in the centre of Boticas town and we were pleased to recruit new

staff from the local population to staff the centres and to

represent Savannah in the community. However, during this extended

period of EIA review, it has been difficult to provide

comprehensive and timely information on the Project and its status

while significant uncertainties persist.

Pleasingly, some good progress is being made with a Social

Impact Assessment (the 'Assessment' or the 'SIA') in relation to

the Project. In the first phase of the study, completed in Autumn

2022, Community Insights Group were on the ground in the local

area, listening to views of local people on the Project and their

expectations and preferences for benefit sharing from the Project.

The resulting 'Social Issues Scoping Report' was submitted to APA

as part of Savannah's revised EIA submission and Savannah has used

these findings to shape its current and future communication with

stakeholders now that the revised EIA has been resubmitted and its

details made public.

Some of the new formats being tried as a result of the study are

a comprehensive series of fact sheets which summarise the key

topics in the EIA as well as a second community information sheet

which summarises the Project and highlights the new features which

have been introduced to further reduce the Project's impact

following feedback from stakeholders.

Financial Overview

Starting 2022 with a cash balance of GBP13.0m put Savannah in a

strong position to begin its plans to progress the Barroso Lithium

Project Definitive Feasibility Study (' DFS ') . The unexpected

development in the environmental licencing process caused by the

movement into the additional Article 16 phase caused Savannah to

change its planned activities somewhat. However, continuing prudent

cost management has resulted in a year end cash balance of GBP7.2m.

Importantly, throughout the period, the Company continued to invest

in its asset base in Portugal (GBP2.6m; 2021: GBP1.9m). Hence, our

opening cash position for 2023 is more than sufficient to see us

through the Article 16 process, and will carry us into the second

phase of the environmental licencing process and allow us to

progress the DFS, which would follow a positive decision from APA

on the EIA.

In terms of the broader financial performance, Savannah recorded

a loss from continuing operations of GBP2.7m (2021: GBP3.5m) with a

GBP0.8m exchange rate gain resulting from treasury management

(2021: loss GBP0.2m). Administration fees were relatively flat over

the period at GBP3.5m (2021: GBP3.3m), however H2 2022

Administration fees were GBP0.3m lower than in H1 2022, resulting

from a reduction in professional fees plus the remuneration costs

eliminated following the departure of David Archer who stepped down

as CEO in July.

Outlook

Our team has worked tremendously hard over recent months to make

the revisions to the Project's design and I thank them sincerely

for all their efforts. We hope the resulting EIA will meet with

approval from APA's Evaluation Committee and the wider stakeholder

group as well. We are currently undertaking a fresh communication

campaign in the local communities to explain the changes we have

made to the Project and to explain the potential benefits it can

bring to local society. Assuming that Savannah receives a positive

decision from APA, we will look to move forward with the Project in

a responsible way, being sure to communicate its plans to all

stakeholders.

As we look towards the future, your board will continue to

follow the same responsible approach it has adopted up to now in

the overall management and positioning of Savannah. As we all know,

the continuation of the conflict in Ukraine and wider global

geopolitical tensions are placing considerable strain on the global

economy in the near term through rising cost inflation and risks to

supply chains. While the underlying market drivers for the

development of the Barroso Lithium Project remain positive,

Savannah's board will continue to closely monitor both internal and

external risks to the business, and make decisions with a clear

focus on the long term stability and growth of the business.

For 2023, subject to receipt of the EIA, the next steps in the

overall Project development process would include; re-commencing

the fieldwork required for the DFS and advancing the Study,

initiating the second, Environmental Compliance Report of the

Execution Project ('RECAPE') phase of the environmental licencing

process, and progressing with the decarbonisation study and offtake

discussions. We also plan to provide a new Scoping Study on the

Project based on the latest design and updated lithium price

forecasts. Putting an initial offtake agreement or strategic

partnership in place would then, along with the completion of all

outstanding technical studies in 2024, allow Savannah to move into

project financing and initiating construction of the Project in

2025. 2026 would bring the completion of construction and the long

awaited first production of spodumene concentrate from the Barroso

Lithium Project. With that agenda ahead, 2023 could be Savannah's

most exciting year to date. My thanks also go to our shareholders

for their own commitment to being part of Savannah's journey.

Matthew King

Chairman

Date: 4 April 2023

CHIEF EXECUTIVE'S REPORT

It is an exciting time to be writing my first CEO report because

in a few short weeks we will reach a defining moment for our

Company. By the end of May the decision from the Portuguese

environmental regulator on the Barroso Lithium Project

Environmental Impact Assessment is due to be announced. If we

receive a positive decision at that point, the development of the

Project as a source of responsibly produced lithium raw material in

Europe, and for Europe, will move a significant step closer.

Everyone at Savannah along with our consultants and advisers has

worked fantastically hard to get the Company to this point. Whether

it has been working on the revised EIA submission itself, producing

communication materials in support of the EIA, meeting with

stakeholders and shareholders, maintaining relationships with

potential commercial partners, or managing our spending and cash

flow, everyone has played their part. Many of the dedicated

employees and Directors are also shareholders, including

myself.

