Norcros PLC Trading Update (8612P)

12 Outubro 2023 - 3:00AM

UK Regulatory

TIDMNXR

RNS Number : 8612P

Norcros PLC

12 October 2023

12 October 2023

Trading update

Norcros plc, a market leading group providing design led, high

quality bathroom and kitchen products, today releases its scheduled

trading update ahead of announcing its Interim Results for the 26

weeks to 1 October 2023 on 16 November 2023.

Robust trading performance in line with expectations

The Group delivered a robust H1 performance despite the

challenging demand environment, reflecting market share gains

driven by successful new product launches, the strength of our

customer proposition and the breadth of our distribution

channels.

H1 revenue increase/(decrease)

Reported CC(1) CC(1) LFL(2)

----------- ------- -------------

UK 1% 1% (1%)

----------- ------- -------------

South Africa (25%) (11%) (11%)

----------- ------- -------------

Group (8%) (3%) (4%)

----------- ------- -------------

In our UK business, reported revenue for the first half was 1%

higher than the previous year and on a LFL (2) basis, just 1% lower

with Triton and Merlyn performing particularly strongly. We

continue to proactively manage our capital allocation and, in this

regard, will be reducing manufacturing capacity at Johnson Tiles

(UK) by approximately 50% in response to lower UK tile demand.

Costs associated with this of circa GBP1.4m will be reported

separately as an exceptional item.

In South Africa, notwithstanding national energy supply

constraints impacting home market demand, our market leading

business, brands, and experienced management team, continued to

take market share, albeit revenue for the first half was 11% lower

than the record prior year on a CC (1) basis.

Group revenue for the 26 week period is approximately GBP202m

(2022: GBP219.9m), 4% lower on a constant currency LFL (2) basis

and 8% lower on a reported basis than the record prior year

comparator.

Our performance in the first half of this financial year

continues to reflect the strength of our in-house product

development capabilities, leading brands and excellent customer

service proposition. We expect to report an underlying operating

profit in the first half of the year of no less than GBP21m (2022:

GBP22.0m).

Financial position

The balance sheet remains strong with net debt of approximately

GBP48m on a pre-IFRS16 basis (net debt of GBP58.9m as at 30

September 2022 and GBP49.9m as at 31 March 2023). This represents

leverage of approximately 1.0x net debt to EBITDA. The Group has

committed banking facilities of GBP130m maturing October 2026.

Senior management appointment

We are pleased to announce the appointment from 2 January 2024

of Helene Roberts to the executive committee of the Norcros Group

as Managing Director for the UK and Ireland. Helene succeeds Thomas

Willcocks following his appointment as Chief Executive Officer in

April 2023. Helene joins from Robinson plc, the European plastic

and packaging manufacturer, where she was CEO for four years.

Helene brings extensive leadership experience and a strong track

record in sustainable product development and sourcing.

Outlook

The Board remains confident that our experienced management

teams and consistent execution of strategy will continue to deliver

market share gains for the year ending 31 March 2024 and expect

full year operating profit to be in line with market expectations

(3) .

(1.) CC refers to constant currency basis

(2.) LFL (like for like) adjusted for Grant Westfield (acquired

31 May 2022) and Norcros Adhesives

(3.) Norcros compiled market consensus for the year to 31 March

2024 is for an underlying operating profit of GBP43.4 million

Enquiries

Norcros plc Tel: 01625 547700

Thomas Willcocks, Chief Executive

Officer

James Eyre, Chief Financial

Officer

Hudson Sandler Tel: 0207 796 4133

Nick Lyon

Sophie Miles

Notes to Editors

Norcros is a design and service led bathroom and kitchen

business with market leading brands operating primarily in the UK

and South Africa.

In the UK, Norcros operates under seven brands, Triton, Merlyn,

Multipanel (Grant Westfield), Vado, Croydex, Abode, and Johnson

Tiles.

In South Africa, Norcros operates under four brands, Tile

Africa, House of Plumbing, TAL, and Johnson Tiles.

Norcros is headquartered in Wilmslow, Cheshire and employs

around 2,400 people. The Company is listed on the London Stock

Exchange. For further information please visit the Company website:

http://www.norcros.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTXFLLFXBLLFBE

(END) Dow Jones Newswires

October 12, 2023 02:00 ET (06:00 GMT)

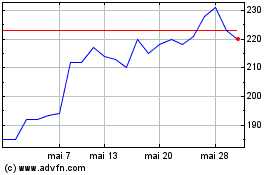

Norcros (LSE:NXR)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Norcros (LSE:NXR)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024