Maintel Holdings PLC Trading update and Notice of Results (1308I)

03 Agosto 2023 - 3:00AM

UK Regulatory

TIDMMAI

RNS Number : 1308I

Maintel Holdings PLC

03 August 2023

Maintel Holdings Plc ("Maintel" or the "Company")

Trading update

and Notice of Results

Solid H1 performance supported by business transformation

Maintel Holdings Plc, a leading provider of cloud and managed

communications services, issues the following trading statement for

the six months ended 30 June 2023, based on unaudited management

accounts.

The Company has made significant progress in the first six

months of the financial year ending 31 December 2023 (FY23),

delivering Adjusted EBITDA of GBP3.7m (H1'22: GBP3.6m)as management

continue to streamline operations and make strategic changes to

optimise the Company's market and product strategy in order to

deliver sustainable future profitability. Revenue amounted to

GBP47.5m (H1'22: GBP46.7m) benefiting from positive trading

conditions, winning new business and the acceleration of the order

book un-winding post the well-documented challenges of global

supply chain shortages. During the period, Maintel secured new

contracts, including with Provident, Harrods, Unify, Angus Council

and IDH.

Having completed their previously announced business

reorganisation, Maintel are now leveraging a new leaner 'fit for

growth' organisation, and the Company continues its business

development efforts focusing on higher profit margin product lines.

As such, the Board is confident that the Company is on track to

deliver results that deliver revenue in line with market

expectations, and Adjusted EBITDA ahead of market expectations.

Net Cash Debt at the end of the period amounted to GBP21.4m (30

June 2022: GBP19.4m). This reflects one-off restructuring costs

albeit the payback period for these is estimated to be realised

within this financial year, and the normalisation of working

capital following the renegotiation with HSBC of the covenants

related to the Company's financing facility.

The Company expects to publish its interim results on 19

September 2023.

Adjusted EBITDA - EBITDA adjusted for exceptional items

(including one-off restructuring costs) and share based

payments.

Net Cash Debt excludes IFRS16 lease liabilities.

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014

For further information please contact:

Maintel Holdings Plc

Carol Thompson, Executive Chair

Gab Pirona, Chief Financial Officer

Dan Davies, Chief Technology Officer 0344 871 1122

finnCap (Nomad and Broker)

Jonny Franklin-Adams / Emily Watts / Fergus Sullivan

(Corporate Finance)

Sunila de Silva (Corporate Broking) 020 7220 0500

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTBRGDIGXGDGXD

(END) Dow Jones Newswires

August 03, 2023 02:00 ET (06:00 GMT)

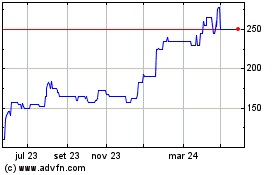

Maintel (LSE:MAI)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

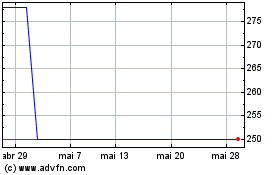

Maintel (LSE:MAI)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024