If the award of an environmental licence was based on effort

alone, I'm sure Savannah would receive one. However, as part of

taking a responsible approach I should reiterate that we cannot

provide a guarantee that the regulator will give a positive

decision. If we receive a negative decision, we would be required

to submit a wholly new EIA for the Project. Equally, I am keen to

point out, particularly to the population living near the Project,

what a positive decision would mean in respect of Project

construction timelines and other associated work streams. I have

outlined the 'next steps' in the process below, so that everyone is

clear about what lies ahead and when to expect each step to take

place. Stakeholders can be assured that Savannah will match the

outstanding technical work that must be completed before we reach a

Final Investment Decision with ongoing community and stakeholder

engagement.

While much of the talk over the past year has been about the

EIA, it is important to highlight that from a commercial

perspective, the Project remains the same. There has been no change

to the overall JORC compliant resources present on the Project

across the C-100 Mining Lease (23.5Mt at 1.02% Li(2) O) and Aldeia

Mining Lease Applications areas (3.5Mt at 1.3% Li(2) O). The Mine

Plan submitted to APA is still based on the sequential mining of

four spodumene lithium bearing orebodies on the C-100 Mining Lease

and the assumed tonnage of 'mineable material' is also unchanged at

17.3Mt. The central plant will utilise conventional technology and

an environmentally sensitive processing circuit to produce

spodumene concentrate and a quartz-feldspar by-product. The annual

mining rate and spodumene concentrate annual production rate are

retained at around 1.5Mtpa and c.200ktpa, respectively, or

approximately 15% larger than the Project perceived for the 2018

Scoping Study.

Environmental Impact Assessment - Work done, decision

awaited

While the extension to the EIA review process was not something

we had planned for, I'm hopeful that the additional time spent will

ultimately prove to be a good investment for all stakeholders in

the Project and deliver the full opportunity for all which this

project can offer. Most importantly, the Article 16 process has

allowed us the direct engagement with APA and the other groups on

its Evaluation Committee which was very limited in the previous

parts of the EIA review process. I trust this engagement in turn

has resulted in us producing a revised design which gives the

decision makers the additional reassurances and peace of mind they

need to make an informed decision on the Project. We believe that

the revised design addresses the feedback we have received during

our constructive meetings with APA and its Evaluation Committee

while retaining many of the key components and features of the

original design, which have always made it a Project which tries to

balance the production of a mineral critical to Europe's efforts to

tackle climate change with being sympathetic to the local

environment and population.

Savannah has provided a series of updates in recent times on the

revised design and I briefly summarise just four of the key areas

below.

Waste management: Dry stack tailings storage to be maintained,

waste rock used for backfill

The original design included an 'Integrated Waste Landform'

approach to onsite waste storage, which would have seen the inert

waste rock from the mine workings stored together with the inert,

dried, and compacted tailings from the processing plant in a highly

stable 'dry stack' structure. This innovation meant that there

would be no traditional, upstream 'wet' tailings dam. In the

revised design, the same innovative, stable dry stack approach is

maintained for the tailings, however, waste rock and tailings will

be stored separately. Furthermore, despite the inert nature of the

tailings, the storage facility will be lined with an impermeable

membrane, eliminating the possibility of any solutions from the

tailings percolating into the subsoil and entering groundwater.

Furthermore, the natural groundwater flow direction from the

tailings storage facility ('TSF') is back towards the Pinheiro pit,

which would contain any fluids moving away from the TSF if the

lining was compromised. This represents another degree of

environmental protection which the new design provides.

Simulation of the Grandao pit, tailings storage facility,

processing plant and water storage facilities during the operating

phase (left) and following rehabilitation, landscaping,

revegetation and closure (right):

Source: Company

To meet with the additional requirements of APA, significant

quantities of waste rock will now be stored in Waste Rock

Facilities ('WRFs') and then used for backfill purposes. Savannah

has taken an extremely cautious approach to this aspect of the

design and ensured that in the unlikely event of any failure of the

largest WRF adjacent to the Grandao pit, it can be contained in the

valley immediately surrounding the structure and no material will

reach the Covas River. Under the new plan, the smaller Pinheiro and

NOA pits will be completely backfilled, while the larger Grandao

and Reservatorio pits will be backfilled to above the local water

table to avoid the formation of a waterbody at each pit. In

addition, any watercourses impacted by the workings will be

remediated and reinstated. A proposed WRF to the north of the

Grandao deposit has now been moved to avoid impact on marshland in

that area. There is no risk from acid mine drainage as test work

shows that the waste rock is inert and that any trace elements will

not be leached out. Sediment runoff from the WRFs reporting to the

Covas River is considered the main risk associated but detailed

designs have been drawn up to ensure that this will not happen. The

residual, permanent WRFs will be landscaped into the natural

topography and revegetated with native species.

Water: Local supply and aquatic environment to be unaffected due

to Project's self-sufficiency & recycling

In our design we have carefully considered both the Project's

own water requirements and its impact on the area's water

ecosystem.

