UK Commercial Property REIT Ltd UKCM agrees GBP74m sale of Wembley logistics asset (7191A)

26 Maio 2023 - 3:00AM

UK Regulatory

TIDMUKCM

RNS Number : 7191A

UK Commercial Property REIT Ltd

26 May 2023

UK Commercial Property REIT Limited

UKCM agrees GBP74 million sale of Wembley logistics asset

26 May 2023: UK Commercial Property REIT Limited ("UKCM" or the

"Company") (FTSE 250, LSE: UKCM) , announces that it has sold its

186,455 sq ft Wembley180 logistics asset in London to Covent Garden

IP Limited ("CG"), a registered charitable company. UKCM will

receive a consideration of GBP74 million, which reflects a net

initial yield of 3.49% and is broadly in line with the 31 March

2023 valuation.

UKCM has owned the property since 2009 and completed a

refurbishment of the asset in 2019 when it let the unit to a global

e-commerce company until 2029. UKCM will primarily use the proceeds

to enhance earnings by paying down a substantial amount of its

GBP93 million floating rate Rolling Credit Facility ("RCF"),

currently costing 6.3% pa.

Will Fulton, Lead Manager at UKCM, comments: "This disposal

allows us to crystallise the value we have created through both the

timely acquisition of an asset in a prime London logistics location

and our subsequent active asset management of the property,

including a long lease to a global e-commerce business. We will use

proceeds of the sale to enhance earnings, primarily by paying down

some short-term debt."

Dale Bills, spokesman for CG, comments: "The purchase of

Wembley180 furthers our efforts to make prudent, long-term

investments. Earnings from our investments are expected to support

the religious and charitable work of The Church of Jesus Christ of

Latter-day Saints in the United Kingdom."

DTRE advised UKCM. DWS and Knight Frank advised the purchaser on

the sale.

ENDS

For further information please contact:

Richard Sunderland / Emily Smart / Andrew Davis, FTI

Consulting

Tel: 020 3727 1000

Email: UKCM@fticonsulting.com

Nick Bone, DWS

Tel: +44 207 547 2603

Email: n ick.bone@dws.com

Notes to Editors - UK Commercial Property REIT

UK Commercial Property REIT is a FTSE 250 Real Estate Investment

Trust listed on the London Stock Exchange. It aims to provide

shareholders with an attractive level of income together with the

potential for capital and income growth from investing in and

managing a GBP1.32 billion (as at 31 March 2023) diversified

portfolio. The portfolio has a strong bias towards prime,

institutional quality properties and is diversified by location and

sector across the UK.

*The Company is managed and advised by abrdn (the Company's

appointed AIFM).

Further information on the Company's investment policies, the

types of assets in which the Company may invest, the markets in

which it invests, borrowing limits as well as details of its

management, administration and depositary arrangements can be found

in the Company's Annual Report and Investor Disclosure Document.

The above documents are available on the Company's website

www.UKCPREIT.com. Paper copies of these documents are available on

request, free of charge, via the contact details outlined on the

website.

Property is a relatively illiquid asset class, the valuation of

which is a matter of opinion. There is no recognised market for

property and there can be delays in realising the value of property

assets. Investors should be aware that past performance is not a

guide to future results. The value of investments, and the income

from them, can go down as well as up, and an investor may get back

less than the amount invested.

For further information on UK Commercial Property REIT, please

visit www.UKCPREIT.com .

Notes to Editors - Covent Garden IP

Covent Garden IP is a charitable company registered with the

Charity Commission. The object of the charitable company is to

promote and further the religious and other charitable work of The

Church of Jesus Christ of Latter-day Saints in the United Kingdom.

CG does this by investing in and holding commercial property for

the benefit of the Church.

For further information on Covent Garden IP, please visit The

Charity Commission - GOV.UK (www.gov.uk)

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCPPUPAAUPWGAA

(END) Dow Jones Newswires

May 26, 2023 02:00 ET (06:00 GMT)

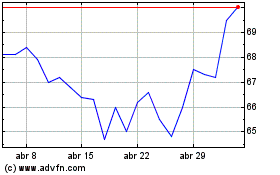

Uk Commercial Property R... (LSE:UKCM)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Uk Commercial Property R... (LSE:UKCM)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024