The Project will be its own water source with water collected

from within or beneath mine workings and from the wider Project

footprint. The water will then be stored in dedicated facilities on

the Project (see image on 'Waste management: Dry stack tailings

storage to be maintained, waste rock used for backfill' section)

which will also act as sediment control structures and have been

designed to withstand a once in a 100 year storm event. This

approach means there will be no requirement to extract water from

the Covas River. The Project's water system is made more efficient

by the 85% recycling level expected to be achieved in the

processing plant, which accounts for 80% of the Project's overall

water requirement. With this level of recycling, which includes

using recycled water in the Project's buildings for drinking, means

that once the system is filled (a process which can begin during

the construction phase) the annual requirement for 'top up' water

will equate to less than half of the Project's total water

requirement.

In terms of protecting the local water ecosystem, the Project's

water system will be a closed network, with significant water

treatment infrastructure and recycling capacity installed. Process

water will not be discharged to the environment, and any water that

does need to be released will meet with the Portuguese Government's

regulations. Furthermore, due to the local geology and poor flow

rates in the area's aquifers, the Project is not expected to

influence groundwater abstraction for either public supply (the

nearest extraction point is 1.3km upstream from the nearest pit) or

agricultural use. However, Savannah has committed to install a

replacement water source of equal size if there is any impact.

As highlighted above, Savannah has committed to avoiding impact

on watercourses wherever possible to protect these important

habitats and to preserve water quality. Where location of workings

or infrastructure makes this avoidance impossible, Savannah has

designed to minimise impact. For example, the new river crossing

that will be required to access the Reservatorio and NOA deposits

will feature a single span bridge to avoid infrastructure in the

river and to minimise disturbance on the riverbank. Savannah will

rehabilitate watercourses on a progressive basis where they have

been impacted.

Road access: Avoiding local villages and towns, improving access

to the area

A detailed Traffic Study in accordance with the regulations of

the Municipal Master Plan (PDM de Boticas) and Infraestruturas de

Portugal, S.A. (IP, SA) was completed into access options for the

planned Project for both light and heavy vehicles and to access

potential impacts. Based on this study and stakeholder consultation

a transport plan was developed including two new roads which will

further limit the movement of Project-related traffic through local

communities. Savannah has committed to limiting road transport to

weekdays only between 7am and 8pm and by accessing the Project from

the north of the concession with a new purpose built 11.6km access

road, which connects the Project to the R311 highway, all

communities to the north of the Project would be bypassed and no

water crossings would be required. Furthermore, a section of this

road will be available for use by the public. A second proposed

17km bypass section connecting to the A24 highway would also avoid

traffic passing through Boticas, Granja and Sapiaos which will mean

that no Project traffic will pass through any villages or towns

between the Project and the A24 freeway.

Rehabilitation

The revised EIA sees Savannah reiterating its previous

commitment to rehabilitation of the Project area. Our objective at

the end of the project is to leave the land rehabilitated, safe,

valued and with new opportunities for different uses by the

population. Savannah commits to ensuring future sustainable use,

whether for tourism, agriculture, or other purposes. Today, of the

271 hectares (2.71km(2) ) which will be temporarily or permanently

impacted by the Project's development is 95% forest or scrub

vegetation with just 14 hectares, or 5%, consisting of agricultural

land and pastures. Hence, the operation's impact on local

agricultural land is very limited. Furthermore, one of the key

advantages of the Barroso Lithium Project is that mining will take

place in a sequential fashion which will allow for continual

rehabilitation from early in the Project's life. Hence, the Project

will never have large, disturbed areas and only essential operating

areas will be left open at the end of the Project's operating life

for the final phase of rehabilitation. Soil removed from working

areas will be carefully stored, maintained and enhanced to allow

its use during the landscape recovery phase.

Barroso Lithium Project: Proposed new road layout avoids

Project-related traffic passing through local villages:

Source: Company

Focus will be placed on harmonising the Project area back into

the local landscape by contouring landforms and backfilling the

pits, replanting with native species of plants and trees, some of

which have been lost in forest fires. In turn, this will encourage

local fauna to recolonise previously impacted areas.

On closure, the processing plant, other supporting facilities,

semi-mobile and fixed equipment will all be dismantled and removed

from site. Structures used to deviate existing water courses will

also be removed, and water courses reinstated as close to their

original orientation as reasonably possible. Office buildings and

other facilities could be retained for subsequent alternative use

by the local community or local businesses.

Monitoring of key environmental performance indicators, such as

water quality, will be maintained over the long term once

rehabilitation is completed. The Project area will be offered to

the respective Parish Councils, making it available for use by the

communities for agriculture, tourism, and community owned

businesses.

Stakeholder Engagement - As critical as the mineral itself

The extra time added by the Article 16 process, as well as the

management and responsibility changes that we have made amongst our

team in the past nine months, has allowed us to refresh and

strengthen our relationships with key contacts within local and

national government, associated agencies and the broader

stakeholder group. As a result, we are pleased with the greater

level of engagement we are achieving with key contacts.

As the Chairman outlined, we have also been undertaking more

'hands on' interaction with local communities under the banner of

the Social Impact Assessment via Community Insights Group ('CIG').

As part of this exercise, CIG will be training our own staff to

make for more effective engagement with community members going

forward. We have also been proactive in our provision of

information about the revised EIA for the community. The community

information sheet, mentioned by the Chairman, was delivered to

every residence in the Municipality, and the follow up fact sheets

on individual EIA topics hopefully press home the key messages we

are keen to make regarding the responsible manner in which we have

designed and plan to operate the Project. We are looking forward to

feedback on these publications as the Social Impact Assessment work

continues.

Although they do not represent examples of the positive

stakeholder engagement we are trying to generate, we are also

equally comfortable to provide an update on the two legal cases

which have been brought involving our Project.

In the civil claim lodged by the Management Commission of the

Covas do Barroso Baldios (the 'Baldios Commission') against certain

private landowners in respect of some land packages at the Project

which they sold to Savannah (RNS 25 July 2022), Savannah and the

private owners submitted their contestation to the lawsuit at the

end of October 2022. The claimant had until 13 January 2023 to

reply to our contestation, which it did not. On 24 January 2023,

the Vila Real district court provided an additional timeline of 10

working days for the Baldios Commission to reply, this time only

applies to the legal protocols (i.e., not the legal arguments in

the lawsuit). During that extension the Baldios Commission

requested the judge to provide a minimum of 30 days to allow it to

correct some documentation and a response is awaited from the

judge. Assuming this request is granted, and the Baldios Commission

is permitted to amend its documentation, we would then have to wait

for the Vila Real district court to set a date for a preliminary

hearing (expected mid-2023).

In the case brought by the Parish of Covas do Barroso ('Parish

Council') against the Republic of Portugal and the Ministry of

Economy as defendants in which Savannah's wholly owned subsidiary,

Savannah Lithium Unipessoal Lda, was joined as the

counter-interested party (not a defendant), the Mirandela Fiscal

and Administrative Court acquitted the defendants and Savannah's

subsidiary in February 2023 having ruled that the defendants were

not the legitimate parties in the lawsuit. The case was

subsequently extinguished in March 2023 after the period available

for the Parish Council to appeal expired. The litigation was

seeking to nullify certain administrative actions taken by the

defendants in June 2016 including the addition of lithium to and

the expansion in the area of the C-100 Mining Lease.

The lawsuits have neither impacted the Barroso Lithium Project's

activities nor the current environmental impact assessment process

which is moving to a conclusion. The C-100 Mining Lease which

contains the Barroso Lithium Project is fully granted, has a term

of 30 years to 2036 and remains in good standing. The advice from

Savannah's lawyers was and remains that the both the extinguished

and ongoing claim are without foundation.

Next steps - The Barroso Lithium Project through to

production

Ongoing licencing:

As we have flagged in our recent releases, if we receive a

positive 'DIA' decision from APA at this stage, we expect it will

be conditional upon us fulfilling some further specific design

requirements which will be set out with the decision. This is a

normal aspect of the environmental licencing process, which

Savannah has planned for, and this will be managed through the

remainder of the licencing process.

The DIA award is the first approval in a multi-stage

environmental licencing process. Receipt of the DIA would allow the

approval process to move on to the subsequent Environmental

Compliance Report of the Execution Project (' RECAPE') and

environmental licence stages during which approval of the Project's

detailed final designs are received ('DCAPE') and the Project's

environmental title is awarded. These stages are expected to run in

parallel. If Savannah receives a positive DIA decision, we expect

the RECAPE phase to take approximately 9-12 months, meaning the TUA

could be awarded in second half of 2024.

Once the DCAPE declaration has been made and environmental

licence received, Savannah will then be able to apply for the

remainder of the licences required for the Project's development

and operation. These licences cover permissions for construction

and use of services on site such as power and water. The conditions

set by the DIA and the agreement of the Project's final designs in

the RECAPE phase will also provide important input parameters for

the DFS.

Updated Scoping Study:

The extended timetable on EIA and the accompanying Definitive

Feasibility Study has meant we have not been able to publish an

update to the 2018 Project Scoping Study. If the DIA decision is

positive, we will prepare and publish a new Scoping Study in the

second half of 2023 based on the revised EIA and Mine Plan. This

study won't reflect all of the details which will come through the

RECAPE phase, however it will act as a useful prelude to the

Definitive Feasibility Study for all stakeholders. As many

shareholders will know, cost inflation in the mining sector over

the last 12 months has been running at over 20%, and Savannah will

need to reflect this in our modelling, along with any additional

costs (and savings) that result from the latest Project design.

Overall, between inflation and the Project's expansion and the EIA

revisions, we expect this to result in an increase in capex from

the c.US$125m (including contingencies) estimate in the Scoping

Study nearly five years ago. However, no amount of cost inflation,

however sizeable, has matched the 1300% inflation seen in lithium

prices since the low of US$375/t in August-October 2020. While we

will not run our models using today's spot price of US$4,750/t over

the long term, we will be able to incorporate a spodumene price

deck which reflects updated forecasts from banks, brokers and

market commentators, which all far exceed the average US$685/t we

used in the 2018 Study. I am confident, the new Scoping Study level

economics will remain highly positive.

Definitive Feasibility Study:

In terms of timing, a ssuming a positive DIA decision is

received, work to complete the DFS will be undertaken in parallel

with the remainder of the environmental licensing process.

Alongside the final Project designs which will come through the

RECAPE phase of the ongoing environmental licencing process, a

modest fieldwork programme is also required. This will include

drilling for reserve and resource delineation and geotechnical

purposes. This programme has been planned and Savannah would look

to initiate it during H2 2023, subject to the DIA decision.

Savannah expects the DFS to be completed no later than 12 months

following the restart of the required fieldwork , so in H2

2024.

Importantly, the process flowsheet for the concentrator plant

was finalised in Q1 2022. Based on industry standard equipment and

processing techniques and an environmentally friendly reagent

regime, which complies with all relevant regulations and allows

both mica and spodumene flotation to operate at near neutral pH,

the plant will be capable of producing a high quality, spodumene

concentrate grading >=5.5% Li(2) O with low levels of

impurities.

Decarbonisation Study:

We are excited and committed to decarbonising the Project and

achieving our goal of net zero carbon over the life of the Project.

The first phase of the Decarbonisation Study took longer than we

had expected, but we have been pleased by its findings, including

the 54% reduction in the calculated Scope 2 emissions the Project

before we initiate any changes. We have also been very pleased by

the interest we have generated with a number of OEMs (vehicle

manufacturers), which are developing new zero emissions surface

mining vehicles. As we announced in early 2023, we will be further

investigating some of the key recommendations from the first phase

of the study in the second phase, with the assistance of our

consultants and ABB. This will include our options around

increasing the renewable power supply to the Project and forging

commercial partnerships with one or more of the OEMs which has

expressed interest in working with Savannah. We look forward to

providing further updates on the study during the year and

incorporating its final recommendations into our DFS and subsequent

operations.

Commercial discussions:

With our focus on the EIA in recent months, we have not been

looking to finalise offtake agreements during the period. Equally,

for most of the counterparties we have been in discussions with,

the uncertainty regarding the EIA has checked their own willingness

to commit to a long term commercial arrangement. Importantly

though, the level of underlying interest in Savannah's future

production of spodumene concentrate has not waned, despite the EIA

process. We continued to receive new commercial inquiries

throughout the year and that has also continued into 2023. This is

clear evidence, along with the persistent high price levels, that

sourcing of lithium raw materials, particularly from low risk

jurisdictions remains a significant challenge for downstream

users.

EV sales have remained very strong with European EV sales

growing again to 2.7m units (+15%) as part of global sales of 10.5m

(+55%, source EV-volumes.com). Hence, when Savannah is in a

position to proceed to finalise commercial arrangements, which we

expect to do next year, we will be pushing hard to secure deals

which meet our criteria including working with a partner or

partners committed to using Savannah's product within the European

battery value chain, willing to talk about pricing levels in line

with reported spot prices at the time, and prepared to contribute

significantly towards the CAPEX of our Project as part of the

offtake's financial arrangements.

European Electric Vehicle Sales Global Electric Vehicle

Sales

Source: EV-volumes.com

Construction & Production: 2025, 2026 and beyond:

If the above timetable can be met, Savannah should be in a

position to make its final investment decision on the Project in

late 2024 / early 2025 and move on with securing the finance

required to construct the Project. Construction could then begin in

H2 2025, and is expected to take approximately 15 months.

Commissioning of the plant, ramp up of production, and delivery of

Savannah's first product to a European customer could then all take

place in H2 2026.

Outlook

Getting Savannah to this point, where we are just a few weeks

away from receiving a DIA decision that we have waited for since

2020, has been a huge effort for everyone in the Company. I would

like to take this opportunity to thank them for their hard work and

resolve. My thanks also go to our shareholders for their patience

and support, and to those stakeholders who have been willing to

engage with us over the past year. Savannah hopes to bring benefits

to all as it looks to make its contribution to Europe's efforts to

tackle climate change through the provision of responsibly sourced,

low carbon, European lithium.

Dale Ferguson

Chief Executive Officer

Date: 4 April 2023

The Financial Statements below should be read in conjunction

with the Notes contained within the full Annual Report which is

available online at the Company's website at:

https://www.savannahresources.com/investors/corporate-documents/

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME FOR THE YEARED 31

DECEMBER 2022

2022 2021

GBP GBP

CONTINUING OPERATIONS

Revenue - -

Other Income - -

Administrative Expenses (3,531,894) (3,305,649)

Foreign Exchange Gain/(Loss) 814,468 (213,088)

OPERATING LOSS (2,717,426) (3,518,737)

Finance Income 34,695 671

Finance Costs (265) (139)

------------ ------------

LOSS FROM CONTINUING OPERATIONS BEFORE

TAX (2,682,996) (3,518,205)

Tax expense - -

LOSS FROM CONTINUING OPERATIONS AFTER

TAX (2,682,996) (3,518,205)

(LOSS)/GAIN ON DISCONTINUED OPERATIONS

NET OF TAX (176,396) 2,371

------------ ------------

LOSS AFTER TAX ATTRIBUTABLE

TO EQUITY OWNERS OF THE PARENT (2,859,392) (3,515,834)

------------ ------------

OTHER COMPREHENSIVE INCOME

Items that will not be reclassified

to profit or loss:

Net change in Fair Value Through Other

Comprehensive Income of Equity Investments (19,598) 82,006

Items that will or may be reclassified

to profit or loss:

Exchange Gains arising on translation

of foreign operations 665,656 154,815

------------ ------------

OTHER COMPREHENSIVE INCOME FOR THE

YEAR 646,058 236,821

------------ ------------

TOTAL COMPREHENSIVE LOSS FOR THE YEAR

ATTRIBUTABLE TO EQUITY OWNERS OF THE

PARENT (2,213,334) (3,279,013)

============ ============

Loss per share attributable to equity

owners of the parent expressed in pence

per share:

Basic and diluted

From Operations (0.17) (0.22)

From Continued Operations (0.16) (0.22)

From Discontinued Operations (0.01) 0.00

CONSOLIDATED STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER

2022

2022 2021

GBP GBP

ASSETS

NON-CURRENT ASSETS

Intangible Assets 16,459,599 14,137,817

Right-of-Use Assets 17,627 5,390

Property, Plant and Equipment 1,583,944 676,536

Other Receivables 454,651 -

Other Non-Current Assets 77,667 69,542

TOTAL NON-CURRENT ASSETS 18,593,488 14,889,285

------------- -------------

CURRENT ASSETS

Equity instruments at FVTOCI 11,977 31,575

Trade and Other Receivables 560,060 962,058

Other Current Assets 1,036 19,300

Cash and Cash Equivalents 7,202,334 13,002,084

------------- -------------

TOTAL CURRENT ASSETS 7,775,407 14,015,017

TOTAL ASSETS 26,368,895 28,904,302

============= =============

EQUITY AND LIABILITIES

SHAREHOLDERS' EQUITY

Share Capital 16,889,598 16,889,598

Share Premium 41,693,178 41,693,178

Merger Reserve 6,683,000 6,683,000

Foreign Currency Reserve 626,930 (38,726)

Share Based Payment Reserve 403,749 305,095

FVTOCI Reserve (41,035) (21,437)

Retained Earnings (40,999,879) (38,284,665)

------------- -------------

TOTAL EQUITY ATTRIBUTABLE TO

EQUITY HOLDERS OF THE PARENT 25,255,541 27,226,043

------------- -------------

LIABILITIES

NON-CURRENT LIABILITIES

Lease Liabilities 12,263 -

------------- -------------

TOTAL NON-CURRENT LIABILITIES 12,263 -

------------- -------------

CURRENT LIABILITIES

Lease Liabilities 5,364 1,132

Trade and Other Payables 1,085,778 1,677,127

Other Current Liabilities 9,949 -

------------- -------------

TOTAL CURRENT LIABILITIES 1,101,091 1,678,259

------------- -------------

TOTAL LIABILITIES 1,113,354 1,678,259

------------- -------------

TOTAL EQUITY AND LIABILITIES 26,368,895 28,904,302

============= =============

The Financial Statements were approved and authorised for issue

by the Board of Directors on 4 April 2023 and were signed on its

behalf by:

Dale Ferguson

Chief Executive Officer

Company number: 07307107

COMPANY STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER

2022

2022 2021

GBP GBP

ASSETS

NON-CURRENT ASSETS

Investments in Subsidiaries 333,740 333,831

Other Receivables 31,877,211 26,184,402

Other Non-Current Assets 6,776 6,776

------------- -------------

TOTAL NON-CURRENT ASSETS 32,217,727 26,525,009

------------- -------------

CURRENT ASSETS

Equity instruments at FVTOCI 11,977 31,575

Trade and Other Receivables 238,189 207,129

Cash and Cash Equivalents 6,241,356 11,085,944

------------- -------------

TOTAL CURRENT ASSETS 6,491,522 11,324,648

TOTAL ASSETS 38,709,249 37,849,657

============= =============

EQUITY AND LIABILITIES

SHAREHOLDERS' EQUITY

Share Capital 16,889,598 16,889,598

Share Premium 41,693,178 41,693,178

Merger Reserve 6,683,000 6,683,000

Share Based Payment Reserve 403,749 305,095

FVTOCI Reserve (41,035) (21,437)

Retained Earnings (27,442,644) (28,707,640)

TOTAL EQUITY 38,185,846 36,841,794

------------- -------------

LIABILITIES

CURRENT LIABILITIES

Trade and Other Payables 523,403 1,007,863

TOTAL LIABILITIES 523,403 1,007,863

------------- -------------

TOTAL EQUITY AND LIABILITIES 38,709,249 37,849,657

============= =============

The Company total comprehensive income for the financial year

was GBP1,101,220 (2021: loss GBP7,851,723).

The Financial Statements were approved and authorised for issue

by the Board of Directors on 4 April 2023 and were signed on its

behalf by:

Dale Ferguson

Chief Executive Officer

Company number: 07307107

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY FOR THE YEARED 31

DECEMBER 2022

Share

Foreign Based

Share Share Merger Currency Warrant Payment FVTOCI Retained Total

Capital Premium Reserve Reserve Reserve Reserve Reserve Earnings Equity

GBP GBP GBP GBP GBP GBP GBP GBP GBP

At 1 January

2021 14,309,910 34,474,884 6,683,000 (193,541) 12,157 393,865 276,712 (35,450,713) 20,506,274

--------------- ----------- ----------- ---------- ---------- --------- ---------- ---------- ------------- ------------

Loss for the

year - - - - - - - (3,515,834) (3,515,834)

Other

Comprehensive

Income - - - 154,815 - - 82,006 - 236,821

----------- ----------- ---------- ---------- --------- ---------- ---------- ------------- ------------

Total

Comprehensive

Income for

the

year - - - 154,815 - - 82,006 (3,515,834) (3,279,013)

Issue of Share

Capital (net

of expenses) 2,579,688 7,218,294 - - - - - - 9,797,982

Share based

payment

charges - - - - - 200,800 - - 200,800

Lapse of

options - - - - - (289,570) - 289,570 -

Lapse of

warrants (12,157) - - 12,157 -

Disposal of

FVTOCI

investments - - - - - - (380,155) 380,155 -

----------- ----------- ---------- ---------- --------- ---------- ---------- ------------- ------------

At 31 December

2021 16,889,598 41,693,178 6,683,000 (38,726) - 305,095 (21,437) (38,284,665) 27,226,043

--------------- ----------- ----------- ---------- ---------- --------- ---------- ---------- ------------- ------------

Loss for the

year - - - - - - - (2,859,392) (2,859,392)

Other

Comprehensive

Income - - - 665,656 - - (19,598) - 646,058

--------------- ----------- ----------- ---------- ---------- --------- ---------- ---------- ------------- ------------

Total

Comprehensive

Income for

the

year - - - 665,656 - - (19,598) (2,859,392) (2,213,334)

Share based

payment

charges - - - - - 242,832 - - 242,832

Lapse of

options - - - - - (144,178) - 144,178 -

At 31 December

2022 16,889,598 41,693,178 6,683,000 626,930 - 403,749 (41,035) (40,999,879) 25,255,541

=============== =========== =========== ========== ========== ========= ========== ========== ============= ============

The following describes the nature and purpose of each reserve

within owners' equity:

Reserve Description and purpose

Share Capital Amounts subscribed for share capital at nominal value.

Share Premium Amounts subscribed for share capital in excess of nominal

value less costs of fundraising.

Merger Reserve Amounts subscribed for share capital in excess of nominal

value in respect of the consideration paid in an acquisition

arrangement, when the issuing company takes its interest

in another company from below 90% to 90% or above equity

holding.

Foreign Currency Gains/losses arising on retranslating the net assets of

Reserve group operations into Pound Sterling

Warrant Reserve Fair value of the warrants issued.

Share Based Represents the accumulated balance of share based payment

Payment Reserve charges recognised in respect of asset acquired and share

options granted by Savannah Resources Plc, less transfers

to retained losses in respect of options exercised, lapsed

and forfeited.

FVTOCI Reserve Cumulative changes in fair value of equity investments classified

at fair value through other comprehensive income (FVTOCI).

Retained Earnings Cumulative net gains and losses recognised in the Consolidated

Statement of Comprehensive Income and other transactions

recognised directly in Retained Earnings.

COMPANY STATEMENT OF CHANGES IN EQUITY FOR THE YEARED 31

DECEMBER 2022

Share

Based

Share Share Merger Warrant Payment FVTOCI Retained Total

Capital Premium Reserve Reserve Reserve Reserve Earnings Equity

GBP GBP GBP GBP GBP GBP GBP GBP

At 1 January

2021 14,309,910 34,474,884 6,683,000 12,157 393,865 276,712 (21,455,793) 34,694,735

---------------- ----------- ----------- ---------- --------- ---------- ---------- ------------- ------------

Loss for the

year - - - - - - (7,933,729) (7,933,729)

Other

Comprehensive

Income - - - - - 82,006 - 82,006

----------------

Total

Comprehensive

Income for the

year - - - - - 82,006 (7,933,729) (7,851,723)

Issue of Share

Capital (net

of expenses) 2,579,688 7,218,294 - - - - - 9,797,982

Share based

payment

charges - - - - 200,800 - - 200,800

Lapse of

options - - - - (289,570) - 289,570 -

Lapse of

warrants - - - (12,157) - - 12,157 -

Disposal of

FVTOCI

investments - - - - - (380,155) 380,155 -

---------------- ----------- ----------- ---------- --------- ---------- ---------- ------------- ------------

At 31 December

2021 16,889,598 41,693,178 6,683,000 - 305,095 (21,437) (28,707,640) 36,841,794

---------------- ----------- ----------- ---------- --------- ---------- ---------- ------------- ------------

Profit for the

year - - - - - - 1,120,818 1,120,818

Other

Comprehensive

Income - - - - - (19,598) - (19,598)

Total

Comprehensive

Income for the

year - - - - - (19,598) 1,120,818 1,101,220

Share based

payment

charges - - - - 242,832 - - 242,832

Lapse of

options - - - - (144,178) - 144,178 -

At 31 December

2022 16,889,598 41,693,178 6,683,000 - 403,749 (41,035) (27,442,644) 38,185,846

================ =========== =========== ========== ========= ========== ========== ============= ============

The following describes the nature and purpose of each reserve

within owners' equity:

Reserve Description and purpose

Share Capital Amounts subscribed for share capital at nominal value.

Share Premium Amounts subscribed for share capital in excess of nominal

value less costs of fundraising.

Merger Reserve Amounts subscribed for share capital in excess of nominal

value in respect of the consideration paid in an acquisition

arrangement, when the issuing company takes its interest

in another company from below 90% to 90% or above equity

holding.

Warrant Reserve Fair value of the warrants issued.

Share Based Represents the accumulated balance of share based payment

Payment Reserve charges recognised in respect of asset acquired and

share options granted by Savannah Resources Plc, less

transfers to retained losses in respect of options

exercised, lapsed and forfeited.

FVTOCI Reserve Cumulative changes in fair value of equity investments

classified at fair value through other comprehensive

income (FVTOCI).

Retained Earnings Cumulative net gains and losses recognised in the Consolidated

Statement of Comprehensive Income and other transactions

recognised directly in Retained Earnings.

CONSOLIDATED STATEMENT OF CASH FLOWS FOR THE YEAR ENDED 31

DECEMBER 2022

2022 2021

GBP GBP

Cash flows used in operating activities

Loss for the year (2,859,392) (3,515,834)

Depreciation and amortisation charges 23,456 35,369

Impairment of Other Assets - 5,948

Share based payment charge 242,832 200,800

Finance Income (34,695) (671)

Finance Costs 265 139

Foreign Exchange (Gains)/Losses (858,679) 213,088

Gain on relinquishment of the rights

and obligations of discontinued operations - (627,078)

------------ ------------

Cash flow used in operating activities

before changes

in working capital (3,486,213) (3,688,239)

Increase in Trade and Other receivables (78,217) (267,267)

(Decrease)/Increase in Trade and Other

Payables (538,972) 451,801

------------ ------------

Net cash used in operating activities (4,103,402) (3,503,705)

------------ ------------

Cash flow used in investing activities

Purchase of Intangible Exploration Assets (1,771,821) (1,603,208)

Purchase of Right-of-Use Assets - (798)

Purchase of Tangible Fixed Assets (852,127) (633,090)

Proceeds from sale of Investments - 654,347

Interest received 28,438 671

Proceeds from relinquishment of the

rights and obligations of discontinued

operations 89,981 6,506,852

------------ ------------

Net cash (used in)/from investing activities (2,505,529) 4,924,774

------------ ------------

Cash flow from financing activities

Proceeds from issues of ordinary shares

(net of expenses) - 9,797,982

Proceeds from exercise of share options - -

Principal paid on Lease Liabilities (5,022) (11,607)

Interest paid on Lease Liabilities (265) (139)

------------ ------------

Net cash (used in)/from financing activities (5,287) 9,786,236

------------ ------------

(Decrease)/Increase in Cash and Cash

Equivalents (6,614,218) 11,207,305

Cash and Cash Equivalents at beginning

of year 13,002,084 2,000,209

Exchange gains/(losses) on Cash and

Cash Equivalents 814,468 (205,430)

------------ ------------

Cash and Cash Equivalents at end of

year 7,202,334 13,002,084

============ ============

COMPANY STATEMENT OF CASH FLOWS FOR THE YEAR ENDED 31 DECEMBER

2022

2022 2021

GBP GBP

Cash flows used in operating activities

Gain/(loss) for the year 1,120,818 (7,933,729)

Impairment Investment in Subsidiaries 17,821 -

Impairment of Financial Assets 102,988 39,215

Impairment of Other Assets - 5,948

Share based payment reserve charge 242,832 200,800

Dividends Income (811,572) -

Finance Income (34,695) (671)

Foreign Exchange (Gains)/Losses (2,274,357) 1,756,702

Loss on relinquishment of the rights

and obligations of discontinued operations - 4,439,229

------------ ------------

Cash flow used in operating activities

before changes

in working capital (1,636,165) (1,492,506)

Decrease/(Increase) in Trade and Other

Receivables 168,209 (181,160)

(Decrease)/Increase in Trade and Other

Payables (488,024) 34,184

------------ ------------

Net cash used in operating activities (1,955,980) (1,639,482)

------------ ------------

Cash flow used in investing activities

Loans to subsidiaries (5,204,762) (4,784,700)

Proceeds from repayment of loans to

subsidiaries 799,772 6,014,021

Proceeds from sale of Investments - 654,347

Proceeds from dividends from subsidiaries 811,572 -

Interest received 28,438 671

------------ ------------

Net cash (used in)/from investing activities (3,564,980) 1,884,339

------------ ------------

Cash flow from financing activities

Proceeds from issues of ordinary shares

(net of expenses) - 9,797,982

------------ ------------

Net cash from financing activities - 9,797,982

------------ ------------

(Decrease)/Increase in Cash and Cash

Equivalents (5,520,960) 10,042,839

Cash and Cash Equivalents at beginning

of year 11,085,944 1,237,876

Exchange gains/(losses) on Cash and

Cash Equivalents 676,372 (194,771)

------------ ------------

Cash and Cash Equivalents at end of

year 6,241,356 11,085,944

============ ============

**ENDS**

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR UPUWWCUPWPGC

(END) Dow Jones Newswires

April 05, 2023 02:00 ET (06:00 GMT)

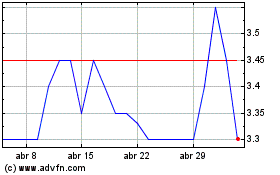

Savannah Resources (LSE:SAV)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Savannah Resources (LSE:SAV)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024